CAISO scored a geographically small but symbolically significant victory in its contest with SPP on Aug. 28 with the announcement that two Black Hills Energy subsidiaries serving parts of Montana, Wyoming and South Dakota will move from SPP’s Western Energy Imbalance Service (WEIS) to the ISO’s Western Energy Imbalance Market (WEIM).

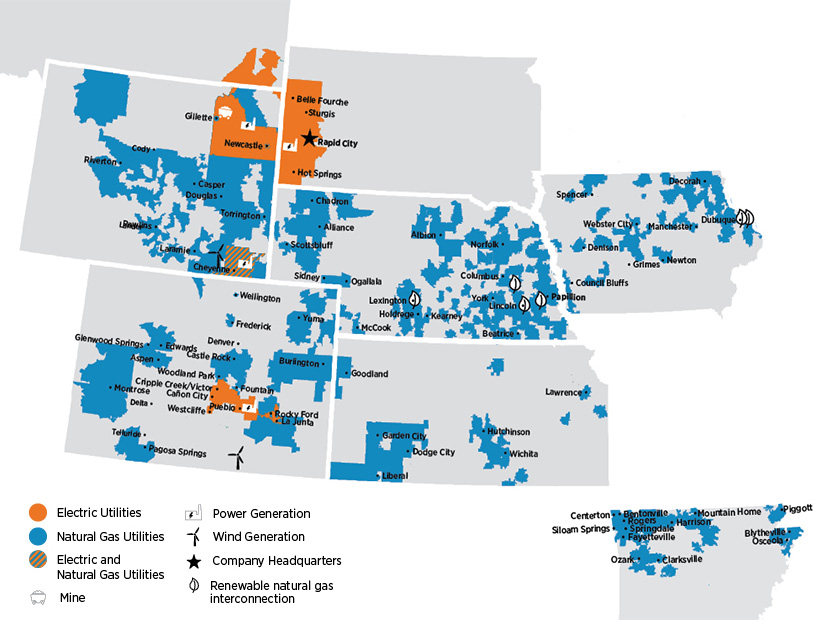

The decision by Black Hills Power and Cheyenne Light, Fuel and Power will expand the WEIM’s presence in Montana and Wyoming and extend its footprint eastward to take in a slice of South Dakota, which would become the 12th state included in the market.

“The agreement with California ISO provides the company with options to support reliability and system balancing, while paving the way for Black Hills Energy to participate in California ISO’s Western Energy Imbalance Market, starting in 2026,” Black Hills Energy said in an email to RTO Insider.

“We are very pleased to begin this process with Black Hills Energy to deliver future economic and reliability benefits to its customers,” CAISO CEO Elliot Mainzer said in a statement.

But the decision might be most consequential as another development in the ongoing competition for participants between SPP’s Markets+ and CAISO’s Extended Day-Ahead Market (EDAM), the latter of which builds on the WEIM.

In 2022, SPP said it eventually would phase out its real-time WEIS once its other Western market efforts gathered more momentum and members. (See SPP to Phase Out WEIS as New Market Offerings Expand.) At the time, SPP said it intended “to only provide one market offering in the West in order to provide maximum benefits for Western utilities” and that WEIS participants “will have the option to join the RTO or participate in Markets+.”

That projected outcome seems to have played a role in Black Hills’ decision to migrate to the WEIM.

“The planned formation of the SPP RTO West required us to assess our future market path, as it did not appear that the WEIS market status quo would remain an option after RTO West is operational,” the utility told RTO Insider. “We have found imbalance market participation to be beneficial for our customers, and the opportunity for our utilities to participate in the WEIM allows us to continue to optimize our generation operations while maintaining our high reliability and creating long-term value for the customers we are privileged to serve.”

Asked whether it is now considering joining the EDAM, Black Hills said it “will continue to monitor and be engaged in the development of markets in the Western Interconnection and will pursue future markets that provide additional value for the company and our customers.”

After joining the WEIS in 2023, both Black Hills subsidiaries participated in the extensive “Phase 1” effort to develop the tariff for Markets+, which SPP filed with FERC in March — and for which it received a deficiency notice last month. (See SPP Dispels Concerns over Markets+ Deficiency Letter.)

Black Hills offered an equivocal response to another question about whether it plans to continue funding Markets+ during the Phase 2 implementation process, reiterating that it will continue to “monitor and be engaged in” Western market developments.

An SPP document shows that Black Hills Power would be responsible for providing a 0.9% share of Phase 2 funding, while Cheyenne Light would be on the hook for 0.6%, amounts other funders would be required to cover if the two utilities withdraw from the effort. SPP estimates Phase 2 will cost about $150 million. (See BPA to Delay Day-ahead Market Decision, Sources Say.)

“SPP is aware of the announcement by Black Hills and continues to support each market participant’s ability to decide on a market choice that they consider best for their customers,” SPP spokesperson Meghan Sever said in an email. “The decision by Black Hills does not impact the viability of Markets+ or the RTO expansion in the West.”

Another Western BA

According to an integrated resource plan the utilities filed jointly with the South Dakota Public Utilities Commission in 2021, Cheyenne Light and Black Hills Power together serve more than 117,000 customers and operate 1,344 miles of transmission, most of which are maintained by the latter utility. That system interconnects with PacifiCorp and the Western Area Power Administration’s Rocky Mountain Region.

While both utilities sit within WAPA’s balancing authority area, the WEIM implementation agreement signed between CAISO and Black Hills Energy on July 31 stipulates that one of the utilities will be required to register a new BA to facilitate participation in the market.

The utilities’ 2021 IRP included a study by NAES that found they “are well situated to become a BA” but noted that maintaining it would cost between $5.77 million and $10.21 million annually, compared with costs of $3.54 million to $5.28 million a year for remaining in WAPA. Moving into PacifiCorp’s neighboring BA would cost the two utilities $3.10 million to $3.21 million annually, the study found.

“The implementation agreement supports our South Dakota and Wyoming electric utilities as they prepare to transition from the Western Area Power Authority, which currently provides balancing authority services, to a new BA in 2026,” Black Hills told RTO Insider.

That move would bring the number of Western BAs to 39.

The Black Hills announcement comes two days after the Bonneville Power Administration said it will delay its choice of a Western day-ahead market until next year. (See BPA Postpones Day-ahead Market Decision Until 2025.)