SPP’s Market Monitoring Unit says in its latest report that the Western Energy Imbalance Service (WEIS) market’s average load energy prices rose “significantly” during the spring quarter (March-May).

The increase was driven primarily by elevated natural gas prices in March, the MMU said in its quarterly State of the Market report for the WEIS market, published Aug. 29.

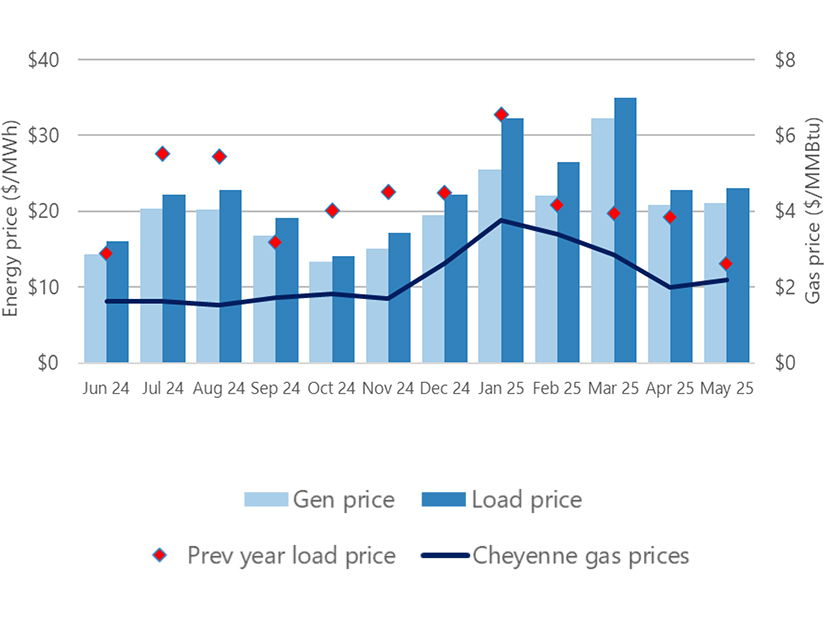

Spot prices for natural gas at the Cheyenne hub started the quarter at $2.85/MMBtu and closed at $2.18/MMBtu. Gas prices averaged $2.342/MMBtu during the quarter, about 45% higher when compared to the same quarter in 2024. Settling additional generation out of the market also increased gas prices.

Energy prices averaged $34.93/MWh in March, up from $19.78/MWh a year ago. Prices dropped to $22.83/MWh in April, slightly higher than a year ago ($19.19/MWh), before averaging $23.09/MWh in May, up from $13.05/MWh in 2024.

The MMU noted coal generation continues to be the primary fuel type for the WEIS market, accounting for about 33% of total generation during the quarter. It said the WEIS market is a voluntary imbalance market. The price volatility is strongly associated with the supply — or lack thereof — of interval-by-interval rampable capacity, it said.

The frequency of negative intervals started at 3.25% in March and increased to 7.43% in April and 9.16% in May, making it difficult for market participants to sell energy to the market and earn revenue. Negative price intervals can be caused by many factors, usually including high amounts of renewable generation and associated subsidies, a lack of dispatchable range and external impacts, the MMU said.

The WEIS market’s total generation nameplate capacity grew by 579 MW. The market added 405 MW of solar, 162 MW of gas and 12 MW of “other.”

This quarter provided a total revenue neutrality uplift credit to the WEIS market of just over $700,000. The uplift was mostly composed of revenue inadequacy surpluses in April and May and uninstructed resource deviations and out-of-merit energy in March.

SPP operates and administers the WEIS market, a price-based, centralized real-time energy imbalance service market. The market gives participants the ability to submit offers and bids for imbalance energy, settling the net supply or obligation for an asset owner.

The grid operator plans to terminate the WEIS market April 1, 2026, when it integrates Western balancing authorities into its Western Interconnection expansion. The MMU said market improvements supporting reliability, transparency and operational efficiency should continue to be implemented as needed.