Federal analysts expect U.S. hydropower generation to increase 7.5% over 2024 totals, which were the lowest in at least 14 years.

The U.S. Energy Information Administration said in its May Short-Term Energy Outlook that the 259.1 billion kWh projected this year still would be 2.4% below the 10-year average and would constitute 6% of the nation’s power generation.

The projections are strongly influenced by conditions in the West Coast states, as roughly half the nation’s hydroelectric generating capacity is in Washington, Oregon and California.

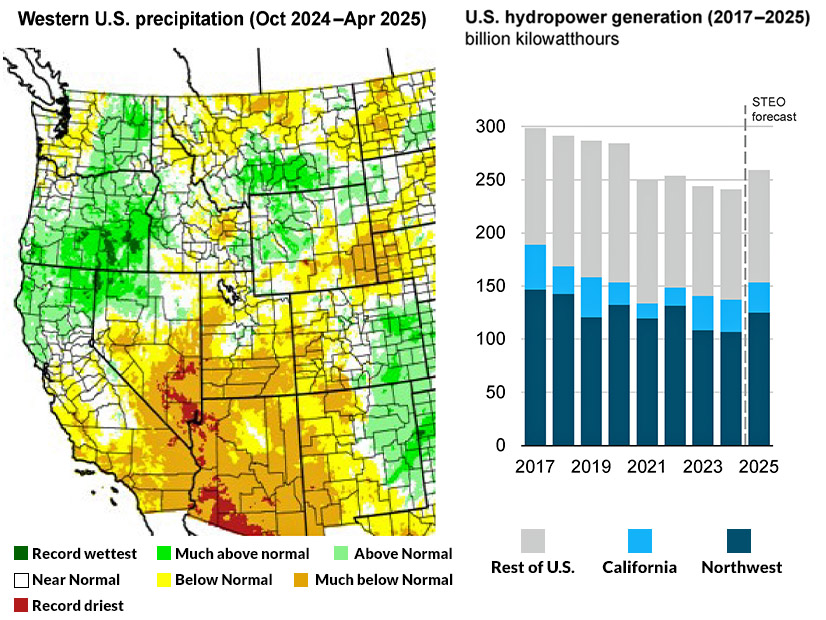

Precipitation conditions have been mixed there and in the Rocky Mountain region.

More precipitation than normal was recorded since October in northern California and eastern Washington, and some areas of Oregon saw record levels of precipitation. But Montana, Idaho and other parts of Washington and California saw below-normal precipitation from October through April.

2025 hydropower output in the Northwest and Rocky Mountain region is projected at 125.1 BkWh — 17% more than 2024 but 4% less than the 10-year average.

By contrast, 28.5 BkWh of hydropower generation is projected in California, 6% less than last year but 15% more than the 10-year average.

As of April 1, most major reservoirs in California were above the historical average for that date — two of the largest, Shasta and Oroville, stood at 113% and 121%, respectively.

Snowpack conditions were above normal in the northern Sierra Nevada region and below normal in the central and southern Sierra regions as of April 1. Higher-than-average temperatures brought the snowpack to well-below-average levels for all three regions by May 1.

Other Generation

More broadly, the EIA’s May Short-Term Energy Outlook forecasts that U.S. electrical power generation will be 2% higher in 2025 than in 2024, and then 1% higher in 2026.

EIA predicts that natural gas will remain the largest single fuel for electrical generation. But it expects 2025 output from gas-fired plants to decline 3% year over year due to gas prices, which are forecast to be 63% higher on average than in 2024.

This — combined with recently relaxed emissions regulations on coal-fired plants — will lead to a 6% increase in generation from coal, EIA predicted.

EIA said about 5% of U.S. coal-fired generation facilities had been slated for retirement in 2025, most of them at the end of the year, which could reduce generation from coal by 9% in 2026. However, the agency also said President Donald Trump’s policy changes in favor of coal could alter these retirement strategies, adding a degree of uncertainty to the forecast.

Utility-scale solar generation is expected to jump 34% in 2025 and 18% in 2026, EIA said, bringing total installed capacity to 180 GW by the end of next year and providing another limiting factor on natural gas-fired generation.