The Bonneville Power Administration would earn $65 million in annual benefits from joining CAISO’s Extended Day-Ahead Market but face $83 million in increased yearly costs from participating in SPP’s Markets+, according to a new Brattle Group study that is sure to further inflame the ongoing debate over day-ahead markets in the West.

The BPA Day-Ahead Market Participation Benefits Study, which examines scenarios for 2032, extends similar findings to the rest of the Pacific Northwest (PNW) system.

“We find that if most of the Pacific Northwest, including BPA, joined EDAM, customers in the region would see a cost reduction of $430 million per year,” Brattle Principal John Tsoukalis, lead author of the study, said in an Oct. 9 press release accompanying the study.

By contrast, PNW net system costs would collectively increase by $18 million under a situation in which most of the region’s entities participate in Markets+, Brattle found.

In the study, the PNW system includes BPA, Avista, PacifiCorp’s West balancing authority area, Portland General Electric (PGE), Puget Sound Energy, Seattle City Light and the numerous public utility districts that largely rely on BPA for low-cost power to serve electricity customers in mostly rural areas of Oregon and Washington.

The report is the latest in the series of Western day-ahead market studies performed by Brattle, the most recent being a white paper comparing key features of the EDAM and Markets+. (See Brattle Study Likely to Fuel Debate over EDAM, Markets+.) It was not commissioned by BPA, but rather by a group of Northwest-based EDAM proponents, including the Northwest & Intermountain Power Producers Coalition (NIPPC), NW Energy Coalition (NWEC), PNGC Power and Renewable Northwest, as well as GridLab.

Those organizations have been firmly in the camp of electricity sector stakeholders who have argued that the West must create a market with the largest possible footprint — and that pointedly includes CAISO — to allow participants to fully tap the “diversity benefit” of resources and loads that would become available from such an arrangement. The Brattle BPA study throws its weight behind that argument.

“The key benefit differentiator in customer cost savings between the two markets is the diversity of the generation resource mix available in an EDAM footprint, which includes the Pacific Northwest as well as parts of the Southwest,” Brattle said in its press release.

Study Structure

The BPA study participants included the Balancing Authority of Northern California, El Paso Electric, Idaho Power, Los Angeles Department of Water and Power, NV Energy, PGE, PacifiCorp, Public Service Company of New Mexico, Sacramento Municipal Utility District and other utilities, transmission owners and independent power producers.

Those participants “helped refine our model by performing full reviews of relevant modeling assumptions including transmission rights, transmission costs, load forecasts, fuel prices, generation mix and costs, etc.,” Brattle said, calling out PacifiCorp and PGE among the “several” reviewers that “were able to provide details relevant to BPA’s system.”

Brattle worked with the Northwest Power and Conservation Council to fine-tune its flexibility modeling of BPA’s hydroelectric system, assuming the federal power agency’s ability to dispatch its fleet would be the same across all market scenarios.

The BPA study was conducted “using a nodal production cost model of the [Western Interconnection] with added markets, transmission rights and contract-path trading functionality.” It chose 2032 as the study year “to reflect the first decade of markets operations, representing an intermediate year that captures known changes in resource mix and transmission infrastructure.”

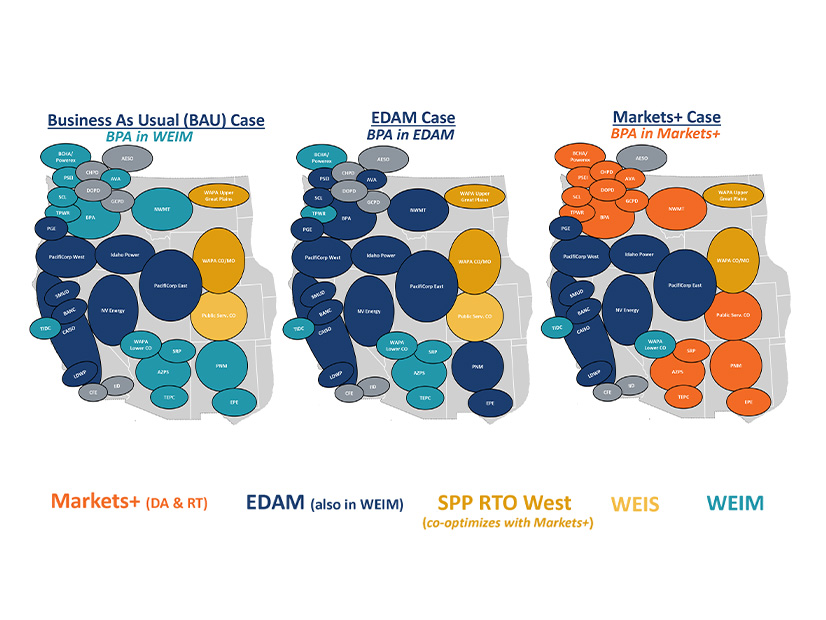

The study models a “business as usual” (BAU) case that reflects current utility participation in markets and the known decisions on day-ahead markets (all for EDAM at this point), as well as two “market participation” cases. In the Markets+ case, BPA and almost all utilities presently uncommitted to a day-ahead market join the SPP market, while an EDAM case shows all existing Western Energy Imbalance Market (WEIM) participants either remaining in that market or joining EDAM.

