New England transmission owners (TOs) have added 39 new projects in the annual update to the region’s asset condition forecast, the companies told the ISO-NE Planning Advisory Committee (PAC) on Aug. 20.

The TOs categorized the projects as either “under development” or “under evaluation.” The projects do not yet have cost projections, but most have estimated cost ranges. The TOs forecast 23 projects to cost less than $10 million, nine to cost between $10 million and $25 million, two to cost between $25 million and $100 million, and one to cost more than $100 million.

Growing costs associated with asset condition projects have been a major focus of New England states and consumer advocates in recent years. While investor-owned transmission companies have insisted the high costs are necessary to maintain the region’s aging grid, states have expressed concern that a lack of oversight and transparency on spending has contributed to higher costs.

According to a June update provided by the TOs, the total estimated cost of in-progress asset condition projects with official price projections is about $5.9 billion. This does not include forecast projects that have only projected cost ranges. (See New England Transmission Owners Add $95M to Asset Condition List.)

Earlier in the summer, ISO-NE agreed to take on a non-regulatory “asset condition reviewer” role to help increase transparency into projects. (See ISO-NE Open to Asset Condition Review Role amid Rising Costs.) The RTO said in late June it will need about 18 months to develop internal review capabilities but said it plans to hire a consultant to help review the most significant asset condition projects in the interim. (See NEPOOL PC Briefs: June 24-26, 2025.)

The TOs also have implemented new guidelines around PAC presentations in recent years intended to standardize the presentation format and increase transparency. But PAC presentations remain strictly advisory, and the committee does not have any regulatory authority.

Project Presentations

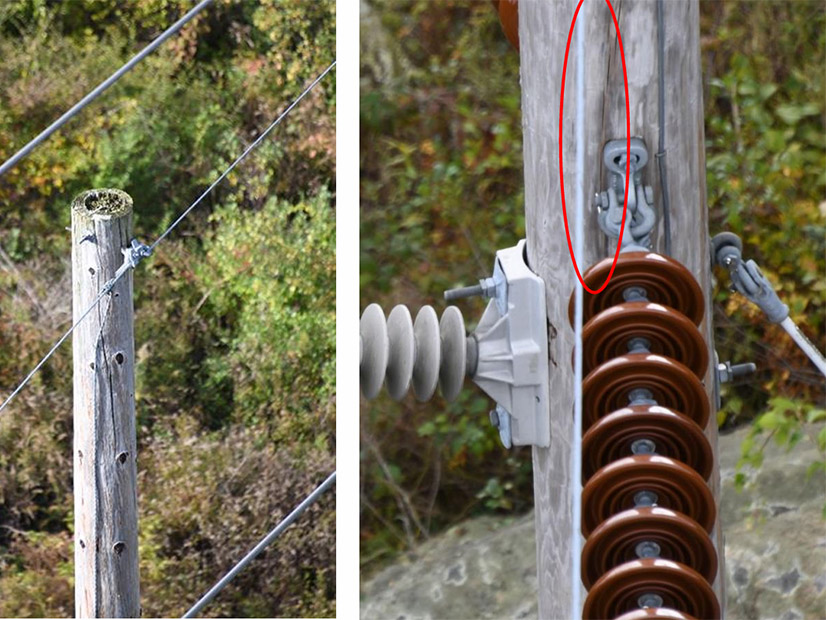

At the PAC meeting, Chris Soderman of Eversource Energy presented an $18 million asset condition project to replace deteriorating wooden structures with steel structures, reinforce overstressed wood structures, and replace Copperweld shield wire with optical ground wire (OPGW) on a 115-kV line in Connecticut.

Soderman said the project would cost about $1.8 million less if the company replaced the shield wire with Alumoweld Static Wire but installing OPGW also would address telecommunication needs.

He also noted that the ISO-NE 2050 Transmission study indicates the line would be overloaded in a 51-GW winter peak scenario and that the upgrades are “setting ourselves up so that when we do look at a reconductor in the future, these structures will be able to handle that.”

Carol Burke of Eversource presented an update to a substation upgrade project in southern New Hampshire. The project originally was presented to the PAC in 2022 with an estimated cost of about $20 million. Burke said this estimate has increased to $35 million due to an expanded project scope, delayed construction and increased material costs.

Lastly, Kyra Lagunilla of Rhode Island Energy presented a $15 million project to replace wooden poles with steel structures and install OPGW and lightning protection on three 115-kV lines. She said the added lightning protection is necessary because the lines do not meet the company’s lightning performance standards and lightning has triggered two long-duration outages on the lines since 2011.