ERCOT staff have made a pair of preliminary recommendations as part of their collaboration on an ancillary services study that is due to Texas regulators before the end of the year.

Jeff Billo, ERCOT director of operations planning, told the Stakeholder Advisory Council on June 24 that staff have been “thinking through this stuff” and running the analyses. ERCOT is working with the Independent Market Monitor and Public Utility Commission staff on the study.

“We really think that we have the right services and the right methodology for quantifying those services today,” Billo said. Unsurprisingly, he said ERCOT plans to use the current mechanisms and is not proposing any changes to those products.

Billo said the first preliminary recommendation covers the frequency control portion of ancillary services: regulation, responsive reserve service and the frequency-response portion of ERCOT Contingency Reserve Service (ECRS). Staff’s other recommendation is to examine the benefits of determining some portion of AS quantities closer to the operating day based on daysahead forecast conditions rather than an annual calculation.

Some ERCOT stakeholders and the IMM have objected to the heavy use of ECRS since its first use last year, saying it has added billions of dollars in costs to the energy-only market. The grid operator procures capacity resources that can be brought online within 10 minutes and sustained at a specified level for two consecutive hours. (See “Contentious NPRR Revising ECRS Passes over Monitor’s Objections,” ERCOT Board of Directors Briefs: June 17-18, 2024.)

Billo reminded TAC of where ERCOT was in 2021, when he told the committee that staff were going to a conservative operations approach, setting aside larger amounts of operating reserves than before.

“[I said we] were going to not walk up right to the edge of the cliff, but we were going to take a few steps back, and we were going to operate with higher reserve margins in real time,” he said. “The idea there is that we’re operating with a lower risk compared to how we historically operated, and that has also driven a change in the amount of ancillary services that we’re getting.”

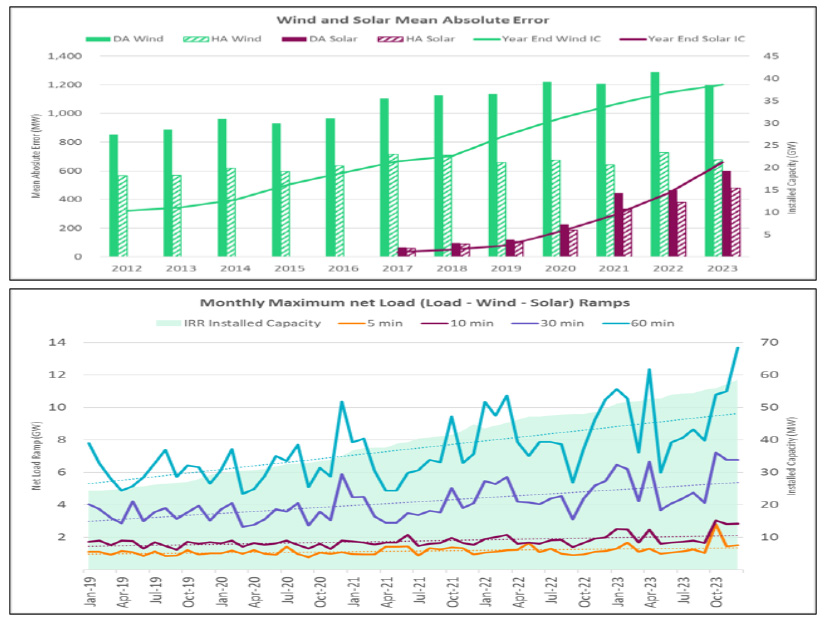

ECRS and other products have become necessary with the increased addition of renewable resources and the resulting growth in load variability, Billo said. He said ECRS was needed to address increasing net load ramps causing greater intra-hour risk and fewer online reserves available to recover frequency after a large unit trips.

“We see the greater exposure when we have forecast misses and so that’s why you’ll see, during especially those ramp times, that we’re getting higher amounts of ECRs to cover that kind of higher exposure,” Billo said.

Also playing a role in the increased use of AS was the public’s anxiety over ERCOT’s ability to meet demand following the disastrous and deadly 2021 winter storm that nearly brought down the Texas grid.

