A new study commissioned by Renewable Northwest (RNW) adds a contentious new wrinkle to the debate about the potential impact of market seams if the West ends up divided between CAISO’s Extended Day-Ahead Market (EDAM) and SPP’s Markets+.

The study, conducted by Grid Strategies, comes about five months after release of a report from the Western Power Trading Forum and Public Generating Pool that cautioned that seams between Western day-ahead markets would create a different set of challenges from those seen at the boundaries between the full RTOs in the Eastern Interconnection. (See Western Market Seams Issues to Differ from East, Study Finds.)

The Grid Strategies study partly expands on that theme, finding that effective “market configuration” — meaning a market based on the widest footprint possible — outweighs the importance of market design. It also warns that lessons from the Eastern Interconnection show that market seams there continue to be a “persistent drag on efficiency” despite the mechanisms MISO, PJM and SPP have implemented to mitigate their impact.

The study also delves into the specific challenges a two-market scenario could pose in the Pacific Northwest, where neighboring and closely interconnected balancing authority areas — such as those operated by the Bonneville Power Administration and PacifiCorp — fall into separate markets, creating a winding and complicated boundary.

BPA, which controls about 75% of transmission in the Northwest, has made it clear its decision on a day-ahead market will not be driven by concerns about seams and has argued such issues can be resolved by seams agreements. (See Seams Concerns Won’t Drive Day-ahead Market Decision, BPA Says.)

The Grid Strategies study finds that “while experience in other markets support BPA’s argument that a seams agreement is necessary, experience also shows that seams agreements do not reduce barriers to transacting across market seams and will not address the detrimental impact of market seams on consumers.”

‘Hard to Achieve’

But the most controversial aspect of the new study is the contention that Vancouver, British Columbia-based energy marketer Powerex has backed the development of Markets+ because it stands to make more money trading in a divided West than in a single market with no seams.

That’s an assertion other Western electricity sector stakeholders have shared with RTO Insider but have been reluctant to put on the record.

“Well, to the detriment of my dreams to retire in Canada, I decided to go on the record,” RNW Executive Director Nicole Hughes joked in an email to RTO Insider. RNW is a renewable energy trade group that long has advocated for the development of a single organized market in the West and is a key supporter of CAISO’s EDAM.

Hughes was referring to a June 14 opinion piece she wrote for the Seattle-based publication Clearing Up.

The op-ed draws on Chapter 9 of the Grid Strategies study, which is headed “Good Configuration is Hard to Achieve Because Some Parties Benefit from Bad Configuration and Inefficient Seams.”

The chapter explains that BPA and Powerex control the largest amount of power supply and transmission in the Pacific Northwest, the latter being “the exclusive marketer of BC Hydro capability in the U.S., holding substantial hydro generation, storage and transmission rights, and is a major energy supplier to the Northwest.”

Powerex’s “mission” in participating in the U.S. market is “to maximize profits” on behalf of British Columbia’s ratepayers, the study says.

“As the exclusive marketer for BC Hydro, Powerex reports that electricity ‘trade provides economic and environmental benefits for British Columbia. All income generated by Powerex is returned to BC Hydro, which helps the utility keep electricity rates amongst the lowest in North America,’” it says, citing Powerex’s description of itself in the “About Us” section of its corporate website.

Last year, the Western Markets Exploratory Group (WMEG) completed a series of studies, conducted by Energy+Environmental Economics (E3), to assess the benefits that would accrue to various electricity market participants in the West under a range of market footprint scenarios.

Grid Strategies cites wording in the WMEG study for Powerex, which found that in a scenario where Northwest utilities join EDAM, Powerex “expects that its most attractive market opportunities would be forward sales,” prompting the company to limit the hourly flexibility of its hydroelectric exports.

But in a situation where Northwest utilities join Markets+, E3 determined Powerex “expects that its most attractive market opportunities will be hourly optimized transactions” and that it would offer the market its full hourly flexibility.

“E3 estimates that the incremental regionwide cost increase attributable to Powerex’s withholding hourly flexibility in these scenarios is approximately $7 million,” Grid Strategies says. “This example shows how positional power and control of transmission can have significant financial consequences for consumers in the Northwest.”

