PJM has selected 51 projects to receive expedited interconnection studies through its Reliability Resource Initiative (RRI), adding 11,793 MW of nameplate capacity to the next study cycle.

The RTO’s May 2 announcement said 39 of the projects are uprates of existing units, amounting to 2,488 MW, while the bulk of the capacity comes from 12 “new construction” projects, which would bring 9,305 MW to market. That translates to 9,361 MW of unforced capacity (UCAP) split between 2,108 MW of uprates and 7,253 MW of new construction.

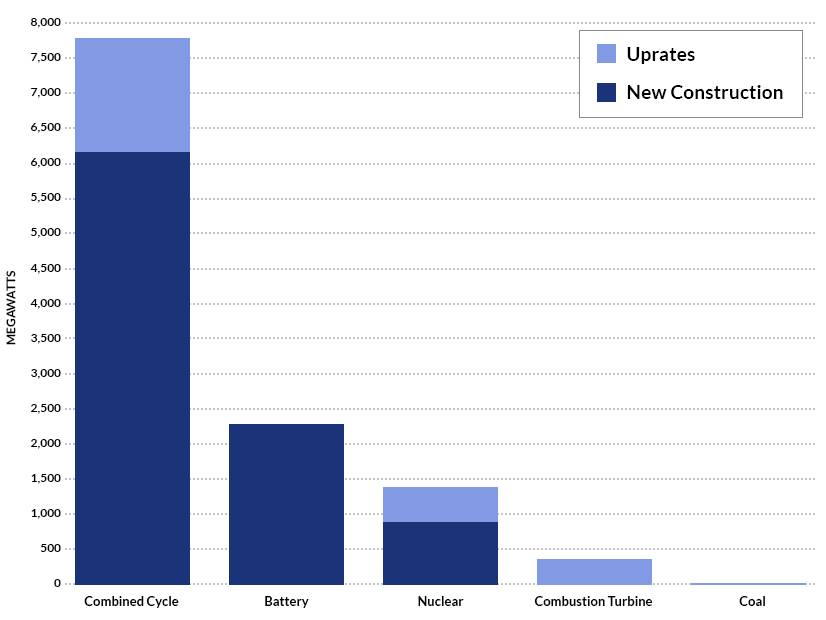

The majority of the additional nameplate comes from six new combined cycle gas generators and 20 uprates, which together would provide 7,756 MW if completed. An additional 2,275 MW of battery storage was selected, coming from five new projects. Four uprates to nuclear units would add 496 MW, while one new unit would carry 887 MW.

Thirteen combustion turbine uprates would provide 365 MW, and 14 MW would come from an uprate to a coal generator. One onshore wind project was selected to increase its capacity interconnection rights (CIRs) by about 20 MW.

FERC approved the initiative Feb. 11 to address a potential capacity deficiency PJM has identified in the 2029/30 delivery year. By ranking and selecting RRI applications according to their expected capacity contribution, in-service date and location, PJM argued that the one-time program would allow projects that could bring additional capacity online quickly to be added to Transition Cycle 2 (TC2).

By limiting the number of projects selected to 50, it said there would be no impact to other queue positions in the cycle; ultimately, 94 applications were received, amounting to 26.6 GW of nameplate. The May 2 announcement said 51 were selected due to a tie in the ranking. (See PJM Receives 94 Applications for Expedited Interconnection Process.)

PJM’s announcement said 90% of the selected projects should begin service before 2030 and all should come online by 2031.

‘Thinly Veiled Effort’

Renewable developers and environmental organizations have objected to the RRI, characterizing it as allowing fossil fuel generation to jump a queue made up mostly of wind and solar projects.

“If PJM were serious about addressing reliability concerns, they would be complying with FERC’s order to reform their interconnection process and speeding up their interconnection queue to get projects online that have been waiting for years. Instead, PJM has decided to let gas plants cut in line,” Sierra Club Staff Attorney Megan Wachspress told RTO Insider.

Wachspress called RRI a “thinly veiled effort to move gas plants ahead of renewable resources” and said it is “beyond disappointing that more than 75% of the projects selected are methane gas projects when study after study [has] shown that renewable energy is more reliable, affordable and better for the environment.”

She also said winter storms Elliott and Uri showed that “gas plants underperform when families need electricity the most. Rather than follow FERC’s direction to improve interconnection and transmission, PJM’s short-sighted favoritism will put customers at risk and threaten our environment.”

PJM highlighted several changes it’s making to its interconnection study process, including the cluster-based study process, of which RRI is a part. Since being approved by FERC in 2022, PJM said, the process has completed studies on about 18 GW of projects, and studies on an additional 62 GW should be completed by the end of 2026.

The announcement also notes the commission recently approved changes to PJM’s surplus interconnection service (SIS), which allows expedited studies for new projects sharing a point of interconnection (POI) with an existing or planned resource not fully using its injection capability (ER25-778).

Another proposal before the commission would revise the process for transferring CIRs from a retiring generator to a replacement resource by allowing all resource classes to participate, most notably storage (ER25-1128). (See PJM Stakeholders Approve SIS Manual Language.)

Increased automation of studies could reduce the queue backlog by 60%, PJM said, pointing to a collaboration with Google announced April 10 to use AI tools to streamline the process. (See PJM, Alphabet Partnering on AI Tools to Speed Interconnection.)

In a statement, Constellation Energy said the Crane Clean Energy Center, formerly Three Mile Island, was among the projects selected. The company said the RRI allows high-reliability projects to respond to rising load forecasts fueled by burgeoning AI and manufacturing demand.

“In addition to Crane, PJM selected three Constellation ‘uprate’ projects that will increase output at three other nuclear plants in our fleet, bringing the total increase from the four projects to 1,150 MW of clean, firm electricity. We look forward to bringing these projects online to help support grid reliability and economic development throughout the region,” the statement reads.

American Clean Power focused on the ability of storage developers to quickly install their selected projects, which improve grid reliability and reduce costs, ACP spokesperson Phil Sgro said in an email.

“The representation of energy storage in PJM’s selection highlights these benefits, including favorable capacity accreditation and shorter development timelines,” Sgro wrote. “To balance the strengths and weaknesses of all generation resources, a diversified grid that includes clean energy is the best way to achieve the most reliable and affordable grid. PJM has [forecast] annual demand growth of nearly 5% over the next 10 years. Renewable resources are quick to deploy and provide additional capacity for the grid, helping boost overall reliability and meet rising demand.”