The New Mexico utility announced its intention to join CAISO’s Extended Day-Ahead Market, extending EDAM’s reach farther into the Desert Southwest in its latest victory over SPP’s Markets+.

Public Service Company of New Mexico announced Nov. 11 its intent to join CAISO’s Extended Day-Ahead Market, extending EDAM’s reach farther into the Desert Southwest in its latest victory over SPP’s Markets+.

In a statement, PNM CEO Don Tarry cited the utility’s experience with CAISO’s Western Energy Imbalance Market (WEIM) as a factor in the decision. PNM has received $125 million in benefits since joining WEIM in 2021.

“Participating in EDAM is the next step in realizing the value of New Mexico’s renewable energy potential for our customers, helping us ensure continued clean and reliable service at the lowest possible cost,” Tarry said. “We know from our experience with the WEIM … [that] coordination with other regional utilities can continue to deliver substantial efficiencies and cost benefits for our customers.”

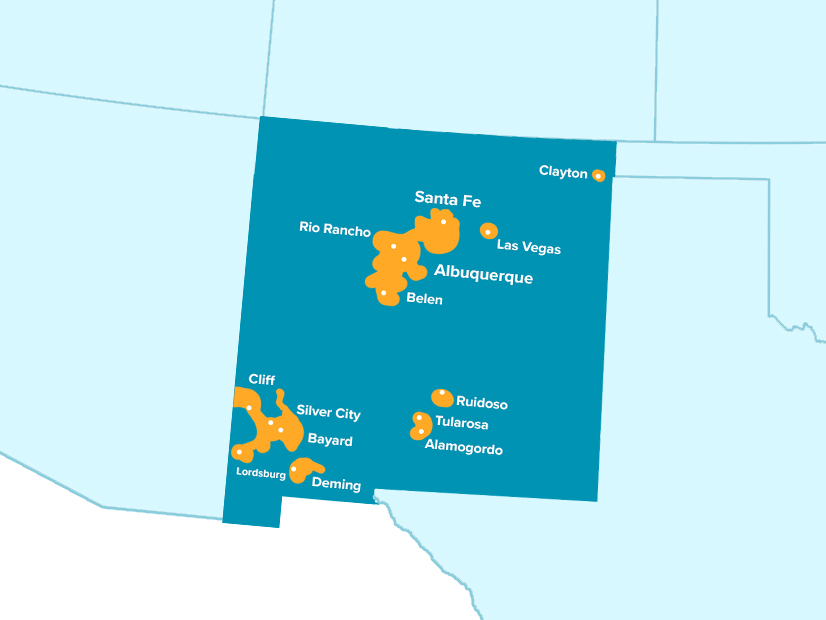

With about 550,000 customers, PNM is New Mexico’s largest electricity provider. The utility said it plans to begin EDAM participation as soon as 2027.

CAISO CEO Elliot Mainzer said the ISO was pleased by PNM’s announcement.

“We look forward to building on the proven track record of the Western Energy Imbalance Market to deliver even greater economic and reliability benefits to PNM customers,” Mainzer said in a statement.

Modeling Connectivity

Playing a large role in PNM’s choice of EDAM was a study The Brattle Group conducted for PNM and El Paso Electric that compared projected benefits of the utilities joining either EDAM or Markets+.

The production cost study carefully modeled transmission connectivity. It modeled a scenario in which three Arizona utilities — Arizona Public Service, Salt River Project and Tucson Electric Power — join Markets+. The Arizona utilities haven’t yet announced their day-ahead market choices, but they have expressed a preference for SPP’s market and have participated in its development.

Even with the Arizona utilities in Markets+, projected annual benefits for PNM would be $20.5 million if it joined EDAM, compared with $8 million from participating in Markets+. (See Brattle New Mexico Study Shows EDAM Benefits Outpacing Markets+.)

The Brattle results gave reassurance that PNM didn’t have to follow the market choice of Arizona utilities in order to realize day-ahead market benefits.

“The Brattle study reinforced that PNM has adequate transmission connectivity to reach the benefits associated with the large and resource-diverse EDAM market,” the company said in an email to RTO Insider.

At the same time, PNM didn’t have any major concerns with the Markets+ design, the company said, adding that the EDAM choice was based on customer benefits from a reliability and economic perspective.

“Much of these benefits come from having diverse loads and resources spread over a large geography,” PNM said.

Guiding Principles

PNM filed a letter with the New Mexico Public Regulation Commission on Nov. 8 sharing its decision to go with EDAM. The brief letter references a set of guiding principles the commission issued Oct. 31 for utilities to consider in selecting a day-ahead market. (See NM PRC Issues ‘Guiding Principles’ for Electricity Market Participation.)

PNM said it made its day-ahead market decision after considering the commission’s principles, “including the comparative analysis of customer benefits, the efficiency of resource dispatch and the importance of robust stakeholder processes.”

The utility plans to file a more detailed response on how EDAM satisfies the PRC’s guiding principles before signing implementation agreements with CAISO, the company said in an email.

PacifiCorp in April became the first Western utility to fully commit to EDAM and sign an implementation agreement with CAISO. That was followed by NV Energy’s announcement in May that it plans to join EDAM.

The Balancing Authority of Northern California, Idaho Power, Los Angeles Department of Water and Power, and Portland General Electric also have made commitments to EDAM.

As for El Paso Electric, which participated in the Brattle study with PNM, the utility has said it hopes to make a day-ahead market decision by the third quarter of 2025. The study’s projected benefits for EPE are $19.1 million a year for EDAM, versus $9.1 million for Markets+.

The company may ask Brattle for analysis of additional scenarios, which could include EPE and PNM choosing different markets. EPE is expected to present the results of those studies to the PRC.