Variable Environmental Costs and Credits

Stakeholders at last week’s PJM Market Implementation Committee meeting peppered RTO staff with questions about a proposal on cost-based energy offers.

Melissa Pilong, lead analyst in PJM’s performance compliance department, provided a first read of the proposal by PJM and the Independent Market Monitor. Developed in the Cost Development Subcommittee (CDS), the plan is meant to provide guidance and updates to rules related to variable environmental charges and/or credits and their inclusion in cost-based energy offers.

Pilong said the proposal was initiated to ensure that PJM’s fuel cost policy is up to date. She said the key work activities and scope of the issue charge created by the CDS focused on the annual emissions review process and requirements to include environmental credits in non-zero cost-based offers.

Stakeholders affected by the proposal include sellers of generation receiving production tax credits and/or renewable energy credits and who also submit non-zero cost-based offers into the energy market. If both those conditions are met, the seller must account for the credits in the resource’s fuel cost policy, Pilong said.

One of the proposed changes includes adjusting review of emissions rates from an annual to a periodic basis and requiring that market sellers are responsible for updating the rates. Pilong said the change was made to align with the periodic fuel cost policy review process so that emissions rates do not change drastically year-to-year.

Another proposed change is for market sellers to “clearly document standards of review for emissions allowance adders.” Pilong said the change provides transparency around required information from market sellers, where the data must be submitted and the expectation for updating data.

Pilong said a minor change is proposed to remove a reference to “emissions policy” in Manual 15 because emissions policies are no longer utilized and emissions allowance information instead resides in the fuel cost policy.

He said the proposed deadline for implementation is six months following PJM’s FERC filing date to give market sellers an opportunity to update their fuel cost policies.

Heather Svenson, RTO strategy manager for PSEG, said her company was “surprised” to see the proposed solution brought to the MIC as a first read without first having taken a vote on the issue charge. Svenson said PSEG didn’t think that the CDS had approval authority over new issues, based on language in Manual 34.

Svenson said PSEG hoped PJM could compromise and consider bringing the proposed solution back to the MIC for a second first read to “make sure the right company resources are engaged on this topic so that we can make an informed decision.”

“Our concern is that solutions are being brought forward on an issue for a first read that maybe hasn’t received the same level of rigorous review as other issue charges in the stakeholder process,” Svenson said.

Dave Anders, PJM director of stakeholder affairs, said a subcommittee can undertake any work that fits within its charter. He said if there’s a lack of consensus by stakeholders on an issue charge at the subcommittee, then it will be voted on at its parent committee, in this case the MIC.

John Horstmann, senior director of RTO affairs at AES Ohio, asked if PJM could provide a list of CDS members who participated in the variable environmental costs and credits issue. He said discussions at the CDS have historically been about “determining how to report fossil fuel costs,” and he wanted to have a better idea whether there was representation from all the sectors at the subcommittee.

“I don’t know how well-attended the meeting was, and I don’t know whether this is representative of very few members, which typically attend the CDS, or whether it was well attended and a good cross section of stakeholders,” Horstmann said.

PJM said it plans to put the issue on the June MIC agenda as a voting item.

Stability Limit Changes Endorsed

Stakeholders endorsed manual changes regarding stability limits in markets and operations.

Zhenyu Fan, senior engineer in PJM’s real-time market operations, reviewed the conforming updates to Manual 11: Energy & Ancillary Services Market Operations and Manual 28: Operating Agreement Accounting.

PJM’s proposed stability limits modeling and market clearing process. | PJM

PJM’s proposed stability limits modeling and market clearing process. | PJM

Last year, stakeholders endorsed PJM’s proposal on stability limits capacity constraints that included language limiting lost opportunity cost (LOC) credits for any generation reduction required to honor the stability limit in the RTO. The limiting of LOC compensation provoked debates among PJM members. (See “Stability Limits Endorsed,” PJM MRC/MC Briefs: Jan. 27, 2021.)

FERC ruled in February that PJM has the right to refuse LOC payments to generators that are temporarily required to limit output to prevent loss of synchronization and additional strain on the system during transmission outages. (See FERC: PJM Right to Block Gen Stability Limit Payments.) The tariff changes take effect June 1.

Zhenyu said PJM will use a new generator output constraint to enforce the stability limit for real power megawatt-only limits. He said the shadow price of the constraint will not be included or reflected in locational marginal pricing.

