This summer should bring high temperatures and electricity demand, but flat prices as cheaper fuel offsets higher load, according to FERC’s Summer Energy Market and Electric Reliability Assessment, released May 23.

The National Oceanic and Atmospheric Administration forecasts a 60 to 70% likelihood of above-normal temperatures in June, July and August across the country compared with the 30-year average.

“High temperatures that are widespread can intensify stressed conditions on the electric grid by creating high electricity demand across a wide geographic area and reducing the availability of imported electricity from neighboring systems because they are also experiencing high demand,” the report said.

Following last summer’s “El Niño” weather pattern, the National Weather Service says there is a 69% chance that a La Niña could emerge this summer. For the U.S., a La Niña means more storms in the center of the country and less precipitation in the South; it can also lead to more Atlantic hurricanes.

NOAA released its hurricane forecast May 23 as well; it predicts an 85% chance of an above-normal season, with 17 to 25 named storms, eight to 13 forecast to become hurricanes, and four to seven of those to be major hurricanes. Forecasters have a 70% confidence in the ranges.

Despite expectations for a hot summer, electricity prices are forecast to be flat or slightly lower than in 2023. The one exception is the Northeast, where regional natural gas prices could mean higher power prices than last year.

FERC is forecasting average ISO-NE prices to be almost $10/MWh higher than last year, while those in CAISO are expected to fall by $23 to $34/MWh.

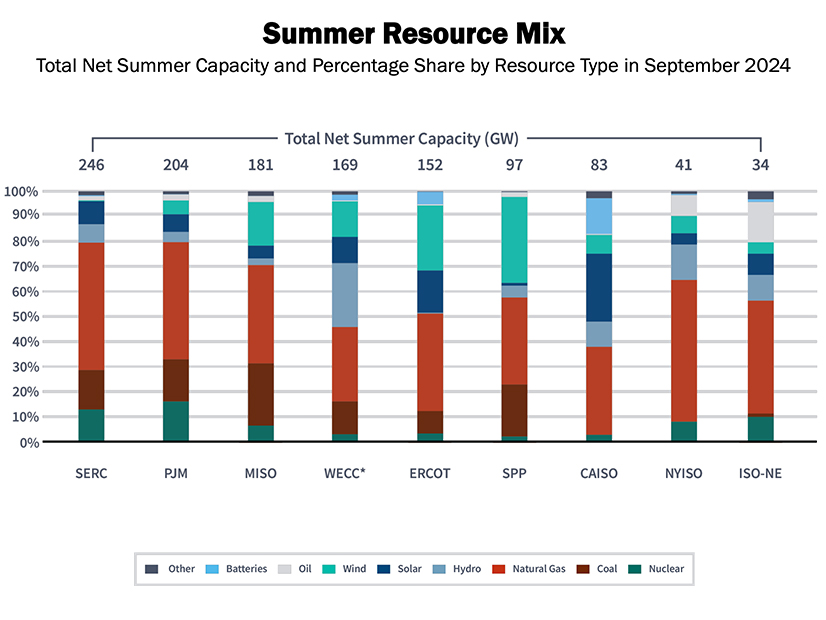

U.S. installed generation capacity is expected to hit 1,207 GW, up 40 GW from 2023 because of additions of wind and solar, while retirements were dominated by coal capacity, with 3.3 GW retiring through September.

ERCOT leads with 20.1 GW of capacity additions, including 12 GW of solar and 4.5 GW of batteries. CAISO is expected to add 8.9 GW overall, but it beats ERCOT, with 5.1 GW of battery capacity additions.

Summer is the season with the highest use of natural gas for the sector, with power burn expected to peak in July and August at 47 Bcfd this year.

“Natural gas used to generate electricity — or power burn — is expected to average 43.5 Bcfd in summer 2024, equal to power burn in summer 2023 but up 9.5% compared to the five-year average,” the report said.

Coal stockpiles at power plants are higher this year, and coal delivery over the rail network does not face the same issues as the pandemic years from 2020 to 2022, but the Francis Scott Key Bridge collapse in Baltimore has impacted some local coal plants.

“Coal power plants nearby may experience delays or disruptions to resupply coal stocks via water (barges) if there is protracted disruption to shipping in nearby waterways to clean up the bridge collapse,” the report said. “The bridge collapse temporarily halted coal deliveries by barge to the Brandon Shores and Wagner coal plants, totaling 1,865 MW, which are located directly adjacent to the bridge.”

Baltimore is the second-largest port for coal exports, shipping the commodity from Appalachia to global markets and representing 28% of exports. That traffic was temporarily delayed because of the bridge collapse.

The Energy Information Administration is expecting demand to be 2.7% higher this summer than last year and 4.4% over the average of the past five summers.

“The expected larger electricity consumption this summer results from forecasted warm weather and strong economic growth,” the report said. “Another significant source of electricity consumption growth is the construction of new data centers in many regions of the country.”