[EDITOR’S NOTE: A previous version of this story’s headline incorrectly said that $3.8 billion had been trimmed.]

LITTLE ROCK, Ark. — It took six votes during more than four hours of discussion — over the course of two days of meetings — before SPP stakeholders endorsed the 2025 10-year transmission plan and some of its proposed 765-kV lines, trimming about $2.5 billion in costs from the portfolio.

Members of the Markets and Operations Policy Committee on Oct. 13 first rejected their own proposal to defer the three southern legs of a proposed 765-kV overlay that would have shaved $3.83 billion in costs off the portfolio. They then shot down a motion to endorse the plan and the assessment report as modified by two stakeholder groups.

Neither motion received more than 57.5% approval, far short of MOPC’s 66.7% threshold.

After a night’s rest, SPP staff regrouped Oct. 14 during MOPC’s second day with three new proposals. They asked members to endorse:

-

- the 2025 Integrated Transmission Planning assessment report as having been completed according to the tariff;

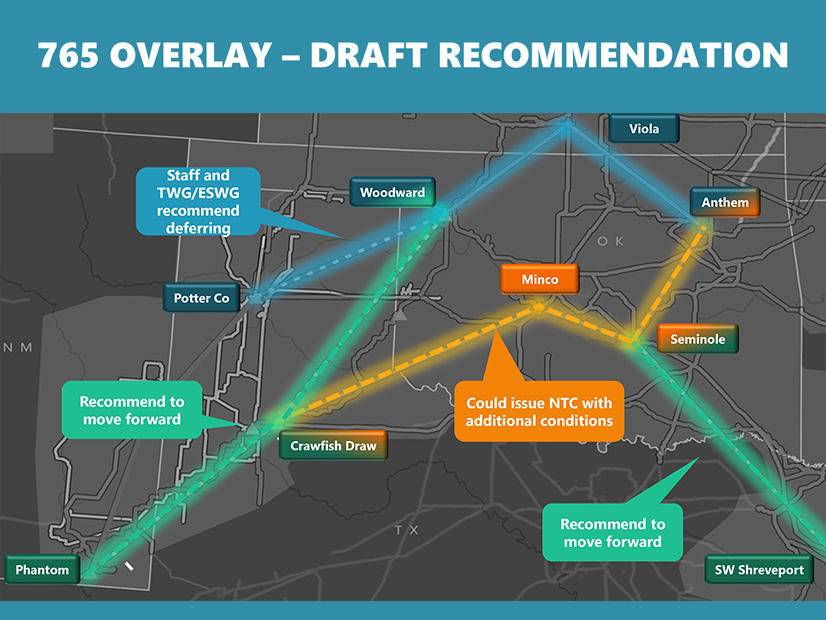

- construction permits for the report’s 345-kV projects and three 765-kV reliability projects on the eastern and western legs of the RTO’s southern extra-high-voltage overlay; and

- permits for the three 765-kV economic projects looping the overlay’s two legs together. The Crawfish Draw-Minco-Seminole-Anthem segments total about 515 miles and are estimated to cost $3.83 billion.

Referring the previous days’ voting “failures,” Casey Cathey, SPP vice president of engineering, asked MOPC for a “more clear and granular” direction for the Board of Directors to better prepare it for its consideration of the ITP when it meets in November.

Staff have been studying about $18 billion in transmission projects as part of the 2025 assessment. The grid operator has proposed deferring $7 billion in 765-kV projects, reducing the portfolio to $11.16 billion for up to 50 construction permits to meet reliability and short-term needs. It has projected benefit-cost ratios of between 10:1 and 15:1. (See SPP Wants to Defer $7B in 765-kV Projects to 2026.)

Cathey reiterated the RTO’s cost-control measures and outlined several recent and in-flight tariff changes that improve the SPP’s cost-estimate process. He said the 2025 ITP’s 765-kV economic projects will have more control measures and conditions, including alignment with the 2026 ITP 765-kV overlay.

The grid operator was stung recently when cost estimates for its first 765 project, Southwest Public Service’s 345-mile Potter-Crossroads-Phantom transmission line that was part of the 2024 ITP, more than doubled from $1.69 billion to $3.62 billion. It took several more months of meetings for SPP to secure the project’s approval after SPS staff refined the RTO’s project projections. (See SPP Board Approves 765-kV Project’s Increased Cost.)