To provide greater transparency, Zhenyu said PJM added a new section to Manual 11 related to stability limits that describes the modeling, clearing and reporting process on the stability limit in the market. Updated language related to stability limits in Manual 28 included additional clarification that LOC credits are not paid for megawatts associated with a stability limit reduction.

“The revisions were relatively short,” Zhenyu said. “It’s about clarifying that generators will not be eligible for lost opportunity cost credits for reductions due to stability limit reasons.”

The manual changes will be voted on at the May 25 Markets and Reliability Committee meeting.

Intelligent Reserve Deployment Changes Endorsed

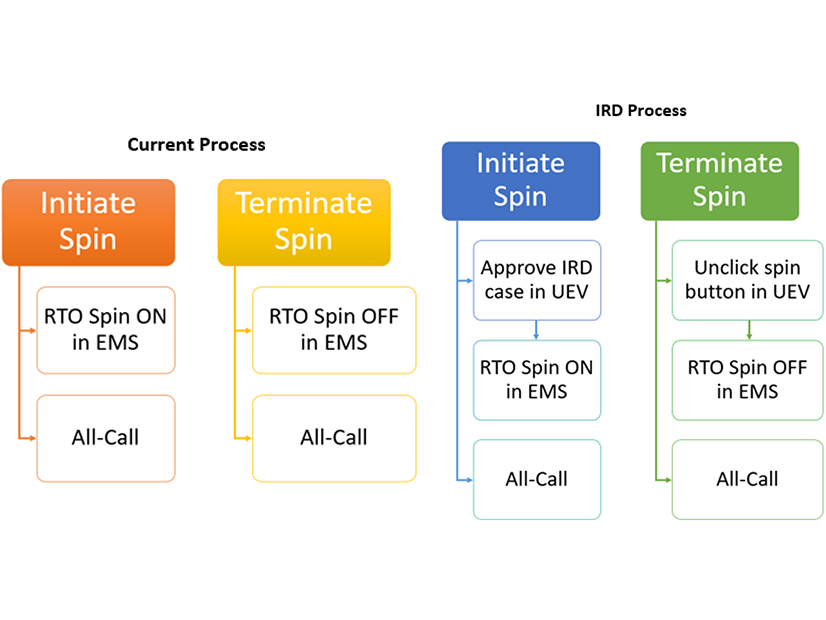

Stakeholders unanimously endorsed manual changes related to intelligent reserve deployment (IRD).

Damon Fereshetian, senior engineer in PJM’s real-time market operations, reviewed the updates to Manual 11 and Manual 28 associated with the IRD issue.

Stakeholders in December endorsed a PJM proposal to improve the deployment of synchronized reserves during a spin event. (See “Synchronous Reserve Endorsed,” PJM MRC/MC Briefs: Dec. 15, 2021.) The proposal created an IRD, which is a security-constrained economic dispatch (SCED) case simulating the loss of the largest generation contingent on the system and for which approval of the case will trigger a spin event.

The proposal also included taking the megawatts of the largest generator contingency and adding them to the RTO forecast to simulate the unit loss. PJM can then flip condensers and other inflexible synchronized resources cleared for reserves to energy megawatts and procure additional reserves to meet the next largest contingency.

Fereshetian said in the verification section of Manual 11, PJM added clarifying language that the response to a synchronized reserve event is “based on the resource following dispatch instructions and is capped at the expected response.”

PJM originally intended to include new Manual 11 language that an approved IRD case “supersedes” any other approved real-time SCED cases for the same target time to be used as the reference case for the locational pricing calculator, but Fereshetian said discussion with stakeholders led to the language removal.

Manual 28 included minor clarifying changes.

The MRC will be asked to endorse the revisions at its May 25 meeting.

Manual 29 Revisions Endorsed

Stakeholders unanimously endorsed minor revisions to Manual 29: Billing as part of the periodic review.

Natasha Holter, manager of PJM’s market settlement operations, reviewed the Manual 29 revisions, saying there were no “substantive changes” in the language and mostly included updates to terminology and reference materials.

Several new subsections were added to the manual, Holter said, including one called “Billing Notifications” that provides guidance on how to obtain notifications for billing statements. Another subsection, “Billing Adjustments,” added language to describe what a billing adjustment is and how to identify one.

Stakeholders will be asked to endorse the revisions at the June 29 MRC meeting.