Construction of new wind, solar and energy storage facilities will decrease significantly over the next five years, a BloombergNEF analyst said in an presentation to the California Energy Commission.

U.S. construction of new wind, solar and energy storage facilities will decrease significantly over the next five years, with a cliff dive projected to take place in 2028, a BloombergNEF analyst said in an Oct. 8 presentation to the California Energy Commission.

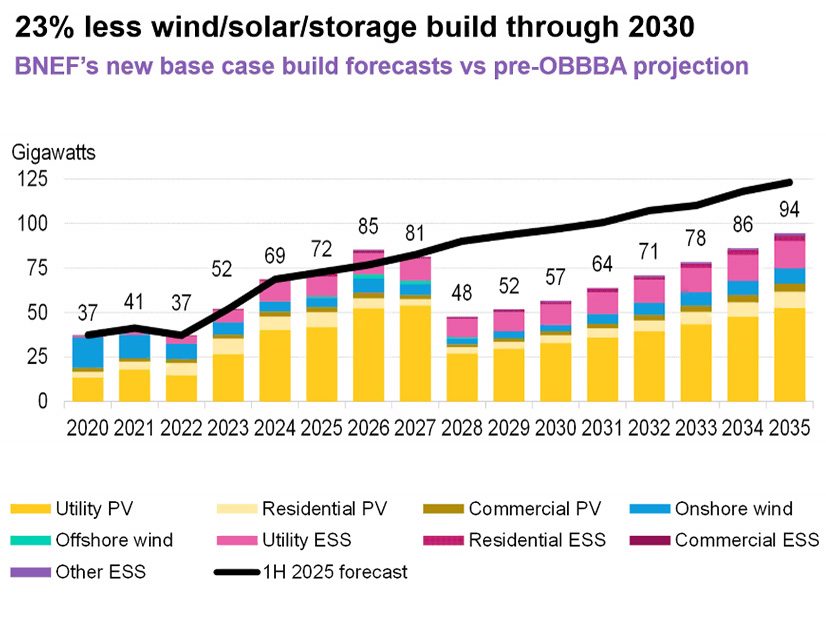

About 81 GW of new wind, solar and energy storage capacity is projected to be installed in the U.S. in 2027, falling to around 48 GW the following year, the analyst said. In total, the wind, solar and storage resource buildout by 2030 will be 23% below forecasts prior to the Trump administration’s One Big Beautiful Bill Act.

The large drop in 2028 will stem from the effects of recent federal policies that will be seen more broadly by that time, Derrick Flakoll, policy expert at BloombergNEF, said at the CEC’s Oct. 8 business meeting. Renewable energy projects are, on the contrary, forecast to increase in the next two years as developers “rush to qualify for federal subsidies,” he said.

But when the decline happens, it will be due in part to new restrictions placed on countries designated as foreign entities of concern, Flakoll said.

“For both clean energy manufacturing and clean energy deployment, there are penalizations for … supply chains that are tied to China,” Flakoll said. “For projects beginning in 2026, anything other than energy storage needs to be at least 40% non-Chinese … or non-Foreign Entity of Concern.”

Although construction of renewable energy projects will drop in the coming years, the impact could have been much harder, he said.

“One reason we only see that 23% decrease is that renewables are generally the fastest thing to get on the grid,” Flakoll said.

Wind, solar and storage are on average faster to connect to the grid than gas turbine facilities in all markets, except MISO, he said.

Offshore wind projects are expected to see the sharpest decline in construction.

“We don’t really see a lot of offshore wind [projects] coming online through 2035,” Flakoll said. “For markets like California, where floating offshore wind is in early stages, we don’t really see anything happening through 2040.”

Even though construction of clean energy projects will slow in the U.S., domestic manufacturing of utility-scale energy storage equipment is projected to increase dramatically over the next 10 years, from about 12 GWh in 2025 to more than 60 GWh in 2035. This is due in part to battery manufacturing facilities in the U.S. shifting from making batteries for electric vehicles to building batteries for energy storage.

“There might actually be enough [battery manufacturing] to meet U.S. demand,” Flakoll said.

CEC Vice Chair Siva Gunda asked about the cost of EV charging in California versus other parts of the U.S.

Prices will be different for each market, such as in California versus PJM, Flakoll said. These price differences “are ultimately political choices,” he said.

“The way that California chooses to pay for certain [energy] programs might have an effect on electricity rates,” Flakoll said. “It is [also] based on California’s changing policy landscape. … We are seeing so much policy change in California as we speak.”

Idaho Gas Plant Capacity Approved for Calif. Utilities

At the Oct. 8 meeting, the CEC also determined that a new, planned natural gas plant in Idaho meets California’s carbon dioxide emissions requirements. The gas plant can therefore provide capacity to Lassen Municipal Utility District and the Truckee Donner Public Utility District, the CEC said in its decision.

The CEC specifically found that the gas plant’s emission in Idaho will be below the CEC’s Emission Performance Standard for Local Publicly Owned Electric Utilities, which limits generator facilities to 1,100 pounds of CO2 per MWh of energy.

The planned 364-MW gas plant will be built in Power County, Idaho and owned by the Utah Associated Municipal Power Systems. It will provide about 7 MW of capacity to Lassen and 5.25 MW to Truckee, with both 30-year contracts starting on July 1, 2031.