NYISO stakeholders are divided over consultants’ proposal to use a two-hour battery as the peaking plant in the ISO’s capacity market demand curve, as part of its quadrennial demand curve reset for 2025-29.

Comments on the draft report, produced by Analysis Group and 1898 & Co., were due last week. Generators generally were opposed to the proposed proxy unit, while state agencies were in support.

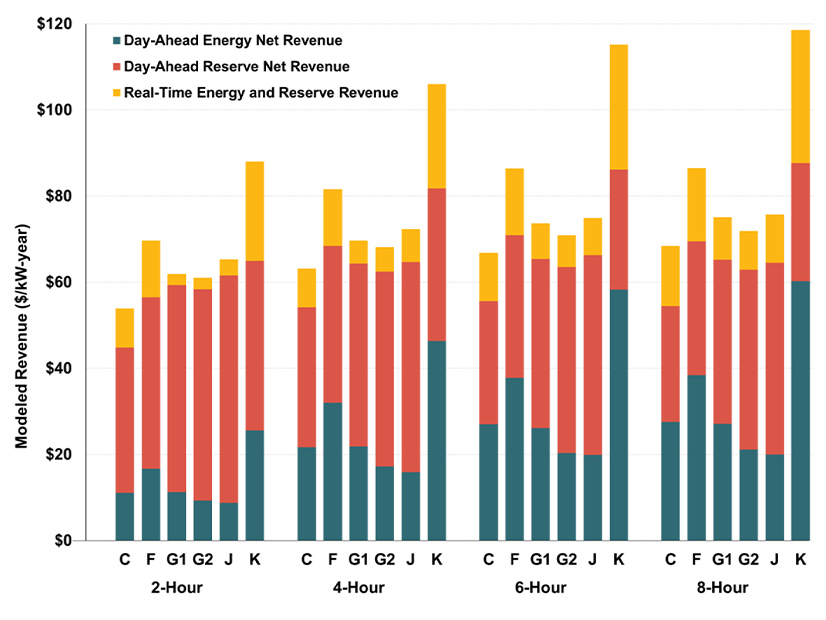

To set the curve, NYISO looks at the gross cost of new entry, the cost of a hypothetical new peaking plant and the likely revenues the plant would earn from participating in the capacity market. The difference between likely cost and likely revenue illustrates what the hypothetical peaking plant would need to earn from the capacity market to support entering the market.

The current curve uses General Electric’s H-class frame gas turbine as the peaking plant. (See FERC Approves NY Demand Curve Reset, Rejects 17-Year Amortization.)

The consultants found that a two-hour battery energy storage system (BESS) “represents the highest variable cost, lowest fixed-price peaking plant that is economically viable,” the report said. “To be economically viable and practically constructible, a BESS would use lithium-ion technology and a modular purpose-built enclosure form-factor.”

The cost of the two-hour BESS assumes a 15-year amortization period and additional costs for capacity augmentation over the life of the battery system to “ensure consistent performance.”

The Independent Power Producers of New York wrote that they strongly oppose the selection of a two-hour BESS as the proxy unit in all locations of the New York Control Area. The IPPNY wrote that two-hour BESS has an inherent limited operating capability, which means it “cannot meet transmission security-based requirements.”

“The Hochul administration says we need 10-hour batteries and up. The NYISO System & Resource Outlook … says we need long-duration storage of four hours and up,” said Richard Bratton, director of market policy and regulatory affairs for IPPNY. “I think that we agree that on a foundational basis that a two-hour battery can’t meet reliability needs for the system, and yet we’re seeing a push for it just because it is the cheapest option.”

Luminary Energy, an energy market consulting firm, recommended the Analysis Group consider “no less than a four-hour BESS or the simple cycle gas turbine” as the proxy unit.

“A two-hour BESS would not be able to mitigate the reliability risks and needs outlined by the NYISO’s Comprehensive Reliability Planning process,” Luminary wrote. “A two-hour BESS would not provide sufficient energy optionality for grid operators to manage volatile and uncertain real-time conditions and presents a high risk to grid operators of depleting the energy from the asset before the most critical systems present themselves.”

The New York Battery and Energy Storage Technology Consortium commented that choosing the two-hour unit would contribute to volatility in the capacity market. The selection potentially would result “in an abrupt drop in capacity prices as the demand curve is determined on a new, lower-cost proxy unit.”

Others questioned the Analysis Group’s appraisal of site leasing costs in New York City. Jones Lang LaSalle Americas, a commercial real estate services and investment firm, commented that the methodology used in the draft demand curve “underestimates the expected site leasing costs.” It recommended using the required rate of return of 7.2 to 7.45%. This would cover the higher site leasing costs for industrial uses required by new generation.

Support, with Some Caveats

The New York Department of Public Service supported the selection of the two-hour BESS as the peaking unit, saying the draft demand curve supported the policy goals of the Climate Leadership and Community Protection Act requirements and the state’s goal of 6 GW of energy storage statewide by 2030.

The DPS did ask that the consultants include revenues and incentives from outside the wholesale market when calculating the net cost of entry for a new peaking plant. The department cited numerous state programs that would compensate clean energy resources for their clean attributes in meeting the state’s CLCPA goals.

Comments submitted on behalf of New York City were more ardently supportive of the draft demand curve and agreed with the selection of the two-hour BESS as the peaking unit of choice.

“Frankly, based on ‘the numbers,’ selection of a two-hour BESS as the proxy peaking unit technology is the clear-cut choice with no close or even obvious alternative,” the city commented. “Moreover, it is beyond rational dispute that a two-hour BESS based on lithium-ion technology is in fact a viable technology.”

The New York Transmission Owners wrote that they agreed with the consultants that the two-hour BESS required less capacity revenue than the other technologies to support its entry to the market and that it had the lowest fixed costs. But they urged the consultants to shift the amortization period to 20 years as opposed to 15, citing the industry’s increased experience with battery storage units.