The opening of Ontario’s nodal market has been marked by real-time volatility and unusually high operating reserve prices.

The opening of Ontario’s new market has been marked by real-time volatility and unusually high operating reserve (OR) prices.

“They seem to be burning through their ancillary service reserves,” said former trader Jake Landis, director of solutions engineering for Yes Energy. “[It’s] almost as if they aren’t carrying enough reserves in general.”

“100%,” agreed Brady Yauch, director of markets and regulatory for Power Advisory. “The ancillary services market is just really tight right now … although energy we’re very long.”

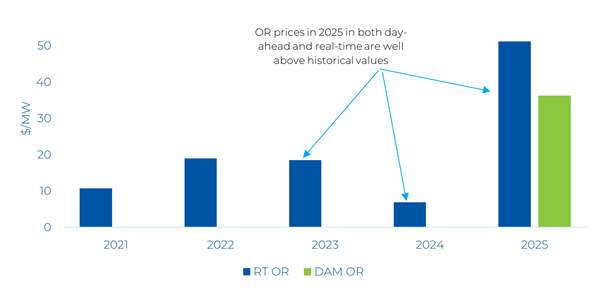

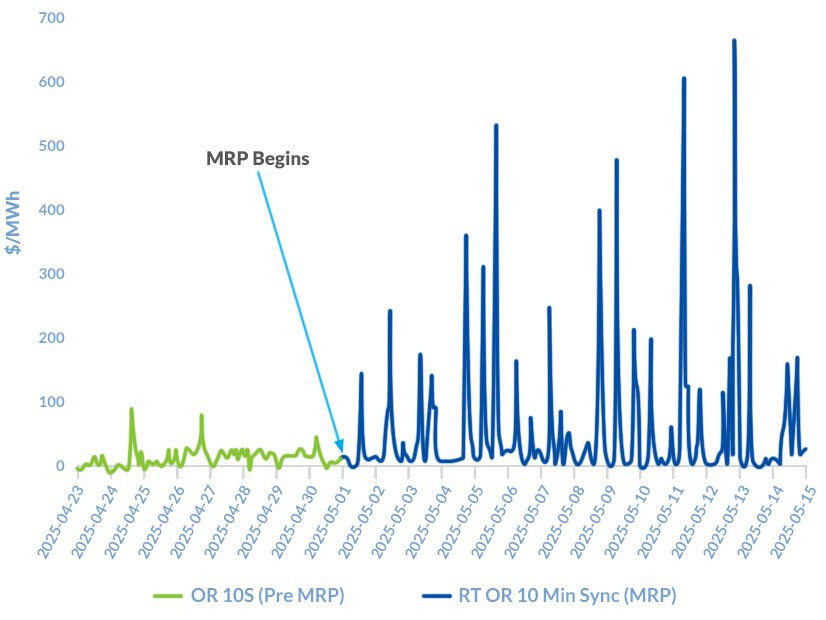

Between 2021 and 2024, Yauch said, 10-minute spinning reserve (10S) prices in the first two weeks of May ranged from $6 (2024) to $19/MW (2022). In the first two weeks of May 2025, the average day-ahead price has been $30/MW, with real-time prices averaging $51/MW. “So there’s a huge difference,” Yauch said.

At an IESO webinar June 4, Yauch asked whether the higher OR prices were a short-term phenomenon or indicative of a structural change as a result of Ontario’s Market Renewal Program, which implemented a financially binding day-ahead market and switched from zonal to nodal pricing on May 1. (See IESO Opens Day-ahead Market in Nodal Rollout.)

Darren Matsugu, director of markets, responded that the OR price trend was a springtime issue, citing “freshet,” the annual influx of water from spring rainfall and melting snow. Many hydropower projects must exit the OR market and operate as “must run” generators in spring because they have to flow the excess water through their turbines.

“It happens every May — this year, even more than perhaps other years — the amount of reserve available from those hydroelectric resources is less than normal,” Matsugu said.

At the same time, natural gas generators are less likely to be committed and online during times of low demand. “And so naturally, that puts a scarcity in the amount of operating reserves that we have available on the system under these types of conditions,” he added. “As we get further into the summer, both as far as the hydrology — but also we have more other resources committed and online that can provide operating reserve — we expect that to stabilize.”

