The introduction to Google’s 2024 Environmental Report begins with a list of the company’s efforts to cut energy consumption and greenhouse gas emissions at its data centers worldwide; for example, Google’s sixth-generation Trillium computer chip is 67% more efficient than its fifth-generation predecessor. The company also has “matched” or offset 100% of its global energy use with renewable energy purchases for seven years in a row and in 2023 signed contracts for an additional 4 GW of renewable power, more than in any previous year.

Such milestones notwithstanding, Google reported a 13% year-over-year increase in greenhouse gas emissions last year, driven primarily by its supply chains and the voracious power demands of the artificial intelligence programs now chewing up electrons at its data centers, the report says.

The company’s 2023 emissions totaled the equivalent of 14.3 million tons of carbon dioxide, up 48% over its 2019 base year, and the report says Google expects further increases “before dropping to our absolute emission reduction target” — net zero by 2030.

The report explains the difference between Google’s assertions of 100% clean energy and its increased emissions in terms of global versus regional accounting: Google tracks its clean energy purchases on a global, annual basis, but the Greenhouse Gas Protocol ― which the company and many other corporations use to track emissions ― monitors on a regional basis.

“In some regions, we purchase more clean energy than our electricity consumption (such as in Europe), while in other regions, we purchase less (such as in the Asia-Pacific region) due to significant regional challenges in sourcing clean energy,” the report says.

Such discrepancies reflect the complicated tradeoffs and uncertainties that Google and other tech giants ― including Amazon, Microsoft and Meta ― now face as AI becomes ubiquitous across almost every sector of the economy and every aspect of daily life. Like Google, Microsoft and Meta have committed to cutting their GHG emissions to net zero by 2030, while Amazon Web Services (AWS) has set a 2040 deadline.

These companies often argue for AI’s potential to cut emissions by optimizing the operation of energy systems, from raising efficiency and cutting electric bills in individual homes to streamlining permitting and interconnection processes to improving visibility across the grid itself.

But realizing that potential comes with a cost: A single AI search can use up to 10 times more power than a standard, non-AI search, which could lead to a doubling of power demand from data centers by 2030, according to a recent report from the Electric Power Research Institute (EPRI). (See EPRI: Clean Energy, Efficiency Can Meet AI, Data Center Demand.)

In the past, increases in data center power demand have been mitigated largely by advances in chip, software and data center efficiency, the EPRI report said. But even with new efficiency measures, like Google’s, the industry is struggling to offset the exponential growth in demand from AI.

Google estimates that in 2023, its data centers used 24 TWh of electricity, or about 7% of the power demand of the world’s data centers, which the International Energy Agency has estimated at 240 TWh to 340 TWh. Overall, cloud and AI data centers represent between 0.1 and 0.2% of global electricity use, the Google report says.

The impact of this increased demand in the United States has become a point of intense discussion across the high tech and electric power industries as more and more states compete to draw in “hyperscale” AI data centers. Historically, power demand for individual “enterprise” data centers has varied from 5 MW to 50 MW; hyperscale centers start at around 100 MW and can exceed 700 MW.

Northern Virginia’s “Data Center Alley” — home to an estimated 150 hyperscale data centers — accounts for 25% of total U.S. power demand from data centers, and a recent study predicted the area would need to add 11 GW of new power by 2030 to meet predicted growth. (See Report Shows Wide Range of Data Center Demand Scenarios for Virginia.)

A list of new load additions in development in the MISO service territory includes a pipeline of nine data centers ― including two Google facilities in Indiana ― totaling 5.7 GW.

Getting to 24/7 CFE

Google’s ambitious targets for using carbon-free energy (CFE) make its net-zero goals even more daunting. The company has pledged to power all its facilities with 24/7 CFE ― matching supply and demand on an hour-by-hour basis ― again by 2030. It also is committed to buying clean power that comes “bundled” with energy attribute certificates (EACs), similar to renewable energy certificates (RECs), to ensure it is adding new carbon-free projects to the grid.

