The U.S. Department of Energy has withdrawn a $716 million loan commitment that would have helped New Jersey upgrade the state’s transmission system to connect offshore wind to the grid.

DOE approved the loan commitment to Jersey Central Power and Light (JCP&L) in January, shortly before President Donald Trump took office. A department spokesperson called the commitment “conditional” and said “DOE and JCP&L mutually agreed to withdraw from the commitment,” declining to comment further.

New Jersey Board of Public Utilities spokesperson Alonza Robertson said the agency is “deeply disappointed in the federal government’s decision to cancel funding for critical transmission infrastructure projects.”

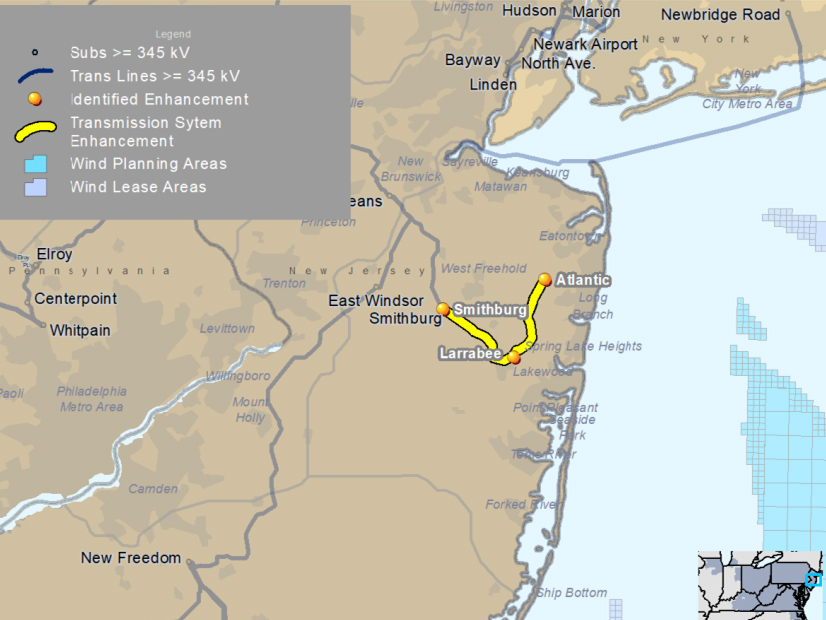

The loan commitment would have supported the New Jersey Clean Energy Corridor, a transmission infrastructure upgrade project. Specifically, it would have funded a portion of the work that resulted from the agency’s use of FERC Order 1000’s State Agreement Approach with PJM.

The $1.07 billion series of projects, in which JCP&L had a major role, were centered around a new $504 million substation next to the utility’s existing Larrabee substation. The package of transmission upgrades would have enabled the state to deliver 6,400 MW of offshore wind generation to the PJM grid.

Grid Plans Postponed

The BPU, however, put the project on hold for 30 months on Aug. 13 after the state’s only remaining viable offshore wind project, Atlantic Shores, asked to terminate its Wind Renewable Energy Agreement because of opposition to the project from the Trump administration (See N.J. Puts on Hold Remaining Pieces of $1.07B OSW Transmission Project.)

“These transmission investments are essential for grid reliability, energy security and economic development in our state,” Robertson said in a statement to RTO Insider. “The cancellation of committed federal support undermines the certainty that developers, utilities and ratepayers need to plan for our energy future and represents a step backward in building a clean energy future.”

A spokesman for JCP&L, which is owned by First Energy, declined to comment.

The loan commitment withdrawal emerged several days before a Labor Day statement jointly signed by New Jersey Gov. Phil Murphy and four other governors reaffirming their commitment to offshore wind. The statement called on the Trump administration to “uphold all offshore wind permits already granted and allow these projects to be constructed.” It followed a stop-work order issued by the administration against Ørsted’s Revolution Wind project off the coast of Massachusetts and Rhode Island. (See related story, Revolution Wind Sues to Lift Federal Stop-work Order.)

“Efforts to walk back these commitments jeopardize hardworking families, wasting years of progress and ceding leadership to foreign competitors,” wrote Murphy and the governors of New York, Connecticut, Massachusetts and Rhode Island. “These projects represent years of planning, billions of dollars in private investment and the promise of tens of thousands of additional jobs. They are revitalizing our ports, strengthening our supply chains and ensuring that America — not our competitors — leads in clean energy manufacturing and innovation.”

Projected Ratepayer Savings

New Jersey’s offshore wind sector, like those of other states, initially struggled amid high equipment costs and logistical challenges, which resulted in Danish developer Ørsted’s abandonment in October 2023 of its Ocean Wind 1 and 2 projects, two of New Jersey’s first three projects, leaving only Atlantic Shores moving forward.

The state’s ambitious effort to use the SAA to create grid upgrades that would tie several projects to the grid, rather than leaving each to forge their own connection route, was seen as innovative. DOE’s proposed loan to the project was among several loan commitments totaling $22.9 billion made to utilities for transmission, pipeline and clean power investments in the waning days of the Biden administration. (See LPO Offers Eight Utilities $22.9B in Loan Guarantees.)

Announcing the loan commitment Jan. 16, DOE’s Loan Program Office (LPO) said the project “comprises 40 miles of transmission and substation upgrades and expansions.” The department said the proposed loan would “reduce upward pressure on electricity rates for ratepayers from project costs as a result of the reduced cost of debt associated with LPO financing” and would produce “an estimated $150 million in savings for JCP&L ratepayers over the life of the loan.”

In a July 30 quarterly report filed as required by its agreement with the BPU, JCP&L said the project was on schedule and in the engineering, procurement and permitting phase. One element, the Larrabee Substation, was in construction, the report said. About 45% of the permitting and 60% of the engineering had been completed, the report said.

The report said the utility had spent about $59.5 million of an expected cost of $910 million.