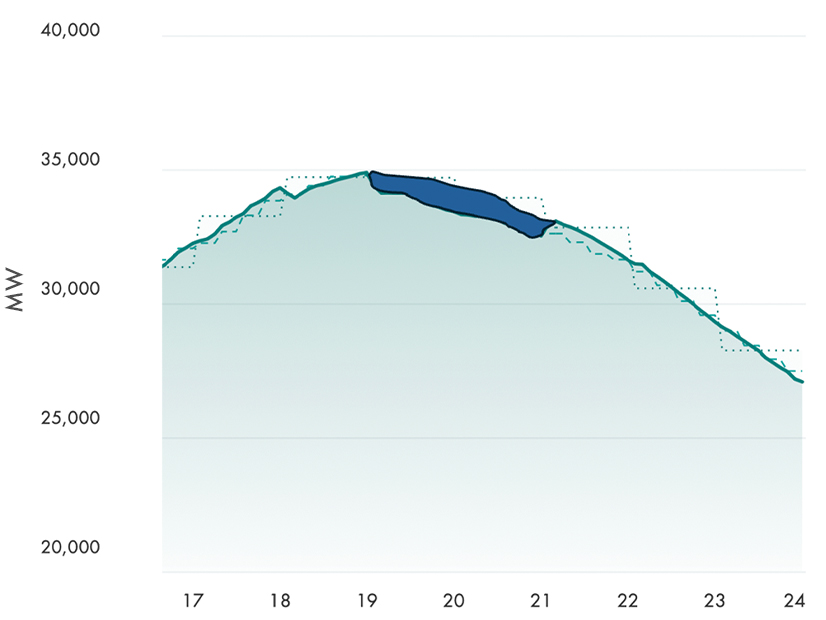

On July 29, at 7 p.m., California’s three investor-owned utilities, in partnership with SunRun and Tesla, orchestrated the largest activation to date of customer-sited batteries across 100,000 locations.

Within seconds, 539 MW of power from this aggregated virtual power plant (VPP) was flowing back into the grid, reducing peak evening demand. This may have been the largest demonstration of its kind to date. It won’t be the last.

Bidirectional Relief

An Expanding Resource: Pacific Gas and Electric (PG&E) noted in its press release that the batteries were enrolled in California’s Emergency Load Reduction Program (ELRP) — which calls for 20 hours of dispatch annually — and the Demand Side Grid Support (DSGS) initiative — which requires at least one event per month. “If no real emergencies happen,” the utility said, “test events like this one will continue to make sure everything works as expected.”

California leads the nation with 686 MW of commercial and 1,829 MW of residential distributed batteries as of April, at more than 25,000 sites. That population is growing quickly in California and elsewhere, often in tandem with solar installations. SunRun reported that in Q2 of 2025, 70% of its customers also bought batteries (up from 54% during Q2 of 2024). The company is dispatching its battery fleet across the U.S., providing 340 MW of batteries to grids in California, Massachusetts, New York and Puerto Rico during a single June day.

Tesla operates in California but also is coordinating battery-based VPPs in Texas, where it gained approval in 2023 to participate in ERCOT’s Aggregated Distributed Energy Resource (ADER) pilot project serving Houston and Dallas. It coordinates with VPP platform company Energy Hub to provide services to Massachusetts, Connecticut and Rhode Island while overseeing a separate aggregated offering in Puerto Rico.

Utilities Increasingly Embrace VPPs: Across the U.S., more utilities are deploying batteries to push the boundaries at the grid edge, offering reliability to customers while creating capacity management, renewables integration and grid balancing services.

To cite some examples, Utah’s Rocky Mountain Power launched a pilot six years ago, connecting 12.6 MW of batteries deployed by solar and storage company Sonnen to its control room. Following that success, it received approval from the state’s regulators in 2020 for a tariff to retrofit batteries to existing distributed solar installations. This year, it went further, signing an agreement with Torus for up to 70 MW of distributed storage systems using batteries and flywheels.

Vermont’s Green Mountain Power (GMP) continues to expand its battery program started in 2016. By 2023, it had 22 MW of distributed batteries that had delivered 10,000 hours of backup power to customers during the previous winter. Under GMP’s program, customers can lease the batteries or own them and receive rebates for participation in the utility’s Bring Your Own Device aggregation program, which pays participants up to $10,500. As of 2025, 5,000 customers are engaged in the program, with batteries both providing backup power and helping GMP reduce exposure to wholesale power costs by an estimated $3 million this year.