The study also models two extreme weather events, each based on a historic cold snap and heat wave.

“These events are modeled as single weeks in which we increase modeled loads (peak and energy) and gas prices, including gas price volatility beyond typical weather-normalized values to reflect the increased strain on the system and the ability of markets for addressing such strain,” the study said.

The study’s transmission assumptions include a “detailed view of the physical transmission system and long-term (contractual) transmission rights”; multiple trade type options between BAAs; and “GHG unit-type-specific trading structure which closely mimics the unit-specific GHG import tracking and charge structures in the EDAM and Markets+ designs.” It also assumes participants will make all their transmission available to the market, except where study participants have called out specific carveouts.

‘Key Differentiators’

BPA’s $65 million estimated benefit from participating in EDAM came down to two key factors, Brattle said.

The first is the expectation that BPA will reduce its adjusted production costs (APC) by $43 million in the CAISO market because of increased sales revenues stemming from higher prices in EDAM during the hours when the agency usually sells power.

The second factor is a projected increase in BPA’s congestion revenue from zero in the BAU case to $166 million in EDAM, a product of “the amount of transmission BPA brings to the market, its advantageous position in the EDAM footprint, and price deltas between” California and the Pacific Northwest.

While the study found that BPA’s congestion would average about $4/MWh in both markets, the agency’s congestion revenues in EDAM would be double those of Markets+ because of its higher trading volumes in the CAISO-run market.

On the downside, Brattle found BPA’s EDAM benefits would be partially offset by a $114 million loss in bilateral trading revenues and $37 million loss (to $2 million) in short-term wheeling revenues — the outcome of declining bilateral activity.

“Bilateral trading revenue falls more in [the] EDAM [case] as almost all of BPA’s trading partners are in the EDAM,” the study found.

In the Markets+ case, BPA’s increased costs stem in part from a projected $87 million drop in bilateral trading revenues, the result of many — although not all — BPA trading partners joining the agency in the market.

But the key difference between the two cases relates to production costs. In Markets+, BPA’s APC is projected to increase by $72 million because of slightly lower prices in that market during some intervals when the agency sells its power.

“The impact on prices is mostly in overnight hours, driven by the higher opportunity for increased thermal resource dispatch efficiency during these hours in the Markets+ footprint relative to the EDAM or BAU cases, which is driven by higher gas prices in the Pacific Northwest compared to the Southwest and Rocky Mountain regions,” the study said, adding that the opportunity for that kind of dispatch efficiency isn’t available under BAU because of “trading hurdles” between the Northwest, Southwest and Rockies region.

“The increased thermal dispatch efficiency and lower prices in the Markets+ footprint benefit net buyers in the PNW through reduced purchase costs but reduces sale revenues to the detriment of net sellers in the PNW such as BPA.”

On the plus side, Markets+ would increase BPA’s congestion revenues by $88 million, while short-term wheeling revenues would remain nearly flat, at an estimated $38.9 million.

“Market congestion, bilateral trading revenues, short-term wheeling revenues, and APC savings are the key differentiators of BPA’s net benefits between EDAM and Markets+,” the study said.

PNW Findings

The Brattle finding that EDAM’s benefits for the full PNW system would far outpace those of Markets+ could be the most significant point of the study for many in the region. It could also stir the most controversy in the debate over the two markets.

The study found that the $430 million in savings in EDAM derive from a $171 million reduction in APC, “driven mainly by higher sales revenues in EDAM for the region” and $651 million in EDAM congestion revenues. Those benefits would be offset by a $283 million decline in bilateral trading revenues and a $66 million loss in short-term wheeling revenues.

The cost increase for the Northwest under the Markets+ case was largely attributed to lower sales revenues, which left the region’s APC net of revenues $18 million higher than in the BAU case.

Reached for comment, BPA spokesperson Doug Johnson said, “BPA did not participate in and has not yet reviewed the study. We will attend the Oct. 17 webinar hosted by the study’s authors and will comment on the results after we better understand the study’s methodology, inputs and findings.”

SPP spokesperson Meghan Sever said the RTO was preparing a statement on the Brattle study.