“I think that prior to Winter Storm Uri, there were lots of times where we had watches or we went into [energy emergency alerts] and the public didn’t really notice and didn’t really care,” Billo theorized. “Post-Uri, I think as we saw in 2021, there were times where we would go into a watch and that there’d be a lot of attention on that from the public, but also from state leadership. I think the message that we got … was, ‘ERCOT, we don’t want you to go into a watch and an EEA as much as you have in the past.’

“In my mind, that is a criteria change for how we operate the system and the amount of reserves we’re procuring,” he added.

The IMM’s deputy director, Andrew Reimers, told TAC the IMM’s study is intended to estimate the reliability value of different levels of reserves to inform AS procurement targets. He said the Monitor is focusing on reserves that are responsive within minutes to hours.

The IMM is using 10,000 random draws of a Monte Carlo simulation for each hour in the study period to determine how reserve levels influence loss-of-load projections, given probabilistic distributions of unplanned outages and net load forecast errors. Its staff are using historic hours from June 2023 to June 2024 to compare the capacity at risk to different reserve levels.

“The timeline is definitely a challenge,” Reimers said. “We’re trying to triage this to do the best study that we can given the relatively limited amount of time we have to go on. Ultimately, that means prioritizing what we can getting the results that we can and then figuring out what things have to be left for future work.”

“We’ve had a lot of really good conversations with the IMM. I don’t know if by this September that we’ll agree on all of the details, but conceptually, I think we agree on the framework,” Billo said. “Some of the things we still need to think through are around data. It’d be great if we used 10 years of data, but the forecasts have improved. I’m trying to quantify what my risk is of a forecast error; I really don’t want to use forecast data from 10 years ago.”

Billo asked for stakeholder input before he presents a study update to the Board of Directors during its Aug. 19-20 meetings. An AS workshop will be held after the Aug. 28 TAC meeting and a final report posted to the commission before October.

The PUC also plans an AS workshop in the latter half of October. It’s asking for TAC feedback on which ERCOT and IMM information presented Aug. 28 would be most helpful in filing comments at the commission (55845).

The study is a requirement of legislation passed last year by Texas lawmakers. It directs the PUC to review the type, volume and cost of AS and determine whether those services are necessary in the ERCOT market. The law also requires the commission to evaluate whether additional services are needed for reliability.

Separately, ERCOT staff will begin discussions with stakeholders in July on the grid operator’s 2025 AS methodology. (Billo said ERCOT won’t have time to incorporate learning from the PUC study’s results.)

Staff plan to present its proposal during the October board meeting, allowing for PUC review before next year. ERCOT’s annual requirement to update its AS methodology now includes commission approval.

Members Endorse 7 Changes

TAC approved a protocol change (NPRR1190) that would recover demonstrable financial loss arising from a manual high dispatch limit (HDL) override to reduce real power output, should the output be used to meet qualified scheduling entity load obligations.

The change’s approval came after an attempt to table NPRR1190 until further IMM review came up short. The measure passed 22-6 with an abstention.

The consumer segment provided all six opposing votes over concerns that the change incorrectly expands the opportunity for entities to receive compensation for scheduled-but-not-provided energy under out-of-market ERCOT actions. Supporters noted the infrequent occurrence of the conditions covered by the NPRR and the language that prevents recovery of lost opportunity costs stemming from an HDL override, according to the committee’s report.

The motion to table failed 8-19 with a pair of abstentions. The consumer segment favored tabling.

Members also endorsed three other NPRRs, an Other Binding Document revision (OBDRR) and single changes to the Planning Guide (PGRR106) and the Verifiable Cost Manual (VCMRR) that, if approved by the Board of Directors, would:

-

- NPRR1215: clarify that the day-ahead market’s energy-only offer credit exposure calculation zeros out negative values, with any zeroed-out values being included in the calculation of the percentile difference.

-

- NPRR1225: update the protocols to align with the PUC’s declaratory order on ERCOT’s settlement systems. The grid operator added revisions to meet the commission’s order that exclusions be effective March 4, 2024, when the transfer of Lubbock Power and Light retail customers to retail electric providers began.

-

- PGRR106: clarify which transmission projects are included in the Transmission Project Information and Tracking report.