Ontario is putting its chips on nuclear power and natural gas to meet its growing energy demand while directing IESO to incorporate gas distributors and the province’s economic development goals in its system planning.

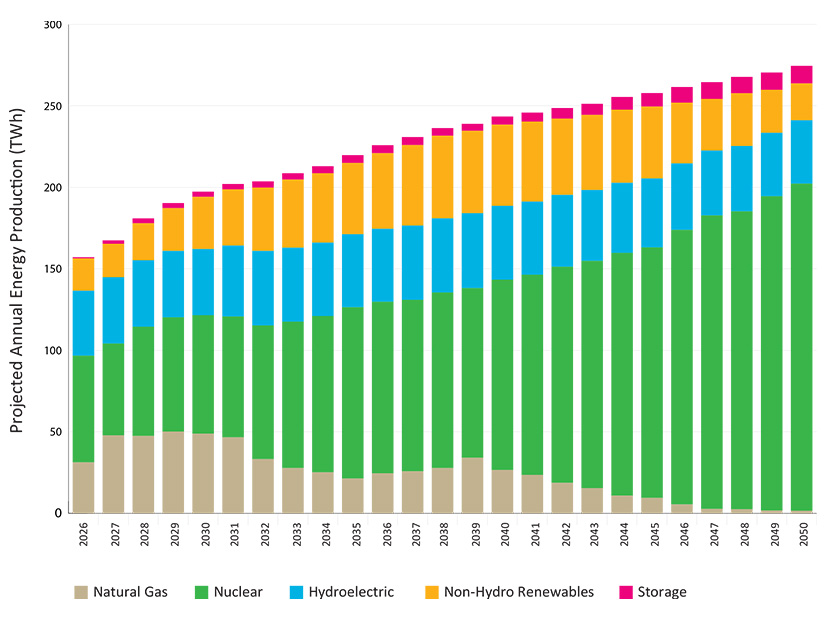

The province’s first-ever integrated energy plan, Energy for Generations, released June 12, seeks to ensure sufficient capacity for a forecast 75% increase in electric demand over the next 25 years.

Authorized by the 2024 Affordable Energy Act, the plan seeks to integrate planning for electricity, natural gas, hydrogen and emerging fuels along with energy efficiency, demand-side management and distributed energy resources. The five-year planning cycle will provide the “long-term certainty [needed] to make smart investment decisions,” according to the plan, which was authored by the province’s Ministry of Energy and Mines.

“As the world searches for affordable, secure, reliable and clean energy, Ontario is doing big things,” Minister Stephen Lecce wrote in the foreword to the plan. “We are leading the largest expansion of nuclear energy on the continent, building the largest battery storage fleet in the country, adding thousands of kilometers of new electricity transmission and modernizing our grid to meet the needs of tomorrow.”

Changing Planning

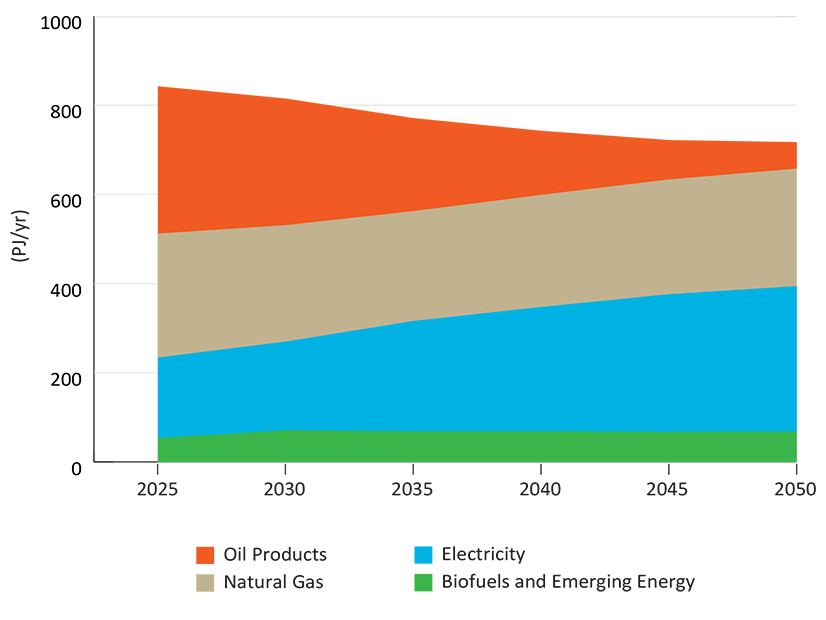

The ministry declared an end to the “siloed approach” to planning, saying, “For too long, decisions about electricity, natural gas and other fuels have been made separately, without a unified view of how they work together to power the province’s economy and communities.”

