California ratepayers would save millions more in a CAISO Extended Day-Ahead Market (EDAM) encompassing nearly all the West than in one that includes only those utilities likely to join the market, according to a new Brattle Group study.

The study, commissioned by the California Energy Commission, covers nearly every utility in the state — except the Imperial Irrigation District (IID) — and not just members of CAISO, whose balancing authority areas accounts for about 80% of the state’s electricity load. It represents yet another in a series of Brattle — and other — production cost model studies published during the increasingly contentious competition between EDAM and SPP’s Markets+.

Brattle Principal John Tsoukalis presented “preliminary” findings from the study during a Jan. 24 CEC workshop that examined the potential impact on California from the West-Wide Governance Pathway’s “Step 2” plan to establish an independent “regional organization” (RO) to oversee CAISO’s EDAM and Western Energy Imbalance Market (WEIM).

“A larger market means a larger and more diverse pool of transmission and generation resources,” Tsoukalis said. “And what that means is … the market is able to more effectively shift from less efficient resources to more efficient resources. It finds the lowest-cost resource that can serve load in every given hour, and that leads to production cost savings for customers.”

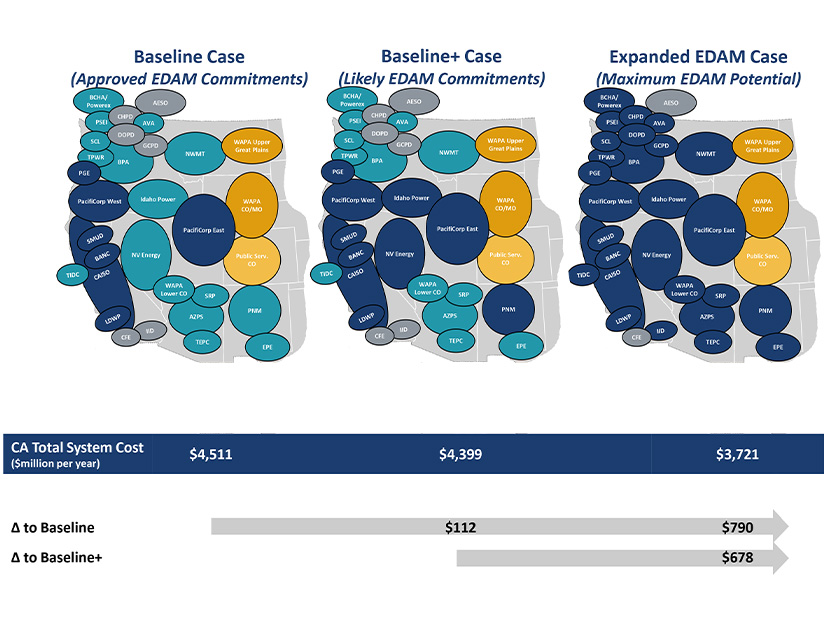

The study differs from previous Brattle studies in that the “Baseline” case is not the status quo — that is, the current arrangement before the launch of EDAM or Markets+ — but assumes a scenario in which EDAM already is operating but includes only CAISO and those entities that already have formally committed to that market. Those entities include PacifiCorp; Portland General Electric; Balancing Authority of Northern California (BANC) and its largest member, Sacramento Municipal Utility District; and Los Angeles Department of Water and Power (LADWP).

Under Brattle’s “Baseline” case, California’s estimated total system cost is $4.511 billion a year.

That figure drops by $112 million (to $4.399 billion) under a “Baseline+” case in which EDAM also consists of entities likely to join the market, which includes Idaho Power, NV Energy and Public Service Co. of New Mexico.

But the biggest savings for California by far are found in the “Expanded EDAM” case, in which the CAISO market includes nearly every Western BA except for Western Area Power Administration entities already engaged with SPP markets, Public Service Co. of Colorado (PSCo) and IID. In that scenario, Golden State ratepayers save $790 million annually compared with the “Baseline” case.

“Intermediate EDAM footprints [are] likely to produce benefits between the Baseline+ and Expanded EDAM ‘bookend,’” according to a slide from the Brattle presentation.

But California likely would see significantly lower benefits than the top end — $182 million — in what will be the most likely outcome in the West — the “Split Market” case, where Markets+ consists of Powerex, the Bonneville Power Administration and most Washington utilities, NorthWestern Energy, PSCo, Arizona’s utilities and El Paso Electric.

“The only difference between the Baseline+ case and the Split Market case is that we have Markets+ forming in that Split Market case, and what we see is there is a slight benefit, actually, to California customers from Markets+ forming, but it is about $500 million less than the Expanded EDAM case,” Tsoukalis said.

The study drew that conclusion based partly on the assumption of a “relatively efficient seam” between EDAM and Markets+, an improvement over the current bilateral day-ahead market that would provide California customers with “increased access to low-cost resources in the Markets+ footprint.”

Tsoukalis nalso oted the study’s day-ahead market benefit estimates likely are “conservatively low,” just as previous studies had underestimated the actual benefits from the WEIM.

Emissions, Reliability Benefits

Brattle’s study also shows significant carbon emissions benefits for California in the Expanded EDAM, with in-state gas generation falling by 31%, wind and solar curtailments falling by 10% and CO2 emissions declining by 11.2% — though emissions in the rest of the West would increase 1.3%. Under the Split case, emissions in California fall by 3.5% and rise by 2.1% in the rest of the West.

The study also represents the first of the Brattle market studies that attempts to capture potential reliability benefits from the day-ahead market for all participants. To do that, it estimates the change in “market supply cushion,” representing “the available generating capacity not committed to serving load” during each hour, which Tsoukalis said consists only of dispatchable resources and explicitly excludes hydro, wind and solar.

The study found that the supply cushion is about 25 GW higher in the Expanded than in the Split case.

“Focusing on the 10 tightest hours of the year, the supply cushion in the EDAM is 20,000 MW larger in the Expanded EDAM case than in the Split Market case (27.8% of load vs. 24% of load),” the study said.

Michael Wara, of Stanford University’s Woods Institute for the Environment, who followed Tsoukalis’ presentation with his own that showed the reliability benefits of Western grid regionalization, said he was “encouraged” to see Brattle’s findings around reliability.

“I would have been surprised and a little depressed if their analysis, using a different method, said ‘not much benefit,’ but 25 GW of additional capacity is a substantial benefit on a hard day,” he said.