Microsoft and other companies, including utilities, sometimes supplement their purchases of clean energy by buying unbundled EACs, which typically come from existing renewable energy projects and may not add new clean power to the grid.

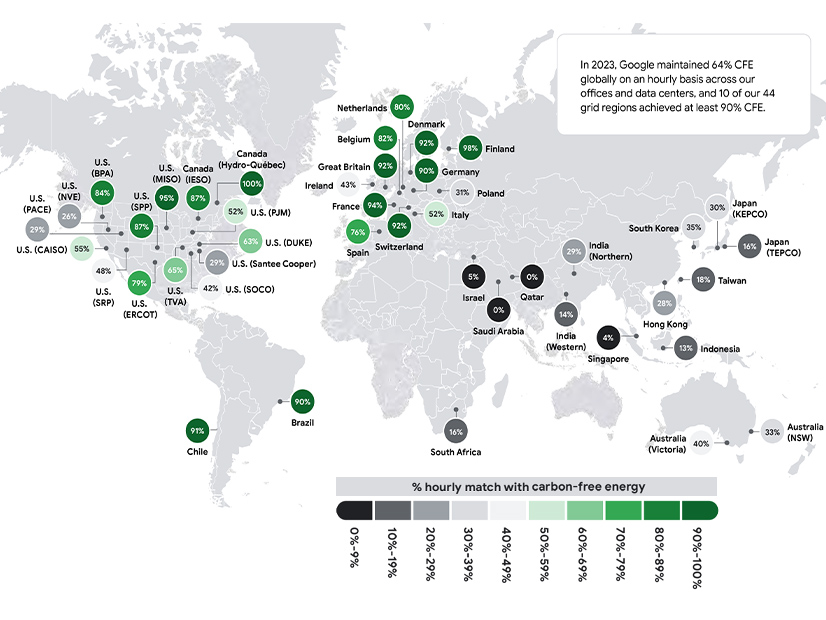

Google now averages 64% CFE at its data centers worldwide, with varying levels of clean energy going to facilities in different grid regions, the report says. Data centers in 10 grid regions — including MISO — are running on 90% or more CFE, while those in the Middle East, Africa and Asia are well under 20%. Total electricity demand at the company’s data centers increased by 3.5 TWh, or 17%, in 2023, the report says.

Beyond making its data centers more efficient, Google also has developed a “carbon-intelligent computing platform” that allows the company to shift computing tasks to other times or locations with more available CFE.

Familiar roadblocks to faster procurement and deployment of CFE have proved harder to shift, including interconnection delays, higher interest rates and development costs, and supply chain backlogs, according to the report. But Google also has become an active partner working with developers and utilities to pilot new business models aimed at untangling some of these problems.

The company partnered with LevelTen Energy, an online energy marketplace, to develop a streamlined process for issuing requests for proposals and negotiating power purchase agreements through standard PPA terms included upfront in the RFP. The new approach has cut the time from RFP to signed PPA from 10 to 12 months to about 100 days, allowing Google to finalize contracts for 1.5 GW of power, according to an announcement on the LevelTen website.

Similarly, the company is looking for ways to de-risk and accelerate the commercialization of emerging technologies that can provide the clean, dispatchable power its data centers need. In June, Google and NV Energy unveiled a “clean transition tariff,” now pending approval by the Nevada Public Utilities Commission. Under the proposed tariff, Google would pay a fixed premium for locally generated CFE ― from an enhanced geothermal project developed by Fervo Energy ― to match demand hour for hour at a Nevada data center.

Google has framed both initiatives as replicable models that can be used in other U.S. or global markets.

Looking to the future, an emerging theme in industry discussions is the need for the responsible use of AI, both socially and environmentally.

Defining “responsible use,” however, will be an evolving and intensely debated target. The Google report notes that the speed of technological transformation driving AI means “historical trends likely don’t fully capture AI’s future trajectory.” Further, as AI is integrated across global economies, “the distinction between AI and other workloads will not be meaningful.”