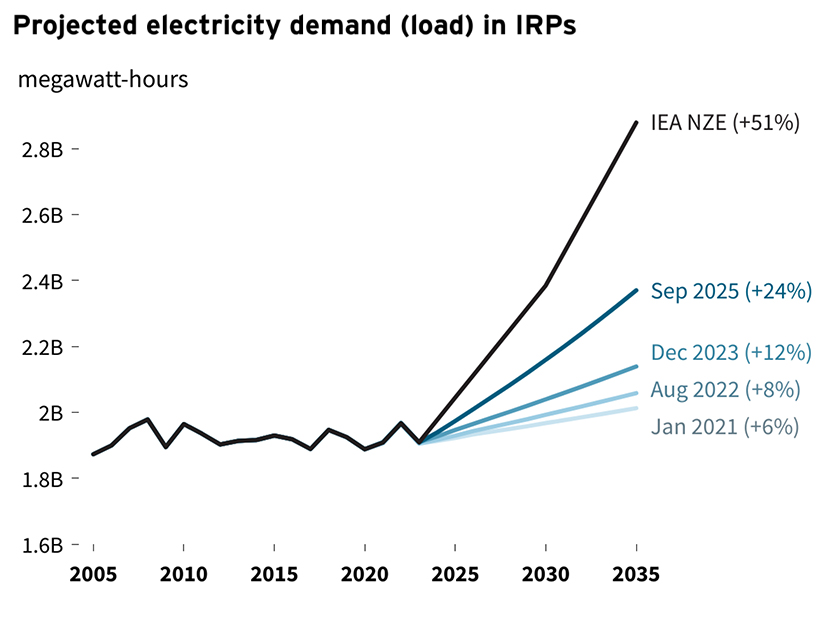

U.S. utilities continue to ratchet up load growth forecasts in their integrated resource plans.

As of September 2025, the IRPs are projecting demand will be 24% higher in 2035 than in 2023, RMI reported Oct. 15. This compares with 12% in December 2023 and 6% in January 2021.

The third-quarter “State of Utility Planning” report is the latest in a series by RMI and combines data from 130 IRPs. As RMI notes in its preface, IRPs are not a clear picture of the future, but they do provide a snapshot of trends, goals and strategies to meet those goals.

The third-quarter report is the first that reflects the impact of the One Big Beautiful Bill Act, with its phaseout of tax credits for wind and solar generation, which recently have been the largest source of new U.S. generation by nameplate capacity.

Other factors gaining prominence in the third quarter included delayed fossil retirements, uncertainty in planning, inability to bring new resources online quickly and difficulties in buying electricity from neighboring utilities.

Trends continuing from previous quarterly reports include changes in resource adequacy rules, particularly in MISO, as well as the expectation that new large loads will present demands that cannot easily be met.

These factors are set against a background of considerable uncertainty over factors such as resource costs, market rules, EPA regulations, other federal policies, frequency of extreme weather events, state policies and the load-growth forecasts themselves. The forecasts are demonstrably imprecise, and some observers maintain that top-end projections are unrealistically large.

Every IRP reviewed for RMI’s third-quarter report increased the load forecast over previous projections but also showed a wide range of uncertainty about the size of that increase. Both the quantity and hourly profiles of these new loads differ from historical trends.

The difficulty of resource planning amid all this is a common point of discussion for utilities, RMI said, along with the need to devise new ways to meet future needs.

RMI noted that since it began tracking IRPs, load projections have increased in all nine quarters and cumulative emissions projections have increased for seven consecutive quarters.

It also pointed out that emissions reductions are lagging in utility projections: The companies examined have targets of 63% emissions reductions by 2035 from a 2005 baseline, but their IRPs would lead to only a 53% reduction.

The IRPs include 259 GW of wind and solar additions through 2035, 103 GW of natural gas additions and 74 GW of coal retirements. This is 2.4% more wind and solar than was planned as of the end of 2023 but 106% more natural gas.

RMI acknowledged the challenges facing electric utilities as they try to balance regulations, costs for customers, profits for investors and climate impact.

But the clean energy advocacy nonprofit also said delayed fossil retirements and new gas generation are the default choice in most IRPs, which instead should incorporate alternatives such as energy efficiency, virtual power plants, grid enhancing technologies and clean repowering.

These alternatives — along with policy and regulatory support — would help utilities hold down costs as they transition to a zero-carbon future, RMI concludes.

The report combines historical data from RMI’s Utility Transition Hub with IRP data manually collected by EQ Research. The 130 IRPs reviewed would cover approximately 48% of U.S. electricity deliveries.