Planning Committee

Stakeholders Endorse Revisions to CIR Transfer Issue Charge

VALLEY FORGE, Pa. — The PJM Planning Committee last week endorsed revising an issue charge focused on how capacity interconnection rights (CIRs) may be transferred from a deactivating generator to a new resource.

The issue charge seeks to solve the misalignment between the transfer process, which is tied to phases of the interconnection queue, and recent changes to the interconnection process. (See “Stakeholders Discuss Change to CIR Transfer Issue Charge,” PJM PC/TEAC Briefs: April 30, 2024.)

The endorsed change rewrites the out-of-scope language to prohibit changes to the process for transferring CIRs to replacement resources interconnecting to the same substation as the deactivating generator but at a different voltage level. It previously prohibited changes for when the replacement located at a different point of interconnection.

The revisions also shift the working group from the Interconnection Process Subcommittee to the PC to accommodate the wider scope. The issue charge was cosponsored by East Kentucky Power Cooperative and Elevate Renewables.

CIFP Manual Revisions Endorsed

Stakeholders endorsed a slate of manual revisions codifying PJM’s new approach to risk modeling and accreditation drafted through the Critical Issue Fast Path (CIFP) process last year and approved by FERC in January. (See “First Read on CIFP Manual Revisions,” PJM PC/TEAC Briefs: April 30, 2024.)

The changes include how PJM will use its marginal effective load-carrying capability (ELCC) framework for accrediting all generation resources, the simulation of resource outputs and the definition of the capacity emergency transfer objective (CETO), which sets the import capability needs to meet reliability objectives. The revisions also include several calculations used in accreditation and for setting capacity procurement targets through the Reserve Requirement Study (RRS).

Manuals 20, 21 and 21A would be replaced with Manuals 20A and 21B beginning with the 2025/26 delivery year, while Manual 14B would remain with language changes. The Markets and Reliability Committee is set to consider endorsement of changes on June 27 alongside a rewrite of Manual 18 to effectuate changes on the markets side. (See “Stakeholders Endorse Manual Revisions to Implement CIFP Changes to Capacity Market,” PJM MIC Briefs: May 1, 2024.)

Preliminary ELCC Class Ratings

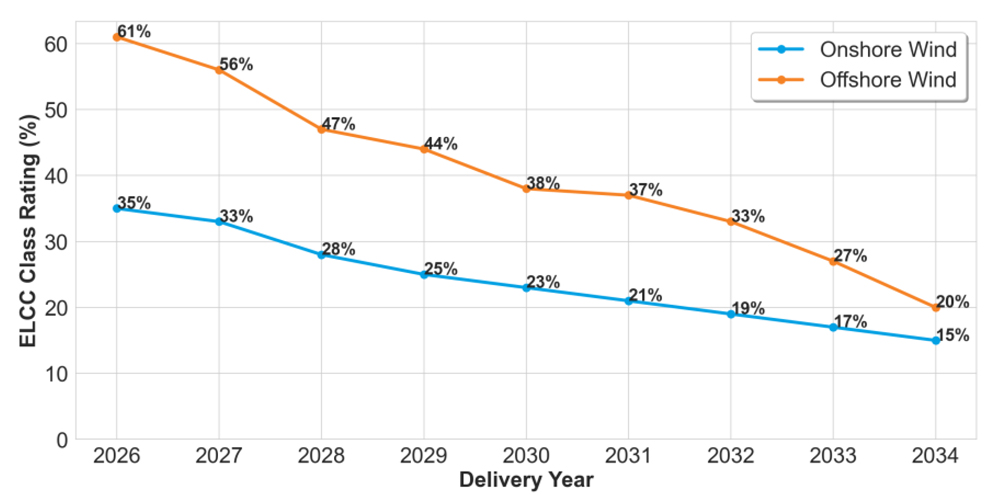

PJM presented a preliminary set of ELCC class ratings projected through the 2034/35 delivery year that show declining values for renewable and storage resources and fairly stable or increasing ratings for fossil generation.

Offshore wind is hit particularly hard, with its class rating expected to go from 61% in 2026 to 20% in 2034. Onshore wind is projected to fall from 35% to 15%.

