The International Energy Agency expects low-emissions hydrogen production to increase substantially through 2030, but not as rapidly as had been expected a few years ago.

The forecast is contained in “Global Hydrogen Review 2025,” the annual analysis IEA issued Sept. 12. The report also indicates limited progress so far toward a cleaner hydrogen sector:

Worldwide hydrogen demand reached nearly 100 million tons in 2024, up 2% from 2023; almost all of it was produced from fossil fuels with conventional techniques, and the bulk of it went to sectors that traditionally have been the largest hydrogen consumers, such as industry and oil refining.

Producing gray hydrogen (and its associated carbon dioxide emissions) from fossil fuels has always been cheaper than producing green hydrogen through emissions-free electrolysis of water, and the cost differential has widened recently due to lower natural gas costs and higher electrolyzer costs, IEA said in its announcement of the report.

At the same time, uncertainty surrounds demand for low-emissions hydrogen and the regulations upon it, IEA said, and development of the infrastructure needed to support expansion of the hydrogen sector has lagged.

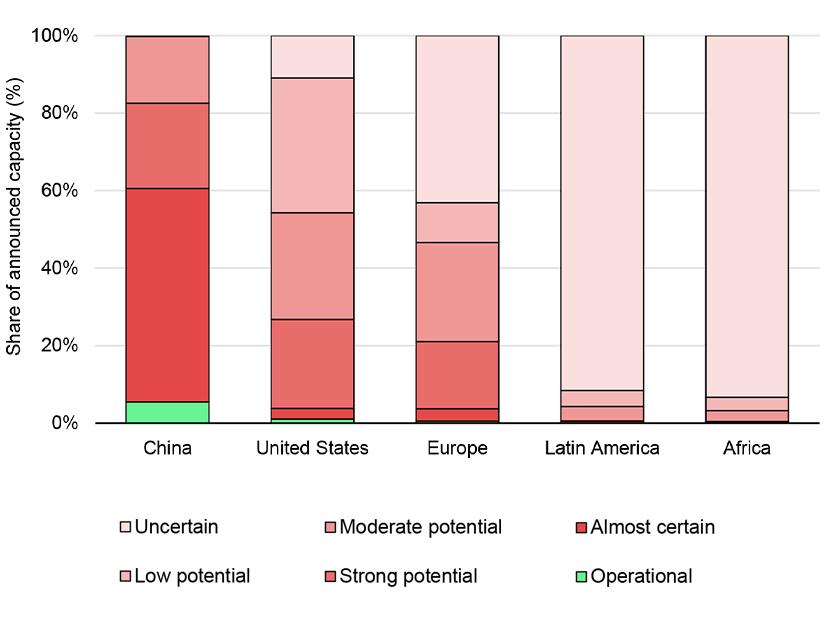

As a result, the 2025 review tallies potential low-emissions hydrogen production at no more than 37 million tons in 2030, down 24% from the 49 million tons the 2024 review calculated. And IEA reminds readers that the actual 2030 production is likely to be much less than 37 million tons, due to project attrition.

The projects that are operational or under construction or have reached final investment decision would produce just 4 million tons per year in 2030, IEA said, though other projects that have a “strong potential” of completion if granted a favorable regulatory environment could add 6 million tons to the total.

On a more positive note, IEA said there were just a handful of low-emissions hydrogen demonstration projects when it published its first review in 2021. As it published its fifth, more than 200 investment commitments have been made.

IEA Executive Director Fatih Birol said the investor interest in hydrogen that spiked in the early 2020s has cooled but not vanished: “The latest data indicates that the growth of new hydrogen technologies is under pressure due to economic headwinds and policy uncertainty, but we still see strong signs that their development is moving ahead globally. To help growth continue, policy makers should maintain support schemes, use the tools they have to foster demand and expedite the development of necessary infrastructure.”

With release of the 2025 review, IEA updated its Hydrogen Production and Infrastructure Projects Database and launched a new online tracker that maps or charts projects, production, infrastructure, production costs and policies.

Among the details in the 2025 review:

-

- Green hydrogen projects accounted for more than 80% of the decrease in expected production levels of low-emissions hydrogen in 2030, but blue hydrogen projects — gray hydrogen production coupled with carbon capture technology — also were removed from the mix.

- Low-emissions hydrogen production is expected to increase 10% from 2024 and reach 1 million tons in 2025, which would place it around 1% of all hydrogen production.

- The cost gap between green and gray hydrogen is expected to narrow by 2030 in parts of the world, but in places where natural gas is less expensive, such as the United States and the Middle East, the gap will remain wide, making blue hydrogen more attractive than green.

- China is a low-emissions hydrogen hot spot: 65% of worldwide electrolyzer capacity has been built or greenlighted there, and it is home to nearly 60% of electrolyzer manufacturing capacity.

- Outside of China, the electrolyzer manufacturing industry is seeing sharply lower revenues and higher losses, triggering bankruptcies and acquisitions that may signal an impending wave of consolidation.

- But Chinese electrolyzer manufacturers have different problems: Their manufacturing capacity far exceeds demand, and their less expensive products do not present a large savings to foreign customers once tariff, transportation and other costs are factored in.

- Policies to create demand for low-emissions hydrogen are expanding, but slowly; once created, they need to be supported by action.

- Project funding cuts announced in 2025 are likely to slow the expansion of low-emissions hydrogen in the U.S. in the short term.

Based on the factors spelled out in the 288-page 2025 review, IEA offers leaders and policymakers a series of recommendations for low-emissions hydrogen, including:

-

- Maintain support for production, with a focus on shovel-ready projects that target existing applications — this would drive a faster upscale of production and enable cost reductions.

- Create demand through regulations and support schemes in key sectors; collaborate with industry to create markets for end-use products to ease early-stage adoption.

- Expedite deployment of hydrogen infrastructure with regulatory frameworks and financial mechanisms that reduce risks for early investors.

- Add more efficient permitting processes and greater coordination among authorities that could help reduce lead times.

- Boost public finance mechanisms to reduce the risks associated with early-stage technologies that do not have a proven performance record.

- Help emerging and developing economies move up the value chain with new domestic uses and new export opportunities.

There are many signs of diminished momentum, the report’s authors say.

They note that the 2022 review found government policymakers had set a collective goal of 190 GW of installed electrolysis capacity at a time when not quite 700 MW was installed.

“These ambitions set the bar very high for a nascent sector that needs to construct new value chains almost from scratch,” they write, and they detail the shortfalls.

But they also detail the progress and say the signs of progress outweigh the setbacks: “While the challenges facing the hydrogen sector have led to slower-than-targeted deployment, a closer look at the evidence shows that — rather than stalling or faltering — the sector is progressing and reaching important milestones.”