Minnesota’s Xcel Energy is adopting a unique approach, installing solar arrays and batteries as part of a distributed capacity program including up to 1,000 MW of DERs in a utility-owned and rate-based VPP. The plan won regulatory approval in February, with a detailed proposal expected this October.

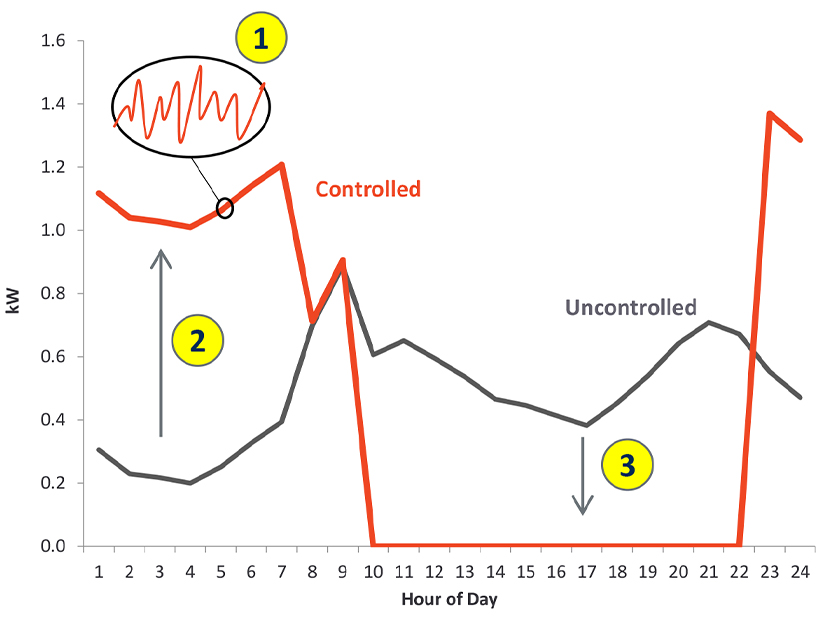

VPPs Go Well Beyond Batteries: While batteries form the backbone of many VPPs, other technologies often are involved. Grid-interactive water heaters frequently participate in load-shifting and peak management programs and have provided frequency regulation services.

Water Heaters can Shift Load AND Help Manage Frequency

Air conditioners and smart thermostats also are part of the mix, with VPP programs expanding in recent years as technology improves. Late in 2024, for example, NRG teamed up with Renew Home and Google Cloud in Texas and aims to distribute, connect and orchestrate hundreds of thousands of thermostats into a 1,000-MW AI-powered VPP by 2035.

Electric Vehicles: Class of Their Own: EVs represent a potentially massive and growing resource. Sophisticated charging architectures and improved batteries now can accept charges of 300 kW or more (and trucks can exceed 1MW). It will become increasingly important to manage when they are charged. The cost of not doing so can run quickly into the billions, as distribution grids come under significant related stress.

EV batteries are big, especially when compared to residential storage. The bidirectional capable battery in the smaller of the Ford 150 Lightning models is 98 kWh, more than seven times larger than a 13.5-kWh Tesla Powerwall battery, while the large Ford version boasts 130 kWh. For its part, a typical “Type C” school bus battery sits around 200 to 300+ kWh.

Multiple auto manufacturers now include vehicle-to-grid (V2G) capabilities in charging and battery architectures to take advantage of the potential grid revenue streams. When BlueBird upgraded the warranty on its Type C bus battery to 360 MWh of lifetime throughput, it specifically cited the ability of EV fleet operators “to sell excess energy stored in school bus batteries back to electric power companies at a profit.”

