CAISO’s own systems may have contributed to a set of “operational surprises” that forced it to declare a series of energy emergency alerts in July 2023, a member of the ISO’s Market Surveillance Committee (MSC) said July 30.

“It is our understanding that CAISO/Western EIM operators were surprised by near-real-time changes in the CAISO/Western EIM supply demand balance on July 20 and July 25, 2023,” MSC member Scott Harvey, a consultant at FTI Consulting, said during a presentation at the MSC’s monthly meeting. “There are also indications that CAISO systems and operator actions may have contributed to operational surprises for Western EIM balancing area operators.”

High levels of self-scheduled exports out of CAISO’s balancing area to support stressed conditions in other parts of the West prompted the ISO to issue an EEA 1 on July 20 and EEA watches on July 25 and 26. (See CAISO DMM: High Exports to Southwest Led to July EEAs.)

On July 20, CAISO was close to being unable to deliver exports that had received hour-ahead awards, though no load was ultimately curtailed. But on July 25, the ISO was unable to award several thousand megawatts of self-scheduled exports.

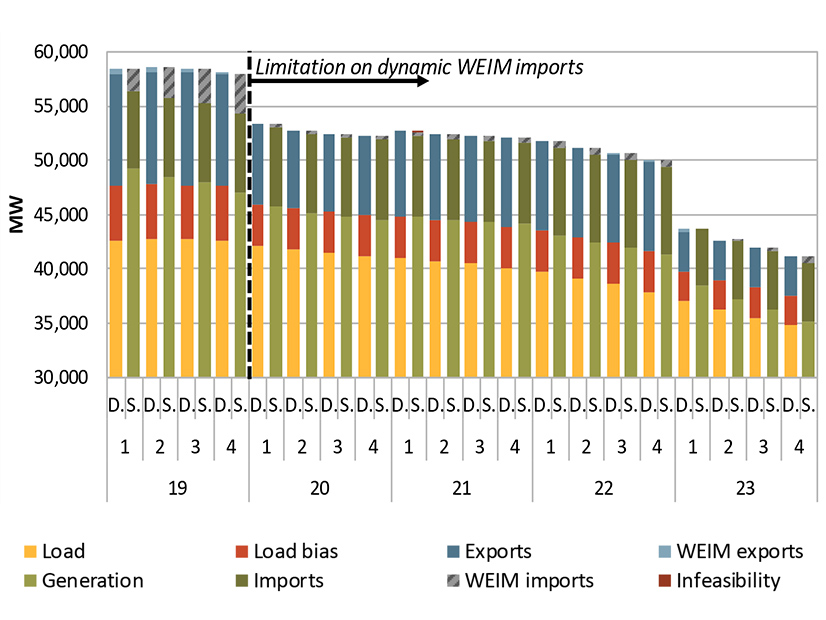

As a result, CAISO imposed import limits from the WEIM into the CAISO balancing authority area between July 25 and Nov. 16, leading to increased transmission congestion in the 15-minute market and lower prices in the five-minute market, the ISO’s Department of Market Monitoring said in March. (See DMM: CAISO Transfer Limitations During Q3 Heatwaves Led to Price Disparities.)

Although the DMM previously said it was unclear why CAISO chose to implement transfer limits through November, Guillermo Bautista Alderete, CAISO’s director of market performance and advanced analytics, provided additional color by identifying two key market issues. The first, he said, was an inaccurate display of dispatchable capability in the market, where information presented to operators showed an imprecise calculation of storage resources, impacting operators’ ability to take proactive action.

“One of the purposes of that display and that information is to project how the ramp capabilities position for the near future,” Alderete said. “If they see that the ramp capability is getting thinner and thinner, they may start taking action rather than applying load conformance.”

The second was related to scheduling and tagging processes. When clearing transactions in the WEIM between Oregon and California, a change in practice led to double counting, which exacerbated congestion and kept flexible ramping product (FRP) “stranded in the north.”

Additionally, export reductions projected in the hour-ahead scheduling process (HASP) led to uncertainties in the real-time market due to exports not materializing.

“We had about 2,400 megawatts of additional demand that HASP was not projected as having to meet, and now the [real-time dispatch] has to meet that extra obligation in real-time,” Alderete said.

The issues weren’t fully addressed until Nov. 16, when the ISO stopped imposing transfer limits.

MSC Questions Flexiramp, HASP Structure

The “operational surprises” associated with July’s events also included problems identified with HASP and CAISO’s flexible ramping product (flexiramp).

While the role of HASP has “evolved dramatically” since it was implemented in 2014, the structure has not, Harvey said.

The HASP originated as a tool to schedule interchange transactions between CAISO and adjacent balancing areas in conjunction with the scheduling of CAISO balancing area resources. While HASP still serves that role, it “has developed into an hourly spot market for the purchase of capacity to meet the [WEIM’s] resource sufficiency evaluation,” Harvey said.

In 2014, almost all imports and exports scheduled in HASP were with balancing areas that didn’t belong to the WEIM. As of July 2023, nearly all imports and exports scheduled in HASP sourced or sank within the EIM.

As a result, stakeholders questioned the implications of the resource sufficiency evaluation of HASP transactions included in WEIM base schedules but not clear in HASP.

“A core issue is that when CAISO clears HASP to schedule hourly interchange between … CAISO and other Western EIM balancing areas, day-ahead market exports that do not clear in HASP improve the CAISO resource balance relative to the day-ahead market, appearing to increase supply in both … CAISO and the Western EIM,” Harvey’s presentation said.

“However, market exports that do not clear in HASP may be included in the base schedules of EIM entities,” it said. “The current HASP structure models the improvement in CAISO supply when day-ahead exports do not clear but does not model the potential reduction in Western EIM supply. Hence, HASP can appear to show a supply demand balance in the Western EIM when there actually is a large supply gap.”

If WEIM entities find out only after HASP posts that exports included in their base schedules will not flow in real time, they will have less time to take remedial action, as was the case in July.

“It seems that this HASP structure is creating an information problem, that it isn’t set up to tell us the truth for the Western EIM,” Harvey said. “It’s going to tell the truth for what the CAISO needs to do to avoid load shedding in terms of having supply that it can point to, but it isn’t looking necessarily at … the big picture.”

Harvey also questioned the effectiveness of flexiramp and pointed to its potential to create more “operational surprises.” In the case of July’s events, flexiramp product couldn’t reach CAISO’s balancing area due to congestion.

“If we’re going to reduce the load conformance, we have to make sure that the flexiramp is deliverable, and it looks to me like part of the problem on the 20th was that it wasn’t,” Harvey said.

Additionally, flexiramp is designed only to cover net load uncertainty and does not procure capacity in real time to cover all types of supply changes, such as those that occurred in July.

To avoid another emergency event, Alderete highlighted a few ways CAISO could improve.

“We have realized there needs to be better awareness for operators to get a sense of the wider picture, how many transfers they have and potentially give them more confidence of how much of those could be realized,” Alderete said.

Staff also took steps to increase transparency, including using market messages to communicate information on transfer limits.

“We realized that we could have communicated better, and I think we can do better for whenever the next time is going to be,” Alderete said.