CAISO is reconsidering its proposal to address unwarranted bid cost recovery (BCR) payments for storage resources following internal analysis that suggested the proposed solution wouldn’t sufficiently address the problem.

The initial proposal would have redefined dispatch unavailable due to battery state of charge (SOC) constraints in the binding interval as “non-optimal energy,” which is ineligible for BCR. (See CAISO Adjusts Timeline for Storage Bid Cost Recovery Initiative.) But due to the use of multi-interval optimization (MIO), the ISO found the proposal may not significantly reduce BCR payments and would be challenging to implement.

“The proposed solution is based on the assumption that dispatch in the binding interval is optimal,” Sergio Dueñas Melendez, CAISO storage sector manager, said at a Sept. 11 Storage Bid Cost Recovery and Default Energy Bids Enhancements workshop. “By optimal, we mean that it’s economic. This assumption, however, may not hold true, in general, because of how MIO operates, particularly with regards to energy storage.”

Dueñas Melendez explained that it’s “possible for an economic dispatch to occur in the binding interval that would preserve or even increase the state of charge moving forward” in a way that could be repeated across several real-time dispatch runs, “resulting in a situation where the proposed solution would not be triggered and BCR would continue to be allowed to accumulate.”

For the proposal to be effective, the ISO would need to modify the solution to consider both binding and advisory intervals. CAISO encountered a similar problem with the ancillary services SOC constraint, Dueñas Melendez said, and while the issue is familiar, it increases the complexity of the solution.

Another concern with the proposed solution was identified regarding market power mitigation, where stakeholders noted that the BCR calculation should not exclude instances in which resources were mitigated in intervals prior to a buy- or sell-back of energy.

“It is important to consider instances in which resources may have had an inadequate state of charge to meet awards of schedules because of mitigation in prior intervals,” Dueñas Melendez said.

CAISO’s Market Surveillance Committee flagged the issue in prior meetings and recommended further analysis to understand its impact on BCR. According to MSC’s recommendation, if the analysis showed a material impact, the market could benefit from the ISO developing an exception for mitigation.

Multi-interval Optimization

The ISO provided background on the relationship between MIO and storage BCR. For storage resources, the MIO charges or discharges a storage asset due to projected conditions in the future, “linking solutions over intervals to ensure the asset’s limited SOC is utilized when it is most valuable,” an ISO presentation said.

MIO charges or discharges a resource to prepare for a future energy award, to avoid hitting a maximum SOC constraint, to adjust for future interval economic conditions stemming from supply, demand or net interchange forecasts, or to rebalance an exceptional dispatch.

“As a result, MIO may dispatch a resource uneconomically in the binding interval due to actions taken by the scheduling coordinator, due to factors that inform the ISO’s market optimization, or due to the optimization process itself.”

MIO could increase the complexity of developing a solution due to the proposal’s assumption that the ISO will be able to identify when a binding interval has an SOC constraint. The problem, Dueñas Melendez said, is that SOC constraints are often not binding in the binding interval, meaning the solution may not be triggered when needed.

Mitigation has ‘Minimal Impact’

While stakeholders noted that instances in which resources were mitigated in intervals prior to a buy- or sell-back could merit specific BCR provisions, a presentation from CAISO’s Department of Market Monitoring (DMM) suggested otherwise.

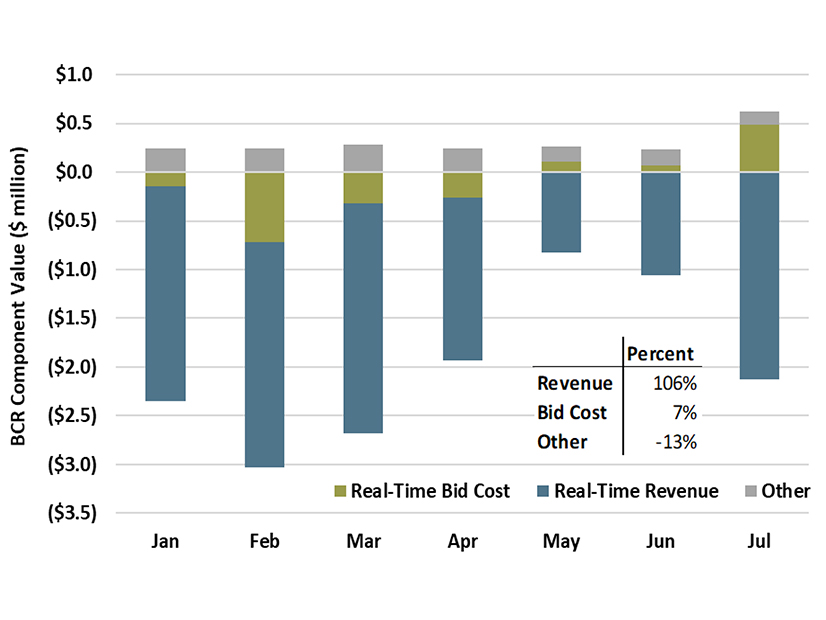

For the first half of 2024, real-time BCR for state-of-charge-induced buy- and sell-backs of day-ahead schedules were “primarily driven by negative revenues, not the bid costs,” DMM Senior Advisor Roger Avalos said.

Avalos also identified that mitigation of batteries has had minimal impact on dispatch of batteries prior to peak net load hours, even if batteries bid high.

“This indicates that more efficient bidding incentives created under ISO’s initial proposal would not have been undermined by local market power mitigation,” the presentation reads.

Stakeholders requested additional data that shows not just the impact of mitigation on dispatch, but also its effect on a resource’s ability to charge.

“That seems to be where the mitigation is really causing a chokepoint, because it’s moving your willingness to pay down lower,” said Cathleen Colbert, senior director of Western markets policy at Vistra.

To better understand the complexity of the issue, other stakeholders echoed Colbert’s request.

“It would be helpful to see a more distinct breakdown between reductions of discharge versus reductions of charging for purposes of mitigation, just to see if there’s any effective patterns that might be found there,” said Josh Arnold, senior market and operations analyst at Customized Energy Solutions. “Some additional clarity would be very welcome.”

The draft final proposal is slated for Sept. 30.