Batteries may be receiving excessive or inefficient bid cost recovery payments in CAISO, an issue that could be exacerbated by the ISO’s recent move to increase its soft offer cap to allow for higher bids by storage resources.

Batteries may be receiving excessive or inefficient bid cost recovery (BCR) payments in CAISO, an issue that could be exacerbated by the ISO’s recent move to increase its soft offer cap to allow for higher bids by storage resources.

The issue was highlighted by CAISO’s Department of Market Monitoring and Market Surveillance Committee on July 8 during the first workshop of a new Storage Bid Cost Recovery and Default Energy Bids initiative.

CAISO staff launched the effort to address concerns related to a rule change pending before FERC that would alter ISO rules related to FERC Order 831 by raising the soft offer cap from $1,000/MWh to $2,000/MWh, in part to accommodate opportunity costs and bidding strategies for storage resources. (See CAISO, WEIM Boards Approve Proposal to Raise Offer Cap.)

“BCR, as [with] many other elements of the CAISO tariff and the market, was initially designed with a thinking of conventional assets,” Sergio Dueñas Melendez, storage sector manager at CAISO, said during the workshop. “This was something that was not developed in a manner or outlined with potential new technologies that could be integrated into the CAISO market en masse, particularly with storage.”

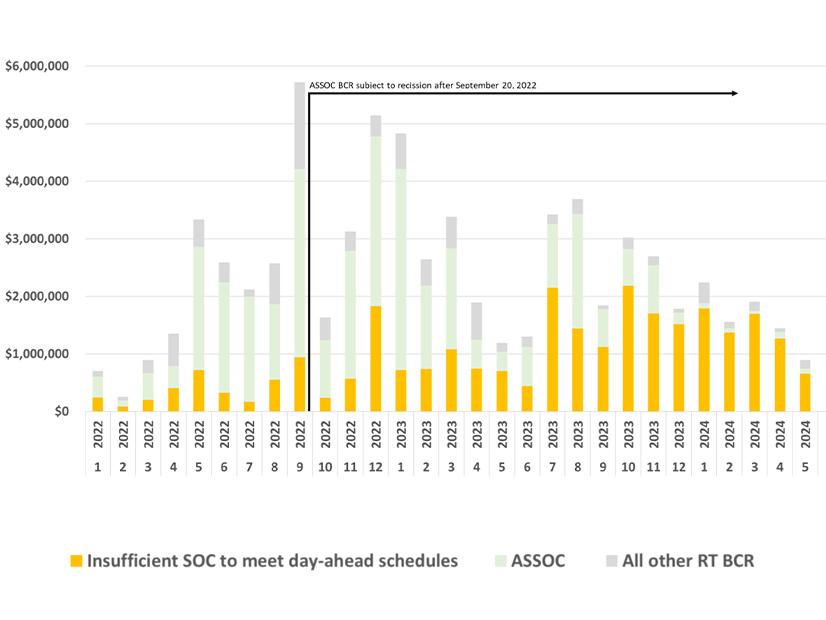

BCR is intended to eliminate the incentive for resources to add a risk premium to their offers, which drives up bids, leading to higher overall energy costs and inefficient market outcomes. But the DMM noted that BCR payments to storage resources have materialized — specifically related to the buy- and sellback of day-ahead schedules — despite not being aligned with the intent.

“Assets might be incented to bid and operate in the [real-time] market in a manner that would trigger buy- or sellbacks of their [day-ahead] energy schedules in order to capture outsized BCR payments,” Dueñas Melendez said.

Generating units can receive BCR payments if total market revenues earned throughout the day don’t cover the sum of the unit’s acceptable bids, which includes bids for startup, minimum load, ancillary services, residual unit commitment availability, day-ahead energy and real-time energy. Because batteries don’t have startup, shutdown, minimum load or transition costs, they “lack the traditional drivers of BCR,” according to a DMM report on battery storage from July 2023.

Batteries, however, can be subject to BCR because of their opportunity costs, incurred when a battery discharges during a particular time of the day, usually from weather-related grid conditions. Discharging energy during low-demand hours, for example, could preclude discharging during hours of high demand, and the difference in market prices between low and high demand hours represents the opportunity cost of discharging in lower-priced hours.

“In the past, battery energy storage has received disproportionate amounts of BCR,” Dueñas Melendez said. “In their comments, throughout the Order 831 process of bidding above the soft offer energy bid cap, DMM highlighted once more that those changes could exacerbate the challenges that they’ve identified regarding BCR. This perspective was also echoed by the Market Surveillance Committee, who recommended that ISO staff engage with stakeholders to review and restructure current BCR provisions for batteries, particularly given the changes around Order 831.”

The July 2023 report highlighted that in 2022, batteries received nearly $30.5 million in payments, primarily in the real-time market, despite making up only 5% of CAISO’s capacity.

‘Aggressive Timeline’

Stakeholders expressed confusion about the root of the problem, specifically related to why batteries, in some cases, don’t have the state-of-charge to fulfill a schedule.

“What caused the real-time state-of-charge to put us in the position of a buyback or a sellback? Was it the result of price or modeling issues? Was it the result of not co-optimizing in real-time ancillary services? Was it because of bidding behavior, and are there rules that need to be put around that?” asked Don Tretheway, managing director of EES Consulting and representing the California Energy Storage Alliance. “I don’t think making these high-level statements helps anybody in terms of trying to understand where the solution is, especially given the speed at which you plan to make these changes.”

Stakeholders also expressed concern about the “aggressive timeline” of the initiative, which Dueñas Melendez said is on an expedited schedule because of its “sensitive nature.” Track 1, dedicated to refining BCR provisions for storage, initially gave stakeholders only three days to submit comments, but after significant pushback, the ISO extended the deadline to July 18.

“The fact that CAISO committed to working on this stuff in 2022 and didn’t do anything for two years, and now we’re going to do this in two months, it seems a little inconsistent with comments made to FERC about taking this as a priority,” Tretheway said.

Alva Svoboda, principal of market design integration at Pacific Gas and Electric, echoed the concerns.

“This is obviously a very aggressive timeline, and in my mind, it implies only one kind of solution feasible for CAISO … which is to essentially trigger periods in which batteries are not eligible for BCR and hence are completely unhedged against any price outcome in the market.”

Rather than meeting to discuss the straw proposal scheduled for publication July 17, the ISO added an additional workshop July 22 to continue working through the issue with stakeholders.