Yauch acknowledged that thin OR supplies are typical in the spring shoulder period. But he said OR prices this May appear to be affected by a change in the supply stack, with the introduction of an operating reserve demand curve. In the legacy market, IESO used a voltage-reduction offer in the OR supply stack — what Yauch called “fictitious supply.”

“Ultimately, the supply and demand on the system create the pricing outcomes observed, including over the last month,” IESO spokesperson Andrew Dow said in an email to RTO Insider. “Market Renewal delivered many improvements to how energy and OR co-optimization produce prices in the market, including but not limited to introducing an OR demand curve. All of these improvements work together to create better alignment between the pricing outcomes and the underlying system conditions and resource availability.”

IESO says the MRP should save Ontario $700 million over the next decade through reduced out-of-market payments and increased efficiency.

NERC and the Northeast Power Coordinating Council require IESO to provide OR equal to the largest single contingency plus half of the second-largest contingency — equivalent to the loss of Ontario’s one-and-a-half-largest generators.

IESO buys three types of operating reserves from dispatchable generators and loads: 10-minute synchronized (spinning); 10-minute non-synchronized (non-spinning); and 30-minute non-synchronized. OR providers must be able to respond within the 10- or 30-minute time frame and provide energy for up to one hour.

LMPs

Yauch said the increase in OR prices was the biggest surprise so far from the new market. He said he was not surprised by the volatility of real-time energy prices in the first weeks.

The real-time hourly Ontario Zonal Price (OZP) — the load-weighted average of all LMPs in Ontario — rose above $100/MWh almost every day in the early weeks, “which is well above the marginal cost of a typical thermal resource in Ontario,” Power Advisory said in a note to clients May 16. “In total, there were 19 hours where the price was greater than $100/MWh last week, compared to eight in the first week in May and zero hours in the equivalent week in 2024, when the uniform price was still determined by the Hourly Ontario Energy Price (HOEP).”

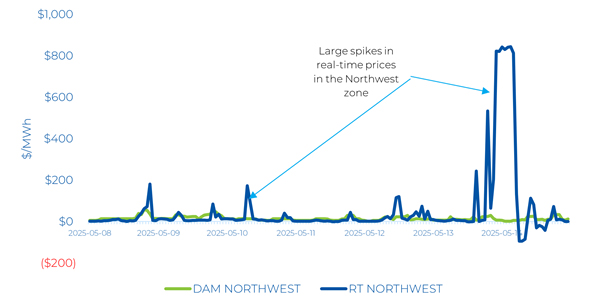

Day-ahead zonal prices averaged $19/MWh for the second week, versus a real-time average of $38/MWh, Power Advisory said. The Northeast and Northwest zones saw much higher congestion and transmission losses than southern Ontario, as was expected, it said.

Yauch called it a “tale of two grids,” with southern Ontario experiencing limited congestion and the north choked by a large number of hydropower facilities and dwindling mining and industrial loads to absorb the supply. “They can’t get the energy out,” he said.

The first two weeks also saw a lot of volatility in the west near Windsor. “That was a surprise, but it’s died down,” Yauch said.

Nuclear Impact

Hydropower isn’t the only generation source affecting Ontario’s market. The province also has more than 12,000 MW of baseload nuclear capacity. Combined, nuclear (53%) and hydropower (25%) constitute more than three-quarters of IESO’s fuel mix, up from 66% in 2003.

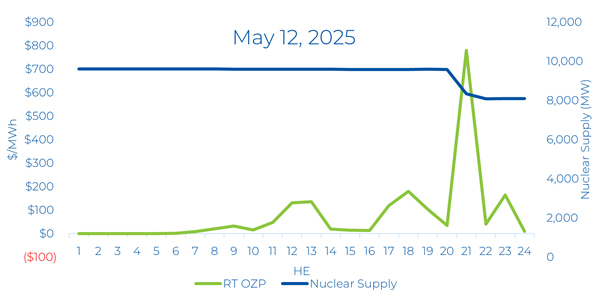

On May 12, three units at the Bruce Nuclear Generating Station were de-rated beginning in the 8-9 p.m. hour, causing real-time prices in southern Ontario to hit the price ceiling of $2,000/MWh, with the real-time OZP rising to $778/MWh.

[Editor’s note: RTO Insider became part of Yes Energy in March 2025.]