EAGAN, Minn. — MISO said a quiet spring isn’t a portent for the months to come. Meanwhile, its Independent Market Monitor insists MISO needs to penalize renewable generators that do not bridle output when asked.

Speaking during a June 25 Markets Committee of the MISO Board of Directors meeting, Executive Director of Market Operations JT Smith said between predicted summer heat, an active hurricane season and the seasonal capacity auction returning a shortfall in spring and autumn, MISO anticipates tense months ahead.

“We should expect probably a nice, stressful summer for our operating folks,” Smith said. “A couple of capacity advisories shouldn’t be surprising.”

Smith said MISO’s Planning Resource Auction in April showed the RTO’s capacity surplus eroded 30% when compared to last year, falling from an overall 6.5 GW to 4.6 GW. The auction returned sufficient capacity in all but Missouri’s Zone 5, where prices topped out at a $720/MW-day seasonal cost of new entry in fall and spring. (See Missouri Zone Comes up Short in MISO’s 2nd Seasonal Capacity Auction, Prices Surpass $700/MW-day.)

However, Smith said MISO should have “a lot of other resources” at its disposal, referring to its load-modifying resources and imports. Soon after Smith spoke, MISO issued its first conservative operations instructions of the summer for about two hours in the North region.

Board member Phyllis Currie pressed MISO on the health of MISO’s relationships with its neighbors, asking in particular about the potential for the Tennessee Valley Authority and MISO to forge a symbiotic relationship.

Recently, MISO leadership have expressed disappointment in TVA because although MISO has assisted TVA with exports — especially during the December 2022 winter storm — TVA as a rule doesn’t flow power to MISO.

“TVA is an interesting animal in the Eastern Interconnect. They are limited in who they can sell power to,” Smith said.

Smith said MISO and TVA are working toward an emergency purchases agreement so the two can transact power when one is experiencing risk.

“Not only is the coordination between PJM and MISO and SPP and MISO good, it’s as good as it’s ever been,” MISO CEO John Bear reassured board members of MISO’s RTO neighbors.

In a spring lookback, Smith called April’s solar eclipse a good learning experience on solar forecasting. He also said MISO staff enjoyed the eclipse because MISO “walked out of it without hassle.”

“This is the first time we’ve had a significant amount of solar on our system to have an impact,” Smith said.

MISO also reported its system performed as expected May 11 during the largest, most severe geomagnetic disturbance across the footprint since 2005.

Otherwise, Smith said MISO experienced a mild spring. He said spring’s peak at 97 GW on May 21 fell short of MISO’s forecasted 100-GW peak for the season. Load averaged 69 GW, in line with the previous three years, and real-time prices averaged $24/MWh, $2 lower than in 2023. Daily generation outages averaged 51 GW, a few gigawatts better than in previous years.

Predictably, MISO set another all-time solar peak May 25 at 6.2 GW.

“Expect that every board meeting for the next couple of years,” Smith told MISO’s board and stakeholders.

IMM Says MISO Should Rein in Renewable Operators

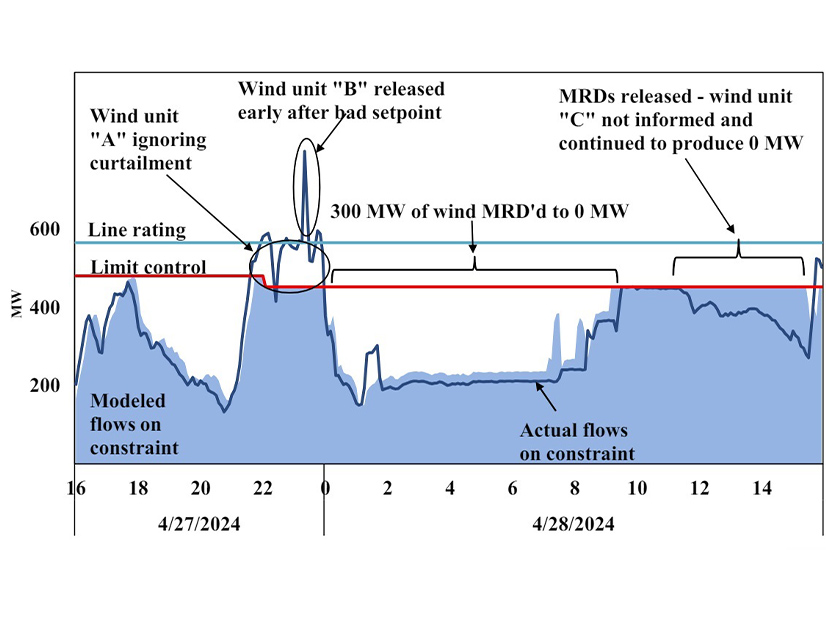

Carrie Milton, of the Independent Market Monitor, said the spring saw a rise in unpredictable output due to renewable energy operators disregarding MISO’s instructions to curtail.

Milton said control room operators were forced to manually intervene “extensively” this spring, with double the rate of manual redispatches and capping wind generation dispatch to bring flows under control of last spring.

She stressed the IMM’s oft-repeated position that unchecked flows from renewable generation exacerbate transmission constraints, with wind operators having little incentive to dial back energy production when told by MISO. That leaves MISO operators having to intervene to maintain system integrity and bring flows back within line ratings.

“It’s effective but very inefficient, and unfortunately, that inefficiency is felt throughout the system,” Milton said. She said not only does manual redispatch raise costs to serve energy, it prevents MISO’s dispatch from pricing congestion accurately and increases uplift payments to generation.

Milton said MISO should introduce software that flags renewable energy owners when their output is exacerbating a constraint and is deviating from their dispatch instructions. If the dispatch flag is ignored, MISO should levy financial penalties, she said.

“They don’t always know when there’s a constraint,” Milton said of wind operators.

Milton said MISO’s wind forecasting also is to blame, and MISO needs to work to reduce forecasting errors. She also said MISO should train its control operators to adjust transmission constraints so its dispatch model can manage constraints optimally.

Over spring, MISO said it experienced $449 million in real-time congestion while wind operators churned out 26 TWh. MISO has acknowledged that uninstructed deviations are worse now than before it introduced the rules to curb them and said it will work with the IMM on potential new rules and software. (See MISO: Worsening Uninstructed Deviation Needs Attention.)