PJM’s Patricio Rocha Garrido said the decline in wind generation ratings was driven largely by the hours of risk being increasingly concentrated on days when wind performance is projected to be low. Much of that data is derived from the 2014 polar vortex on Jan. 7 and 8, as well as low performance hours on Dec. 26, 2022, during Winter Storm Elliott.

As the amount of wind generation on the grid increases, Rocha Garrido said, the resource class is able to meet the need on a wider number of days. That in turn concentrates the risk that remains onto winter days with low wind performance.

Solar ratings similarly are being driven down by increased winter risk matching up poorly with times of peak solar availability. Tracking solar has a rating of 11% in 2026 dropping, to 4% in 2034, while fixed solar falls from 7% to 3%.

The longer duration of winter events also also a factor for declining ratings of shorter-term storage resources. Four-hour storage falls from 56% to 38% over the years analyzed, while six-, eight- and 10-hour storage see less significant drops.

While both coal and nuclear generation saw modest declines in their ELCC ratings, gas-fired resources saw upticks owing to risk patterns swaying toward days when they have stronger performance. Combustion turbines fared particularly well, increasing from 61% to 78%.

PJM spokesperson Jeff Shields said the increased gas generation ratings are from increased winter performance since the 2014 polar vortex and the pattern of risk shifting to days when other resources do not perform as well.

“The gas CT ratings increase because the risk shifts to winter days with poor wind performance in which the gas CT performance is not as low as during days such as the first polar vortex. Therefore, you can argue that the increase is driven by risk shifts that are caused by better gas CT performance, and other resources — wind, in particular — performing worse,” he said.

Rocha Garrido said the assumptions for the projections included using the 2025/26 delivery year assumed resource portfolio as a basepoint and modeling retirements and new entry using a vendor forecast. That includes growth in the wind, solar, four-hour storage and solar-storage hybrid classes, as well as coal generation deactivations.

PJM Pushes Pause on LTRTP to Focus on 1920

PJM plans to hold off on advancing its long-term regional transmission planning (LTRTP) proposal and shift its focus to its compliance filing for FERC Order 1920, which requires RTOs to develop scenario-based planning processes on a 20-year horizon. (See FERC Issues Transmission Rule Without ROFR Changes, Christie’s Vote.)

The PC endorsed the LTRTP approach in March, but deliberations were deferred at the MRC in April to see how it measured up against the commission’s long-awaited order. (See “Stakeholders Defer Vote on Long-term Planning Proposal,” PJM MRC Briefs: April 25, 2024.)

PJM’s Jason Connell laid out several differences between the LTRTP design developed over the past year and Order 1920’s requirements, which include at least one extreme weather scenario, “plausible” and “diverse” scenarios, and a wider range of planning factors. While the LTRTP would implement a 15-year planning horizon, the order requires at least 20 years, and the two reliability and policy scenarios PJM proposed fall short of the minimum of three scenarios the commission required.

“There is quite a bit of deviation between what we proposed and the order,” Connell said.

Presenting the Natural Resources Defense Council’s perspective on the differences, Senior Advocate Tom Rutigliano said the first year of PJM’s proposed LTRTP timeline involved building scenarios, work that could be done in parallel with preparing the compliance filing. Waiting until compliance is approved by FERC likely would result in delaying implementation until the fourth quarter of 2026. Laying some of the groundwork in scenario design ahead of time could shave a year off implementation and begin addressing PJM’s long-term resource adequacy concerns faster, he argued.

“This needs to start sooner, so what we’ve got here is work that can be done in parallel,” Rutigliano said.

Connell said PJM’s goal is to move quickly and bring manual revisions to stakeholders within a few months detailing how it will initiate the assumptions phase of a larger long-term planning effort. The revisions also may include starting on the analysis phase as well while the compliance filing is prepared and pending at the commission.

Transmission Expansion Advisory Committee

NJ BPU Pausing 2nd SAA Competitive Window for Offshore Transmission

The New Jersey Board of Public Utilities has suspended the second State Agreement Approach (SAA) competitive transmission solicitation window, which PJM was planning to administer in July.

Ryann Reagan, wholesale market policy specialist for the BPU, told the Transmission Expansion Advisory Committee that the board’s timeline no longer aligned with the 2024 Regional Transmission Expansion Plan (RTEP) cycle. The amount up in the air with regional transmission planning and offshore wind also contributed to the decision, she said, pointing to the board’s work updating the state’s Energy Master Plan and Offshore Wind Strategic Plan.