“We just went through that with the Potter-to-Crossroads-to-Phantom facility, so everybody has kind of a clear understanding of how that might work,” Cathey said, calling it a “good example” of SPP’s existing cost-control measures. “That project obviously came in higher for a number of reasons, but it also helped from benefits, cost-ratio and reliability needs perspective.”

MOPC members provided the “granular” feedback with their concerns on affordability, cost allocations, inequitable benefits and uncertainty about moving too fast or whether load growth slows. They questioned staff about the lack of analysis in the two motions to approve transmission projects and raised concerns about reliability concerns when 765-kV projects are set aside.

NextEra Energy Resources’ Jeff Wells objected to voting on separate construction permits rather than the entire portfolio.

“It was designed as a whole. It was studied as a whole, a complete portfolio. It works in concert,” he said. “Piecemealing it apart, simply because maybe we don’t like the designation, potentially, of reliability or economic [projects] … when you piecemeal that, you run the risk of losing the benefit that the portfolio has as a whole.”

“SPP has a really tremendous opportunity for growth with the industrial and technological developments that we’re seeing in this country; load growth as a result is also predicted to be tremendous,” said Jennifer Solomon, also with NextEra. “If we don’t build this portfolio as a whole, the development may not come, because what we’re seeing is that there may not be room for it. MISO, ERCOT and PJM are all moving aggressively forward with 765-kV lines just to keep up with the loads that they’re seeing.”

MOPC easily endorsed the first two motions. However, the motion to endorse the three 765-kV economic lines fell woefully short at 43.8% approval.

As staff mulled next steps, Director Steve Wright weighed in. He pushed for compromise among stakeholders and called for a better understanding of mitigating risks with large transmission facilities.

“One of the things that’s been ingrained in me in the three years on the board is it’s a hallmark of the board that we really want a high level of consensus,” he said. “We don’t have it here. The question is, what’s going to happen over the next couple of weeks? I really hope the Members Committee vote [an advisory ballot that precedes board votes] will not be the same vote as what we just had, because that just basically punts the issue to the board and is something that clearly there’s not much agreement around.”

American Electric Power’s Richard Ross echoed Wright in calling for a separate vote on the Seminole-Anthem portion of the 765-kV southern loop in the utility’s eastern Oklahoma service territory. The project is fast becoming a reliability project, Ross said, with 2.5 GW of load added to transmission service agreements after the 2025 ITP models were locked.

“That further solidifies that this will be a reliability project in the 2026 ITP,” Cathey said.

“I don’t want us to get away from this meeting without addressing that issue and mitigating the risk that we delay beginning work on that project as soon as possible,” Ross said, “begging” for one more vote “so that that message is clear to the board that we as a group agreed on moving forward with that particular project.”

MOPC endorsed the project’s approval and its projected $1.2 billion price tag, giving it 72.5% approval. Transmission owners voted 11-6 in favor, with one abstention, while transmission users approved the motion 45-11, with eight abstentions.

The committee’s actions reduce the 2025 ITP’s costs to $8.7 billion, SPP said. That still exceeds the record 2024 assessment, which approved permits for more than $7.6 billion in projects. (See SPP Stakeholders Endorse Record $7.65B Tx Plan.)

SPP COO Antoine Lucas promised staff will provide more information on cost-containment measures and risk mitigation as staff takes the ITP before state commissioners and the board, saying he understood the concerns being expressed. He said staff will continue to evaluate the $7 billion in deferred projects as load forecasts continue to evolve.

“This [2025 ITP] comes in the context of increasing strain on the existing transmission network,” he said. “The challenges that we’ve had to interconnect new generation and load without the need for tremendous new upgrade costs is a pretty good signal that the transmission system is at its limits. What we see every day in our [markets] is increasing levels of congestion, another very clear metric of very limited and — in some areas and cases — insufficient transmission.”

Staff have scheduled an education session for the Regional State Committee on Oct. 24. The state commissioners do not have any say over the ITP, but Cathey said the RTO will use the session to support any regulatory concerns or necessary additional policy.

The board will take up the package during its Nov. 4 quarterly meeting in Little Rock.