Such coordination will avoid situations where non-pipe alternatives such as electric heat pumps “are advanced without accounting for their impact on local electricity demand and grid capacity,” the plan says. (See related story, Ontario Energy Plan Gives IESO Long ‘To Do’ List.)

IESO will be required to identify transmission projects that would be needed under high-growth forecasts to conduct at least annual meetings of Technical Working Groups in each planning region, “in consultation with [local distribution companies], [transmission companies], municipalities and major customers, to ensure more frequent sharing of demand forecasts, system needs and planned infrastructure investments.”

Long Bridge for Natural Gas

While the plan endorses an “all of the above” approach to fuel diversity, it places a heavy emphasis on retaining and expanding nuclear power and natural gas.

Natural gas makes up 36% of Ontario’s end-use energy consumption and is the home heating fuel for about 75% of residential customers. While climate activists are calling for replacing gas with renewable generation and home electrification, the Ontario government said it supports “the rational expansion of the natural gas network” to serve homeowners in rural and northern areas who do not have access.

Chapter 5 of the plan is the ministry’s Natural Gas Policy Statement, which concludes there are few alternatives to gas for Ontario’s industrial and agricultural sectors and warns “a premature phaseout of natural gas-fired electricity generation is not feasible and would hurt electricity consumers and the economy.”

Although it provides only about 16% of the province’s power, natural gas represents 28% of its generation capacity, giving it a critical role in meeting system peaks.

The ministry says gas-fired generation will increase through the 2020s and 2030s because of rising demand and planned nuclear refurbishments. “This will result in a short-term increase in electricity system emissions. However, as new non-emitting supply, particularly new and refurbished nuclear generation comes online, emissions from electricity generation are expected to decline significantly,” the plan says.

The province directed the Ontario Energy Board (OEB) to provide a report on expanding its mandate over natural gas and electricity to include alternate energy sources, hydrogen pipelines, carbon dioxide pipelines and district energy systems.

It directed OEB to improve the alignment between gas and electricity policies, citing limits on the grid’s ability to serve customers switching from gas to electric heat. It also ordered OEB to develop a new gas connection policy to support faster home building. “OEB will take steps to encourage — and, where appropriate, require — regulated natural gas distributors and LDCs to participate in regional and bulk electricity planning processes,” it says.

The province said it supports a new east-west energy corridor to expand access to Western Canadian natural gas and crude oil and reduce reliance on U.S. imports, which account for two-thirds of Ontario’s gas consumption.

Big Bets on New Nukes

Ontario also is making big bets on nuclear power, which generates more than half of the province’s electricity. In a high electrification scenario, IESO says, the province could need up to 17,800 MW of new nuclear generation in addition to its current 12,000 MW.

On May 8, Ontario authorized Ontario Power Generation (OPG) to begin construction on the first of four small modular reactors at the Darlington nuclear site. The initial unit, targeted for commercial operation in 2030, would be the first grid-scale SMR in the Group of Seven countries, of which Canada is a member. OPG says building all four SMRs, a total of 1,200 MW, will cost $20.9 billion. The additional SMRs could come online between 2033 and 2035. (See Ontario Greenlights OPG to Build Small Modular Reactor.)

The government also is supporting the expansion of the Bruce Nuclear Generating Station, referred to as Bruce C, which could add up to 4,800 MW.

The plan enrolls IESO in a New Nuclear Technology Panel with OPG and Bruce Power “to ensure prospective sites for new nuclear generation are considered in electricity system and transmission planning studies.”

Hydropower

The plan calls for expanding and refurbishing the province’s hydropower resources, which provide about 24% of Ontario’s electricity, behind only nuclear.

OPG, which is investing $4.7 billion to refurbish and expand its 66 hydroelectric generating stations, has identified up to 4,000 MW of potential new hydropower in northern Ontario. The government is supporting early-stage development for two new sites in the Moose River Basin: Nine Mile Rapids and Grand Rapids.