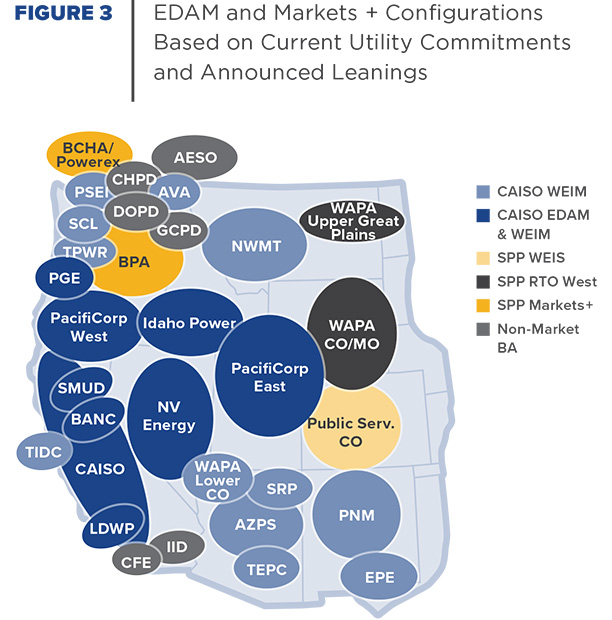

As the competition between EDAM and Markets+ plays out, SPP has found its strongest support among some entities in the Northwest, including BPA and Powerex, and among Arizona utilities Arizona Public Service, Salt River Project and Tucson Electric Power. But other major players in the Northwest, including PacifiCorp, Portland General Electric and Idaho Power, have signaled their intent to join EDAM, with Seattle City Light likely to follow.

Transmission links between the Northwest and Southwest are limited, and the Grid Strategies study notes that “control of key transmission capacity rights connecting the Northwest to the Southwest is highly concentrated, with a meaningful portion controlled by Powerex, who as a power marketer has an objective of maximizing profits, rather than minimizing consumer costs as do load-serving transmission capacity owners.”

“A pivotal supplier exercising market power can manipulate prices, benefiting itself to the detriment of load-serving entities and consumers,” the study continues. “It is very difficult to mitigate this market power in a two-market setting with no centralized oversight of the broader region. If the seams were more efficiently managed internally within a single market, this would be less likely to occur.”

Powerex Points to Governance, Design

In her op-ed, Hughes points out Powerex controls about 20% of transmission capacity rights on the California-Oregon Intertie, a key link between the Northwest and CAISO. She says direct trade with the Desert Southwest would allow Powerex to avoid paying to wheel power through the CAISO system.

“Powerex states that the solution to congestion rents wheeling through CAISO is to build more transmission to the Desert Southwest,” Hughes wrote. “More interregional transmission connectivity between the two regions would definitely benefit customers West-wide. However, several utilities serving major load centers are committed to continuing to operate in CAISO’s WEIM [Western Energy Imbalance Market] and have committed to expanding their commitment by joining its Extended Day-Ahead Market, while BPA is leaning toward leaving the WEIM and joining Markets+.”

Hughes also asserts the WMEG study indicates BPA would benefit from increased transmission revenues in a divided day-ahead market scenario while the rest of the region would see rising transmission costs.

Reached for comment, BPA spokesperson Doug Johnson said the federal power marketing administration was unprepared to respond to the Grid Strategies study or Hughes’ op-ed.

In an email to RTO Insider, Jeff Spires, director of power at Powerex, said that while “attention to seams is important,” the intent of the study “appears to be to distract from the essential governance and market design elements that differentiate the two day-ahead market options.”

“Powerex is just one of numerous entities participating in the development of Markets+, who collectively seek an organized market that provides independent and inclusive governance, an impartial market operator and a market design that achieves competitive market outcomes while balancing the interests of a broad array of participants,” Spires wrote.

Takeaways

The Grid Strategies study concludes with a handful of “key takeaways.” Chief among them is the assumption FERC is “unlikely to mandate good configuration and does not have a template for effective, efficient and equitable seams coordination,” leaving it to Western utilities and regulators “to evaluate customer impacts and make the best decisions for ratepayers” when it comes to day-ahead market decisions.

Another point is that attempts to address market inefficiencies caused by seams in the East have been “largely unsuccessful.”

“Transactions between markets are far below efficient levels, resulting in higher consumer costs,” the study says.

Yet another takeaway has to do with the access issues that would stem from a two-market configuration in the Northwest because of the region’s “heavy reliance” on BPA’s transmission.

“If market seams are developed between the major load centers in the region and the generation and transmission needed to serve these load centers, costs to consumers will increase, and efforts to bring new clean energy generation to load will be hindered,” the report says. “Particular attention should be paid to avoiding development of these seams today, and ample opportunity currently exists to develop a market [that] will minimize negative impacts to customers.”