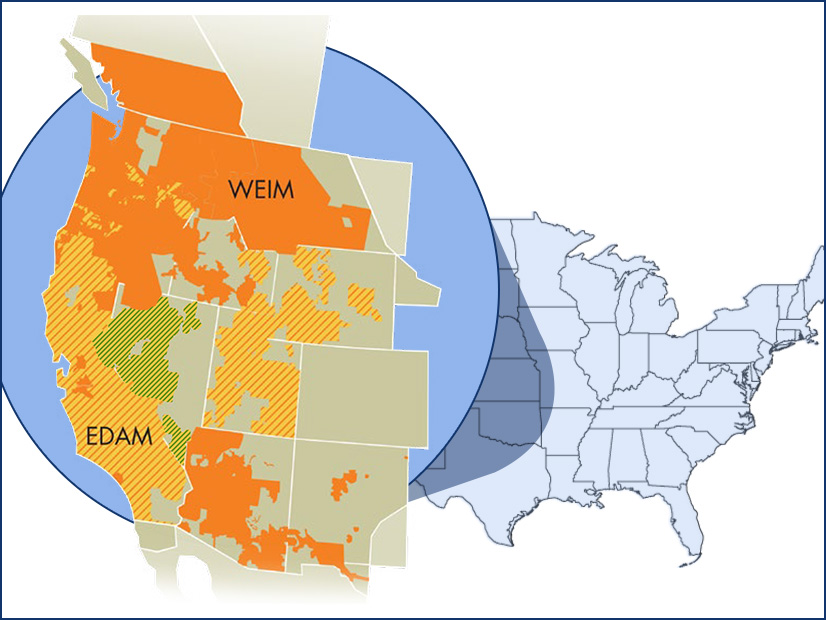

The growing footprint of CAISO’s Extended Day-Ahead Market (EDAM) was a critical factor in NV Energy’s recently announced decision to join it rather than the competing Markets+ offering from SPP, the utility said in a regulatory filing.

PacifiCorp, the Balancing Authority of Northern California, Los Angeles Department of Water and Power, and Portland General Electric, as well as CAISO, all are expected to participate in EDAM. In addition, Idaho Power has said it is leaning toward EDAM as its day-ahead market choice.

The expected EDAM lineup “provides a significant degree of interconnectivity and supports a diversity of resources,” said Ryan Atkins, NV Energy’s vice president of resource optimization and resource planning.

Atkins’ comments are from written testimony included in the company’s 2025/27 integrated resource plan, filed with the Public Utilities Commission of Nevada on May 31. The commission made the filings public June 5.

CAISO’s recent approval of the Southwest Intertie Project-North (SWIP-North) was another key factor in NV Energy’s decision, Atkins said. A joint project by NV Energy and LS Power, SWIP-North will be a 285-mile, 500-kV line to send Idaho wind energy to markets to the south. It will connect to the One Nevada (ON) Line at Robinson Summit, a site that eventually will be one corner of a transmission triangle across Nevada when NV Energy’s Greenlink North and Greenlink West lines are completed. (See CAISO Board Approves Nevada Transmission Line to Access Idaho Wind.)

SWIP-North “will only enhance the transfer capability of the existing ON Line transmission line in Nevada, bringing even greater benefits to all EDAM participants,” Atkins said.

Atkins also noted the “significant economic, reliability and environmental benefits” that NV Energy has gained through participation in CAISO’s Western Energy Imbalance Market (WEIM). Since joining the WEIM in December 2015, the utility has reaped $488 million in benefits.

Although NV Energy stated in its IRP that it plans to join EDAM, the utility will file a separate, formal proposal later this year seeking PUC approval to join the day-ahead market.

In a June 6 release, CAISO called NV Energy’s intent to join EDAM “a substantial milestone in advancing the efficient coordination of the electric needs for growing loads and a changing resource mix across the West.”

‘Least-cost, Least-regrets’ Decision

NV Energy’s announcement of its EDAM choice may be a central piece in the day-ahead market puzzle in the West.

As competition for day-ahead market participants has been heating up between CAISO and SPP, many potential participants have indicated they are waiting to see who will join each market before making their own decision.

Entities that have shown the most interest in joining Markets+ include the Bonneville Power Administration and Puget Sound Energy in the Northwest, and Arizona Public Service, Salt River Project and Tucson Electric Power in the Desert Southwest. NV Energy’s balancing authority area sits between those two areas.

The comments in the IRP are the latest confirmation of NV Energy’s intent to join EDAM.

David Rubin, NV Energy’s federal energy policy director, confirmed the utility’s decision May 31 during a meeting of the Launch Committee for the West-Wide Governance Pathways Initiative. (See NV Energy Confirms Intent to Join CAISO’s EDAM.)

Before that, NV Energy had disclosed its decision to join EDAM during private meetings, multiple sources previously told RTO Insider.

In his testimony, Atkins also addressed the question of how NV Energy plans to meet a Nevada requirement to join an RTO by 2030.

“Events in the West are still too fluid, and the requirement dates still far enough out, to make any judgments about [NV Energy’s] ability to meet the Jan. 1, 2030, requirement,” he said.

Atkins described the decision to join EDAM as an incremental step to capture “substantial customer benefits on a least-cost, least-regrets basis.”

Last year, the PUC opened a docket to explore ways to evaluate a utility’s request to join a regional market or RTO. (See Nevada RTO Proceeding Examines EDAM, Markets+ Design.)

In a May 20 procedural order, Commissioner Tammy Cordova laid out 18 topics that NV Energy should address in an application to join a day-ahead market.

Those include governance, cost of participation, greenhouse gas tracking, impacts on non-jurisdictional transmission customers and pathways to joining an RTO.

Another topic for consideration is any investment in generation and transmission that would be needed to participate in the market or maximize its benefits.