PacifiCorp could earn up to $359 million a year in net benefits from participating in CAISO’s Extended Day-Ahead Market, nearly double the previous estimate, according to a newly updated study prepared for the utility by The Brattle Group.

The update also more than doubles the estimate of benefits for the entire EDAM footprint compared with the original market study Brattle produced for PacifiCorp in April 2023.

That study showed the six-state utility reaping $181 million in net benefits from a day-ahead market whose footprint included CAISO, Balancing Authority of Northern California, Idaho Power and Los Angeles Department of Water and Power, with all market participants realizing a total of $437 million in benefits.

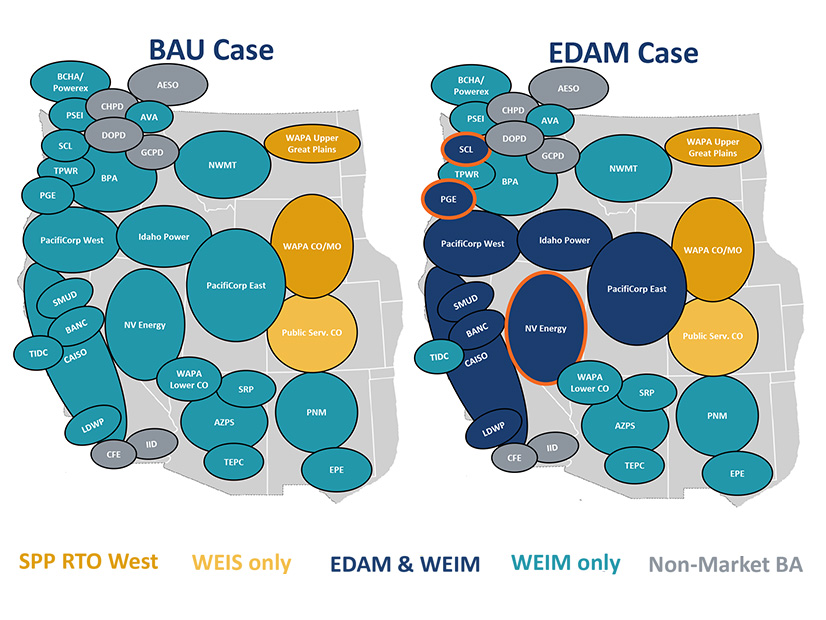

The revised study expands the EDAM footprint to include more recently announced participants NV Energy and Portland General Electric, as well as likely joiner Seattle City Light. It also factors in the effects of SPP’s RTO West and Western Energy Imbalance Service footprints.

As in the original, the updated study measures PacifiCorp’s EDAM benefits against a “business as usual” (BAU) case that consists of the current Western Energy Imbalance Market footprint. It doesn’t consider the effect of potential Western participation in SPP’s Markets+.

According to Brattle’s updated modeling, PacifiCorp’s rise in benefits results in part from a $53 million reduction in the utility’s adjusted production costs (APC) under the expanded EDAM footprint. The utility sees an even bigger boost from a $120 million increase in EDAM congestion and transfer revenues, with $88 million of that realized on paths with the three newly included market participants.

More specifically, the updated study found that PacifiCorp’s benefits in its resource-heavy East (PACE) balancing authority area are driven by increased economic dispatch of gas generation into the rest of the EDAM and rising sales revenues from renewable resources.

“PACE receives $163 million in increased sales revenues on $82 million in increased generation costs, with average day-ahead sales prices increasing from the BAU case to EDAM from $23/MWh to $29/MWh,” the study says.

Brattle said PacifiCorp’s extensive transmission network would be “extremely valuable” to the EDAM because it connects to more of the market’s members than any other participant.

The benefits in PacifiCorp’s West (PACW) BAA and Washington territory would derive largely from reduced generation and energy purchase costs.

“PACW is both able to reduce its generation 360 GWh in EDAM (saving $16.4 million) and time purchases better to buy 539 GWh more in EDAM, but for $12.2 million less than in the BAU case,” according to the study.

Compared with the 2023 study, the updated study assumes PacifiCorp will be heavier in annual output from renewable and thermal generation, with a 9 TWh increase in wind — mostly in PACE — and a 6 TWh increase in coal-fired generation because of the carbon capture tax credit for the Jim Bridger plant in Wyoming. Nuclear output declined based on removal of one small modular reactor project. Estimates for hydroelectric generation also were lowered to reflect the utility’s own hydro capacity updates.

PacifiCorp in April became the first Western utility to fully commit to the EDAM and sign an implementation agreement with CAISO.

Brattle’s updated study increases the EDAM-wide benefit estimate to $837 million, noting the larger footprint produces larger APC savings and increases market revenues.

“New footprint members account for more than $200 million of the [$285 million] increase in trading revenues,” the study finds.

The expanded footprint also reduces the region’s bilateral trading value by an additional $275 million, for a total decline of $531 million, according to the study.