The plan orders IESO to launch a program to re-contract 26 hydroelectric facilities larger than 10 MW, a total of more than 1,000 MW. The ISO already is working to recontract about 80 small hydroelectric facilities, totaling more than 200 MW.

Other Provisions

The plan also outlines roles for:

-

- hydrogen, which could constitute 12 to 18% of energy use in the country by 2050 under “supportive policy measures or key input cost reductions.”

- energy efficiency, which is earmarked for $10.9 billion in spending over 12 years, “nearly three times [the] historical annual investment.”

- pumped storage: The government is supporting predevelopment work for the proposed Ontario Pumped Storage Project, which would provide up to 1,000 MW. OEB is directed to consider changing its rate regulation to support such “long-life” electricity projects.

- storage: The province will add nearly 3,000 MW of energy storage to supplement intermittent renewable generation.

- interconnections: The government is using authority under the 2024 Affordable Energy Act to reduce the capital costs for residential developers and industrial customers connecting to distribution and transmission infrastructure. “These changes will help unlock new developments by reducing investment risk for ‘first mover’ customers, while ensuring fairness is maintained for ratepayers,” the plan says. Draft regulations will be posted for public comment in summer 2025.

- distribution systems: The plan defines grid modernization, directing Ontario’s 59 LDCs to make upgrades that allow them to respond more quickly to outages, improve efficiency, and support two-way power flows and real-time system monitoring to accommodate DERs.

- National Energy Corridors for clean energy, transmission and pipelines: “This includes exploring opportunities to build the critical infrastructure needed to move energy and resources east-west across Canada and north to tidewater, including through new transmission lines, pipelines, rail networks and a potential deep-sea port on James Bay.”

Transmission

The plan outlines additions to Ontario’s 18,600 miles of high-voltage transmission, calling for expanding its north-south “electricity backbone” to reduce constraints preventing generation sites in the north from delivering to loads in the south. In total, IESO has about 1,500 kilometers of new transmission lines “under development or planned,” according to IESO CEO Leslie Gallinger.

The plan supports the 500-kV Barrie-to-Sudbury single-circuit line, due in service in 2032. “Because of the critical system value to this strengthened corridor, the IESO has also recommended initiating early development work on a second 500-kV line,” the plan says.

IESO also has recommended reconductoring the 230-kV Orangeville-to-Barrie line.

The two projects are “critical enablers” for future generation projects such as the proposed Nine Mile Rapids and Grand Rapids hydropower stations, the plan says.

IESO also has identified two major projects in the Greater Toronto Area (GTA): reconductoring the 115-kV Manby-Riverside line, due to be in service in 2026; and a new double-circuit 500-kV line from Bowmanville Switching Station to an existing 500-kV station in the GTA. The line, expected in service in the early 2030s, would connect OPG’s SMR units 2, 3 and 4 at Darlington to the grid and send additional electricity to the GTA.

The ministry ordered IESO to recommend by August an option for additional transmission into Downtown Toronto to support growth and electrification. “Once IESO makes a recommendation, the government intends to act quickly to kickstart development, so it can be delivered in the early-to-mid 2030s,” the ministry said.

The government has authorized Hydro One to make advance purchases of up to five 750-MVA, 500/230-kV autotransformers to be deployed in the GTA and in southwest and northern Ontario.

Streamlining Regulation

The ministry called for streamlining provincial approval processes for “priority energy projects that are essential to supporting housing, job creation and long-term economic security.”

The province is creating a “One Team” initiative to accelerate approvals of “strategically important” energy projects, starting with projects in IESO’s Long Term 2 procurement. (See related story, IESO Purchasing 3,000 MW of Energy and Capacity.)

In 2022, the government exempted transmission lines wholly funded by commercial, industrial or generator customers from requiring Leave to Construct approval from the OEB. In 2024, the government moved all transmission projects into Ontario’s Class Environmental Assessment process, which is expected to reduce development timelines for large projects by up to two years.

The government ordered IESO and OEB to review their approval, connection, procurement and regulatory processes and report back on ways they can reduce duplication, shorten timelines and improve efficiency.

“Complex permitting and regulatory processes across multiple ministries and levels of government can create barriers, delays and added costs for projects that are critical to the province’s growth and competitiveness,” it said.