Two years after announcing its $1.8 billion Joint Targeted Interconnection Queue (JTIQ) transmission portfolio with SPP, MISO is putting final touches on its FERC filings to make it happen.

During a June 18 teleconference to outline its plan, MISO’s Milica Geissler said the RTO will begin making filings to FERC at the end of July, starting with an addition that chronicles JTIQ procedure for its joint operating agreement with SPP. Subsequent filings on cost allocation, generator interconnection agreements and rate schedules will follow, Geissler said, and may be standalone or combined. All filings concerning JTIQ will seek a common effective date, she added.

MISO said it will work with its transmission owners to make the later filings. SPP similarly is finalizing JTIQ details. (See SPP Board Adds Final OK to JTIQ Cost Framework.)

“We’ve been working on this for four years, and we’re finally able to present a full package,” MISO Director of Resource Utilization Andy Witmeier said, referencing the 2020 announcement that MISO and SPP would try a new approach to interregional planning after years of unsuccessful pursuits for transmission prospects.

MISO counsel Chris Supino said the JTIQ process — which will replace MISO and SPP’s affected-system studies — will allow generation developers to learn their cost responsibility earlier and get projects connected sooner.

Supino said the first portfolio represents the most “immediate need for beneficial, backbone projects” along the MISO Midwest and SPP seam. He said MISO may focus on MISO South for its next JTIQ portfolio with SPP.

Witmeier said the first portfolio should dramatically decrease the costs of getting generation online near the seam. He said a recent SPP affected-system study returned $1.4 billion in network upgrades for just 8 GW of projects connecting in MISO. On the other hand, Witmeier said the $1.8 billion JTIQ is expected to enable 28 GW in generation additions.

MISO and SPP are pursuing a 100% cost allocation to interconnection generation. The two initially planned to use a split entailing 90% to generators and 10% to load, but they abandoned the approach after the Department of Energy announced the portfolio would receive $464.5 million from the department’s Grid Resilience and Innovation Partnership program. (See MISO, SPP Ditch 90/10 JTIQ Allocation After $465M DOE Grant.) MISO and SPP’s load will act as a temporary cost backstop for their share of JTIQ costs until enough new generation commits to the lines and picks up the tab for construction.

Geissler said it’s unlikely that load will have to cover any JTIQ costs permanently because of the sheer numbers of prospective projects in MISO’s and SPP’s interconnection queues. However, construction may begin on the JTIQ projects before they’re fully subscribed. MISO said it will consider JTIQ portfolios fully subscribed when 85% of the megawatts they can enable are spoken for. For the first JTIQ portfolio, that subscription threshold will be a little more than 24 GW in generation projects.

Witmeier added that MISO load should benefit from lower congestion costs and decreased market-to-market payments once JTIQ projects are built.

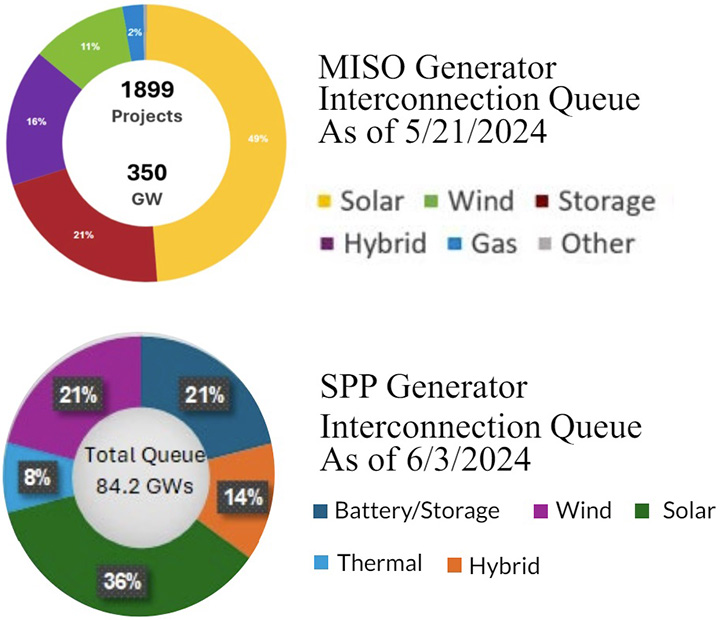

SPP’s interconnection queue boasts 412 projects totaling more than 84 GW; MISO’s interconnection queue could approach 350 GW, if all the 123-GW 2023 class of queue applications are allowed to proceed. (See MISO Reports 123-GW Roster for 2023 Interconnection Queue Cycle.)

“The existing system was not designed to handle this level of generation,” Supino said.

MISO expects to begin accounting for JTIQ projects in its generator interconnection queue study modeling next year, after the RTOs’ boards approve the JTIQ portfolio.

MISO and SPP plan to study generation projects that may rely on JTIQ projects in clusters. MISO said it will screen projects and move those dependent on JTIQ into a “participation group.” Generation projects will enter a “commitment group” once they close in on generator interconnection agreements and will be assessed a per-megawatt JTIQ charge that is billed directly by either MISO or SPP.

Sustainable FERC Project attorney Lauren Azar asked if MISO is planning to change JTIQ rules to integrate changes stemming from FERC’s recent show-cause order issued to MISO and three other RTOs. The commission last week put the grid operators on notice that their policies allowing transmission owners the opportunity to provide initial funding for network upgrades may impede interconnection customers’ right to finance the upgrades they pay for. (See FERC Issues Show-cause Order on TO Self-funding in 4 RTOs.)

“That’s something we’re still evaluating,” Supino said. “We’re still going to have to determine how this impacts it.”

But Supino said that unlike normal upgrades that transmission owners can elect to self-fund, the JTIQ involves large projects that are prebuilt by transmission owners assigned by MISO or SPP.

“I’m not certain it’s going to raise the same questions,” Witmeier said.