New York has executed renewable energy certificate contracts for 26 solar, wind and hydro projects to help meet its clean energy goals.

The combined 2.57 GW of nameplate capacity and estimated 5,000 GWh of annual output would help rebuild the state’s renewable energy portfolio, which saw sharp attrition in late 2023 and early 2024 as previously executed REC contracts became financially untenable because of soaring construction costs.

The New York State Energy Research and Development Authority’s 2024 Tier 1 solicitation was launched 11 months ago. The results were reported May 21.

In its announcement, NYSERDA said the projects would generate more than $6 billion in direct private-sector investment. But it said REC pricing details will not be reported until the projects reach commercial operations.

A spokesperson said this is being done to align NYSERDA with industry standards and to avoid releasing information that does not reflect actual ratepayer costs.

The 2024 Tier 1 solicitation included provisions for price adjustments to reduce the possibility of renewed attrition between contract award and final investment decision.

Considerable price volatility faces renewable energy developers in early 2025, due in part to federal policy shifts. Supportive policies at the state level are expected to be important to continuing the clean energy transition that accelerated in the Biden era.

Gov. Kathy Hochul (D) highlighted this in the announcement: “The advancement of renewable energy is part of the foundation of New York’s plan to transform to a zero-emission electricity system and continue our green economy’s momentum forward.”

The 26 projects and their estimated 5,000 GWh are expected to direct more than $300 million in commitments to disadvantaged communities and reduce emissions by more than 1.7 million metric tons per year. Several of the projects have begun construction, and all are expected to be operational by 2029.

For perspective, NYISO reported recently the state used approximately 151,000 GWh in 2024.

Support and Opposition

The two hydro, six wind and 18 solar projects awarded REC contracts are mostly in remote or less populated upstate areas. All are far removed from the New York City region, which is heavily reliant on fossil-fuel generation and looking over the horizon for renewable power that would allow it to turn off the fossil plants and enjoy improved air quality.

This strategy sets up a friction point in a state with stark upstate-downstate differences: Some upstaters resent having to look at wind turbines and solar arrays and resent the state’s recent efforts to limit local governments’ ability to thwart siting of these facilities.

One of the new REC contract holders — Terra-Gen’s 147-MW Prattsburgh Wind Farm near the Finger Lakes — said May 15 that it will begin pre-construction work June 8.

Around the same time, a local opposition group asked the Public Service Commission (Matter 21-00749) to block any movement of soil until a protocol for the golden nematode is clarified and accepted by the U.S. Department of Agriculture.

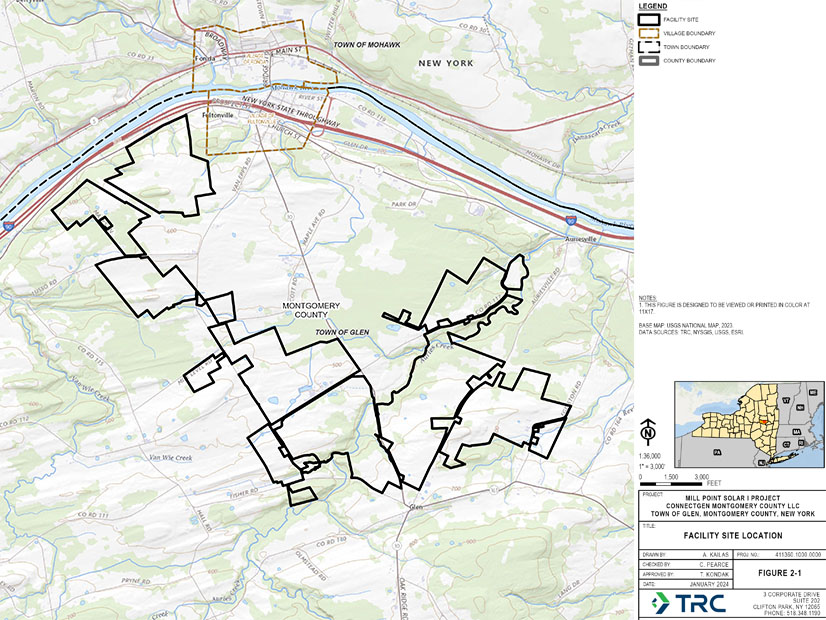

Another of the newly contracted projects is Repsol Renewables’ Mill Point Solar 1 in Montgomery County, which at 1,124 acres and 250 MW would be one of the largest solar farms in New York state.