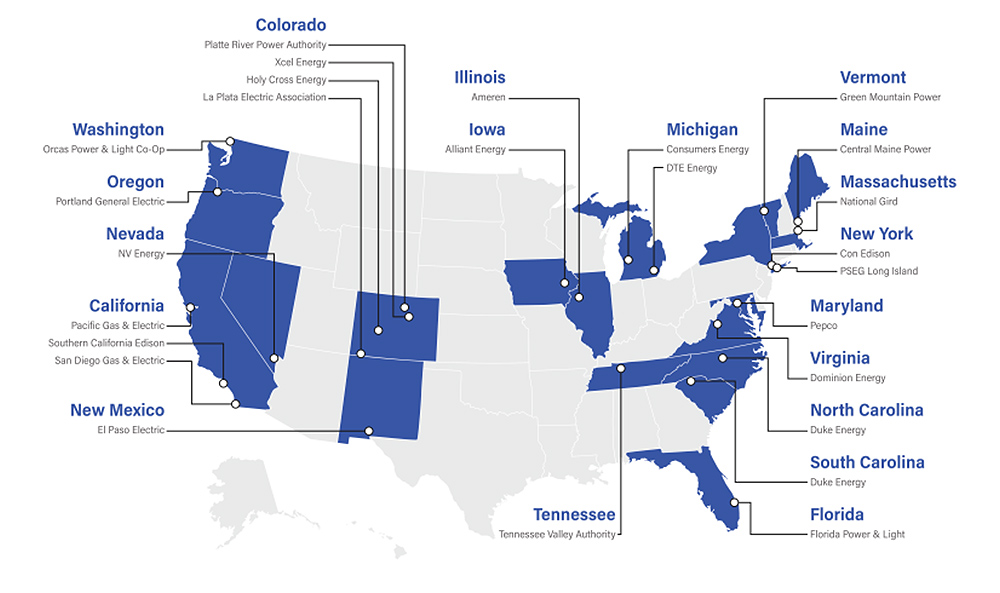

While only a handful of drivers participate in bidirectional charging pilots, vendors and utilities are addressing the technical and behavioral challenges holding this potential back. School Bus V2G programs are having the most initial success, with 26 utilities in 19 states having rolled out programs to date.

Last year, leasing company Zum announced a program to deliver 2,100 MWh of energy annually from 74 electric buses (leased to the Oakland Public School District) back to PG&E. This month, PG&E teamed up with Fremont Unified School District (FUSD) and The Mobility House to manage 14 bidirectional-capable school buses.

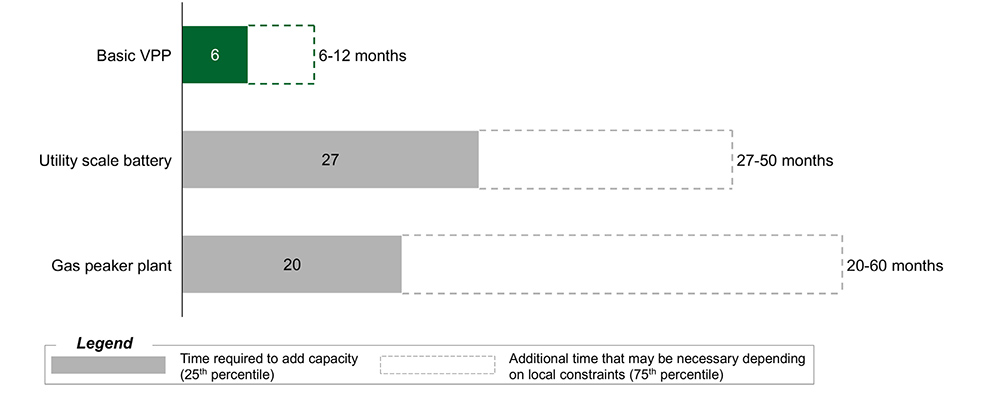

The Outlook: Fast, Flexible, and Expanding: As electricity demand grows, and generation has trouble keeping pace, VPPs offer a nimble alternative. A recent Department of Energy report (now unavailable on DOE’s website) found that VPPs can be built over just six to 12 months, far faster, and at a lower cost than batteries or gas-fired generators. The report also suggested that VPPs eventually could grow to represent as much as 10 to 20% of U.S. peak demand.

Getting Needed Capacity Faster

The DOE report noted that VPPs still face some critical obstacles. Areas to be addressed include simplification of asset enrollment, increased standardization of operations and improved integration of these aggregated resources into both utility and wholesale markets.

The VPP world is fragmented and generally characterized by pilots and evolving initiatives. There is a long way to go before we move from today’s typical demand response programs — with limited numbers of dispatch events — to a more seamless and price-responsive future, in which on-site assets simply react predictably to price signals or specific grid conditions.

Nonetheless, solutions providers are making true progress, and the achievements are considerable. To take some other examples: EnergyHub reports 2,000 MW of flexible load, made up of 1.7 million DERs. Demand response provider CPower manages 6,700 MW of dispatchable load across 23,000 customer sites, while its competitor Voltus stated recently that it is dispatching distributed assets every single day.

The challenge of resource adequacy will become increasingly critical as supply resources struggle to keep up with rapidly growing demand. However, as artificial intelligence and grid software improve, VPPs will become an even more helpful tool for improving economic efficiency, reliability and resilience. Keeping the lights on in the decades to come may in part depend on how quickly these virtual power plant resources become a normal part of our electricity landscape.

Around the Corner columnist Peter Kelly-Detwiler of NorthBridge Energy Partners is an industry expert in the complex interaction between power markets and evolving technologies on both sides of the meter.