Reagan said it’s hard to see where the state’s offshore wind goals could align with PJM’s planning processes until there is more clarity around the LTRTP and Order 1920.

The board intends to move forward with its fourth and fifth solicitations for offshore wind generation, with awards likely prior to the transmission planning being completed.

Deactivation Request Update

Two generators have filed for deactivation over the past month, PJM’s Michael Herman told the TEAC.

J-Power USA Generation is seeking to bring nine gas-fired turbines in the ComEd zone offline in June 2025, while AES submitted a deactivation request for a 5-MW battery located at its Warrior Run cogeneration plant.

PJM also is in the process of studying a deactivation request for Cogentrix’s Elgin generator, which has four gas turbines amounting to 483 MW. Reliability analysis is set to begin in the third quarter of this year, Herman said.

IEC Remains on Hold

PJM’s Nick Dumitriu said the RTO’s annual re-evaluation of market efficiency projects recommended leaving Transource Energy’s Independence Energy Connection (IEC) project on suspension because of poor cost-benefit results and possible reliability violations. The PJM board voted to suspend the project on Sept. 22, 2021. (See “Transource Update,” PJM PC/TEAC Briefs: Oct. 5, 2021.)

The two-pronged project seeks to alleviate congestion on the AP South Interface by building about 20 miles of lines between a new Furnace Run substation in York County, Pa., and Harford County, Md. The western portion would consist of a 230-kV double-circuit transmission line running 28.8 miles from Franklin County, Pa., into Washington County, Md.

Dumitriu said the project would reduce congestion on AP South by $84.97 million by 2033, along with reducing congestion by about $41 million on a series of other constraints, but a new $341.72 million constraint would be introduced on the 230-kV Ringgold-Frostown Junction line.

PJM’s Tim Horger said an update on the project’s future is planned for next month.

Supplemental Projects

American Electric Power proposed a $155.7 million project for a new service request to serve 1,100 MW of load in New Carlisle, Ind., expected to come online in December 2026.

The project would consist of two new 345-kV substations, Larrison Drive and New Prairie, cut into the Elderberry-Dumont and Dumont-Olive Bypass lines. End work also would be conducted on the Sorenson, Elderberry and Dumont substations.

PPL presented a new service request expected to interconnect 240 MW in 2026 and grow to 1,980 MW by 2033. The customer, located in Hazleton, Pa., would be served by a 230-kV source.

PECO Energy presented a $36 million project to rebuild its 6.24-mile, 230-kV Planebrook-Bradford line, which the utility said is nearing end of its life at 96 years old.

The utility also proposed a $17 million project to rebuild its nearly 100-year-old, 69-kV Tacony substation and install new equipment to upgrade it to 230 kV. Inspection of the site has found that equipment is in poor condition and cannot be repaired.

Duke Energy Ohio & Kentucky proposed a $7.8 million project to replace nine 345-kV oil-operated breakers at its Woodsdale substation because of maintenance issues. The project would install gas-filled circuit breakers, replace 17 switches and replace all bus conductor.

Duke also presented a new service request for a customer near Mount Orab, Ohio, seeking to interconnect 2,000 MW by 2029.

FirstEnergy presented a $9.8 million project to convert its 230-kV Milesburg substation, located in the APS zone, from a straight bus to a four-breaker ring bus. It said maintaining the existing configuration elevates outage risks for 3,116 customers with 107.6 MW of load if the facility experiences a single stuck breaker contingency.

Dominion Energy presented several projects to interconnect data center load in Northern Virginia totaling $57 million.

A new 230-kV Sloan Drive substation would be built for $30 million, which includes building two 230-kV lines to the future Bermuda Hundred substation. The substation has an projected in-service date of Dec. 31, 2027, and would serve more than 100 MW of data center load.

The utility proposed cutting into the 230-kV Techpark Place-White Oak line to build a new “Decoy Airfield” substation serving 100 MW of data center load. The new substation would cost an estimated $12 million to build with an in service date of Jan. 1, 2026. A $15 million project would tap the 230-kV ICI-Allied line to connect to the new Bermuda Hundred facility.