It also would be placed in one of the hot spots for solar development, and for utility-scale solar opposition, where there is a combination of affordable farmland and woodlands populated by multigenerational residents who like looking at those fields and woods. Many have come out against Mill Point.

The state Office of Renewable Energy Siting and Electric Transmission has permitted Prattsburgh Wind. It still is reviewing Mill Point I and has scheduled a May 28 public comment hearing at a school near where the solar farm would stand. To judge by the 300-plus comments submitted (Matter 23-02972) in opposition to and support for the proposal, it could be a crowded and lively session.

Other projects that received the new REC contracts may prove less controversial.

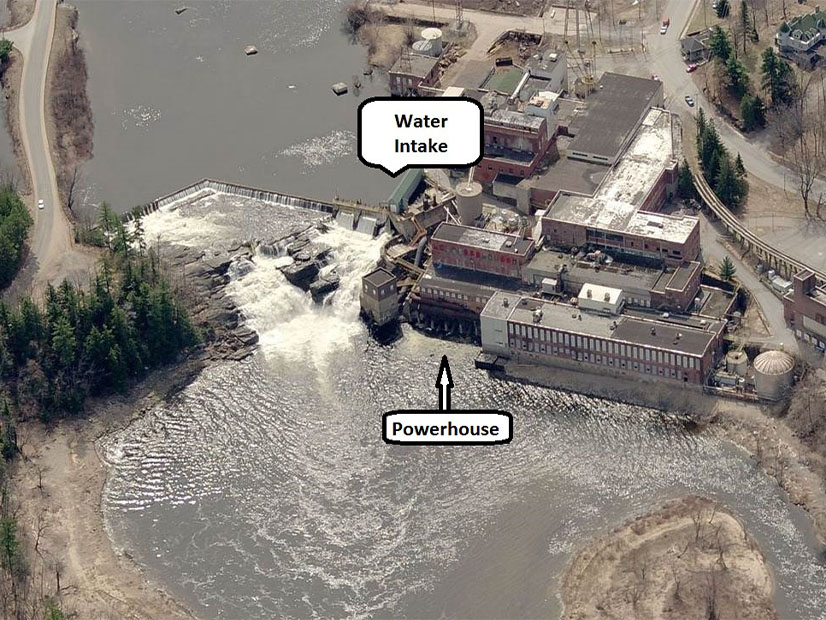

The little village of Lyons Falls lost its main industry and hundreds of jobs a generation ago when the local paper mill closed. The crumbling eyesore eventually was demolished, but its hydro plant would be repowered under a plan that now carries state support.

NYSERDA said the state continues to emphasize engagement with host communities to build support for the projects and spread their benefits.

The List

The contracts awarded REC contracts are:

Agricola Wind in Cayuga County

Dolan Solar in Washington County

Dolgeville Hydro in Herkimer County

ELP Ticonderoga Solar in Essex County

Flat Creek Solar in Montgomery County

Fort Covington Solar Farm in Franklin County

Hawthorn Solar in Rensselaer County

High Bridge Wind in Chenango County

Highbanks Solar in Livingston County

Homer Solar Energy Center in Cortland County

Horseshoe Solar Energy Center in Livingston and Monroe counties

Lyons Falls Mill Repower in Lewis County

Mill Point Solar I in Montgomery County

Moraine Solar Energy Center in Allegany County

Prattsburgh Wind Farm in Steuben County

Shepherd’s Run Solar Project in Columbia County

Skyline Solar in Oneida County

Somers Solar in Washington County

South Ripley Solar in Chautauqua County

Tracy Solar Energy Center in Jefferson County

Two Rivers Solar Farm in St. Lawrence County

Valcour Altona Windpark in Clinton County

Valcour Bliss Windpark in Wyoming County

Valcour Clinton Windpark in Clinton County

Yellow Barn Solar in Tompkins County

York Run Solar in Chautauqua County