The 2025 California legislative session ended in disappointment for virtual power plant proponents, as Gov. Gavin Newsom vetoed several VPP-related bills and lawmakers didn’t approve new funding for an existing program.

Assembly Bill 740, AB 44 and Senate Bill 541 were vetoed before the governor’s Oct. 13 bill-signing deadline. Bills sent to Newsom that aren’t signed or vetoed become law without the governor’s signature.

Edson Perez, California lead at Advanced Energy United, called the vetoes of the VPP bills “missed opportunities to save billions in energy costs by leveraging technologies all around us in our homes, garages and on our roofs.”

“This policy whiplash undermines confidence across the sector, discourages the deployment of cost-saving technologies and drives away investments,” Perez said in a statement.

Virtual power plants are collections of distributed energy resources, such as solar panels, batteries, electric vehicles or smart devices, that can be called upon to boost the grid when needed.

AB 740 would have directed the California Energy Commission to work with CAISO and the California Public Utilities Commission to explore how virtual power plants could help meet statewide load shift goals and what opportunities are available for VPPs to qualify for resource adequacy. Perez said the bill aimed to make VPPs a core part of California’s energy portfolio rather than solely an emergency resource.

In vetoing the bill, Newsom cited budget constraints.

“While I support efforts to realize the potential of these energy resources and others, this bill results in costs to the CEC’s primary operating fund, which is currently facing an ongoing structural deficit, thereby exacerbating the fund’s structural imbalance,” Newsom said in his veto message.

Newsom also vetoed SB 541, which would have required the CEC to work with CAISO and the CPUC to analyze the cost effectiveness of certain load-shifting strategies, estimate each retail electricity supplier’s load-shifting potential, and report the amount of load shifting that each retail supplier achieved in the previous year.

Newsom called SB 541 “largely redundant and, in some cases, disruptive of existing and planned efforts” by the agencies to maximize the potential of load-management strategies.

AB 44, which the governor vetoed, would have directed the CEC to devise methodologies that load-serving entities could use to modify their demand forecasts in response to measures such as VPPs.

The governor said the bill does not align with the CPUC’s resource adequacy framework.

“As a result, the requirements of this bill would not improve electric grid reliability planning and could create uncertainty around energy resource planning and procurement processes,” Newsom said in his veto message.

Another disappointment for VPP advocates was lawmakers’ decision to not provide additional funding for the CEC’s demand side grid support (DSGS) program. As part of the program, battery owners agree to make their stored energy available to the grid during energy emergency alerts or when day-ahead prices go over $200/MWh. They then are compensated based on the power they shared with the grid. (See Budget Cuts Threaten Calif. VPP Program.)

In an Oct. 1 statement, the CEC said DSGS had about $64 million remaining. CEC expects to have enough money to pay out incentives from the 2025 program season and will look for ways to continue the program in 2026.

Advanced Energy United hopes the state will “course correct” on VPPs as soon as possible, Perez said, starting with more funding for DSGS in early 2026 to keep the program going.

Offshore Wind Funding

In contrast to the setbacks for VPP bills, lawmakers made progress on other energy-related issues.

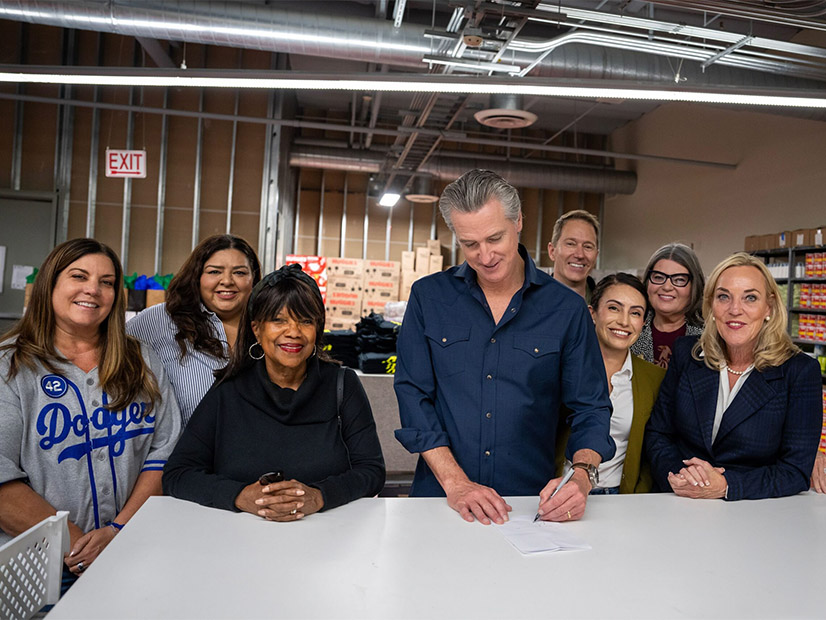

As previously reported, the legislature passed and Newsom signed AB 825, known as the Pathways bill. The bill will allow CAISO to transition the governance of its markets to an independent “regional organization.” (See Newsom Signs Calif. Pathways Bill into Law.)

Newsom also signed SB 254, a law that will create a “transmission accelerator” to develop low-cost public financing programs for certain transmission projects. The legislation also establishes an $18 billion “continuation account” for the state’s wildfire fund to cover investor-owned utilities’ wildfire liabilities. (See Calif. Lawmakers Pass Bill to Accelerate Transmission Development.)

Offshore wind advocates were pleased that lawmakers passed and Newsom signed SB 105, a budget bill that includes $228.2 million for offshore wind. The funding is the first installment out of $475 million earmarked for offshore wind in Proposition 4, the $10 billion climate bond measure that California voters approved in 2024.

Of the $228.2 million in SB 105, the CEC has already distributed $42 million in grants to improve port facilities for floating offshore wind projects. (See CEC Approves 5 Offshore Wind Projects at California Ports.)

Offshore Wind California, an industry coalition, called the funding “another important proof point of California’s progress and commitment to move forward on offshore wind.”

“California is demonstrating its continued determination to be a clean energy leader, despite the federal headwinds we’re facing this year,” the group said in a statement.

Other legislation that Newsom signed includes a data center-related bill. SB 57 requires the CPUC to send a report to the legislature on the extent to which utility costs associated with new loads from data centers are shifted to other customers.

And SB 80, which Newsom signed, creates the Fusion Research and Development Innovation Initiative to distribute $5 million for fusion energy research and development. The goal is to deliver a fusion energy pilot project in the state by the 2040s.

Surplus Interconnection Bill Vetoed

Newsom vetoed other bills, including AB 1408, which would have required CAISO to consider surplus interconnection service in its long-term transmission planning. It also would have required utilities to evaluate and consider surplus interconnection options in their integrated resource plans. Proponents said unused interconnection capacity creates an opportunity to add renewable energy resources or battery storage at or near fossil plants.

In his veto message, Newsom pointed to the “highly technical structure of processes” used by the CEC, CPUC and CAISO for grid planning.

“This bill risks constraining energy resource procurement and interconnection options, likely increasing customer electric costs and undermining electric grid reliability,” he wrote.

A bill aimed at requiring more accountability from the CPUC didn’t even make it to Newsom’s desk. AB 13 also would have asked the governor and Senate to consider geographic diversity when selecting CPUC members to address a lack of Southern California representation. (See Calif. Lawmakers Seek More Accountability from CPUC.)

The bill died in committee.