The formation of two competing day-ahead markets will create seams across the West, but at least one utility representative is more worried about seams resulting from the fracture of CAISO’s real-time Western Energy Imbalance Market.

RENO, Nev. – The formation of two competing day-ahead markets will create seams across the West, but at least one utility representative is more worried about seams resulting from the fracture of CAISO’s real-time Western Energy Imbalance Market.

“My biggest concerns are definitely not the seams created by the day-ahead market, but by the breakup of the EIM footprint,” said Kelsey Martinez, director of regional markets and transmission strategy for Public Service Company of New Mexico (PNM).

Her comments came during a panel discussion on seams as part of a Western Energy Markets Regional Issues Forum meeting June 17.

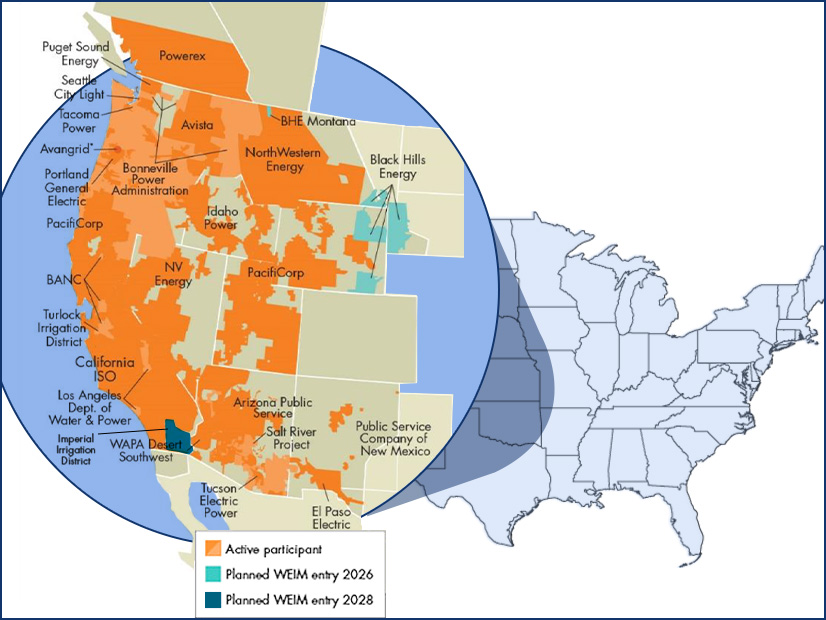

Since CAISO launched the WEIM in November 2014, it has grown to include 22 market participants representing about 80% of the electricity demand in the Western Interconnection. As of April 30, WEIM’s cumulative gross benefits totaled $6.99 billion, the ISO has estimated.

But participants who choose to join SPP’s Markets+ rather than CAISO’s Extended Day Ahead Market (EDAM) will leave the WEIM for an SPP day-ahead market.

For PNM, WEIM has helped relieve congestion that comes from “overbuilt” intermittent resources such as solar and wind, Martinez said.

“The EIM footprint has allowed us to integrate most of our renewables,” she said. “And we will be faced with a completely new problem when we have the same renewable mix but we don’t have the same connectivity through EIM that we used to.”

Martinez called for a focus on real-time seams “because those are the ones creating a reliability problem.”

Seams Road Map

Panelist Mark Rothleder, CAISO’s chief operating officer, said the seams that should be addressed first are those that are needed for the launch of EDAM.

PacifiCorp is scheduled to go live with EDAM in spring 2026, followed by Portland General Electric (PGE) in the fall. (See CAISO EDAM Pioneers Share Implementation Details.)

“Launching EDAM is our main focus and resolving any of those immediate seams issues, especially as they relate to reliability but also market efficiency for EDAM to go live,” Rothleder said.

Rothleder said it would be preferable to avoid creating new seams. He proposed “as a concept” learning from the experience with WEIM “to mitigate and not create a real-time seam, especially where one does not exist today.”

“The EIM works very efficiently over a wide footprint,” he said. “How do you maintain that, even if markets may fragment? We should look for those opportunities and explore them and be open to them.”

Pam Sporborg, PGE’s director of transmission and markets, said PGE’s top focus is for EDAM to go live. She said EDAM is a key strategic goal for PGE that will help address affordability challenges for customers.

“Conversations that distract from the ISO’s focus on EDAM go-live or on our focus on EDAM go-live are just non-starters,” Sporborg said.

Sporborg proposed the creation of a seams “road map” giving a timeline for when particular seams — such as those between the two markets, or even between EDAM and WEIM — would be addressed. Other panelists liked the idea.

“For me, the value of the road map is it gives us a collaboration point with those who are also looking at Markets+,” said Kathy Anderson, transmission and markets senior manager at Idaho Power. “We all are customers of each other. So regardless of what market you’re going to be going to, you’re likely going to be participating in some way in that other market.”

Idaho Power has said it is leaning toward EDAM as its day-ahead market choice.

Rothleder said CAISO hoped to develop a seams road map that it would release to stakeholders for feedback.

Communications Seam

With the competition between EDAM and Markets+ becoming heated at times between proponents of each option, Sporborg called for work on what she called a communications seam. Rather than continuing with the divisive language that’s sometimes been used, she said, “We have to be nice to each other.”

“As those market footprints are aligning and coming into focus, I think we have an opportunity to step back and reset the way we are communicating with each other and recogniz[e] that we all have common interests at heart,” Sporborg said.

“We all want reliability, we all want affordability. We are all making choices that are in the best interest of our customers,” she said.