Presenters at NYISO’s 2025 Fall Economic Conference painted a confusing portrait: Conflicting evidence between a weak labor market and overall economic growth leaves uncertainty about whether the economy might tip into a recession.

“I could have just presented a ‘shrug’ emoji and just left for the next few hours. But I feel like that probably would not have been that enlightening,” said Adam Kamins, senior director of Moody’s Analytics. “Instead, we’ll try to walk through all the different sources of uncertainty.”

NYISO engages Moody’s Analytics to present on state and federal economic trends twice a year as part of the Load Forecasting Task Force. Economic outlook is a major component of load growth.

In the Oct. 23 presentation, Kamins showed an index of employment gains across 260 industries from the Bureau of Labor Statistics. Over the previous six months, the balance of industries adding vs. shedding jobs tipped in favor of shedding. Monthly growth in non-farm payroll has flattened, according to the BLS.

Another point of concern in the labor market is the sharp decline in immigration due to a Biden executive order in June 2024 capping asylum requests. That was followed by President Donald Trump’s dramatic increase in immigration enforcement actions and deportations. This has led the foreign-born share of the labor force to contract.

“We are seeing hiring at very, very low levels,” said Kamins. “The way firms are hiring is consistent with the kind of thing you would see during a recession.”

Firms are “just sitting tight” on their workforces, said Kamins. Companies are waiting to see where the economy is going.

A stakeholder asked whether Kamins and other economists had considered the “integrity” of data coming out of the Trump administration. Kamins pointed at the firing of BLS head Erika McEntarfer in June when the jobs data were not to Trump’s liking. While the BLS largely was staffed by “apolitical civil servants,” Kamins explained, if the administration puts political actors in charge of the bureau, that could damage the credibility of BLS data.

“We’ve started to think about what other ways can we verify the data we’re getting from the BLS,” Kamins said. While he wasn’t as worried about the BLS as he is about the Federal Reserve, Moody’s is taking steps to confirm government figures. “We’ve done some of the work to create our own indexes of other sources out there. Bottom line, yes, it’s a concern.”

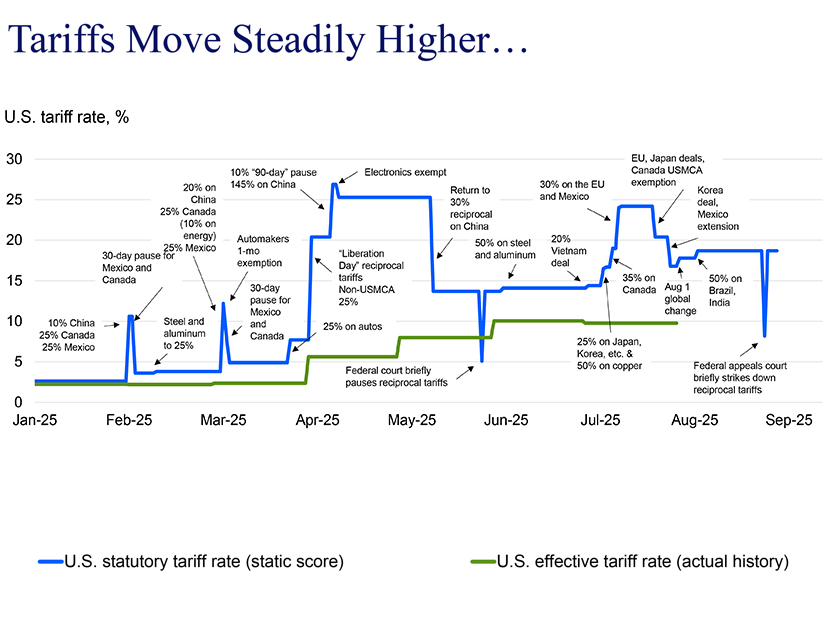

Later in the presentation, Kamins showed a timeline of the effective U.S. tariff rates and the statutory increases that have bounced around since Trump took office. He said the effective U.S. tariff rate was higher than it had been since 1920. A survey from the Federal Reserve Bank of Dallas found that more than 75% of manufacturers intended to pass on tariff costs to consumers, and 50% said they were absorbing costs internally.

“There are some that are doing both,” said Kamins. “There was a lot of action to make the impact of tariffs not necessarily that evident to consumers.”

Eventually, this would increase costs across the economy, which in turn would create inflationary pressure, Kamins explained. Tools and hardware, vehicles, bicycles, jewelry, meat, poultry and fish are places where you can find evidence of tariff-based price increases.

This increased price pressure makes it difficult for the Federal Reserve to balance its targets in the job market and inflation. Kamins added this is even more difficult because of the administration’s erosion of Fed independence.

“Any day now there’s going to be a nominee for who will be the next Fed chair,” Kamins said. “I think that will be a very telling indicator of where things are headed. Whether there’s going to be a political operative or if it’s someone who is generally respected in the economics community.”

New York’s Resilient Economy

While the nation might be experiencing an overall decline in job growth, New York’s labor market is healthier, Kamins said. The labor market is anchored by hiring in state government, health care, education and construction. New York’s consumer sentiment is higher than the U.S. average, meaning that people feel better about the economy in New York than elsewhere.

Several metro areas in New York are experiencing economic expansion, particularly Albany, Kingston and Rochester. The upstate city of Glens Falls is a trouble spot. Kamins said it was more reliant on Canadian tourism than other areas of the state and likely already is in recession.

Some of this growth is from the state’s lack of reliance on federal money. According to the state comptroller, New York historically has been one of the few states to put more money back into the federal government than it receives. As of the most recent report, New York had not fully returned to this pre-pandemic norm, but it was getting close.

“It’s a bit of a good-news, bad-news situation,” said Kamins. “The good news is that New York is not as dependent on federal government expenditures as some of its peers. … The bad news is that by no means is New York immune from potential cuts.”

Kamins said New York faced the most risk from federal funding cuts through programs like Medicaid. New York and Minnesota were the only two states that signed a provision of the Affordable Care Act, the Basic Health Program, to create a state-administered public option. If that were cut, New York would get hit harder than most other states.

New York also is heavily dependent on microchip fabrication for its upstate economic outlook. Without the impact of the new Micron chip fabrication center, upstate economic outlook looks much bleaker.

Housing prices have begun to level off statewide as more supply comes onto the market. Prices are high, and that likely will drive office-to-apartment conversions in markets like New York City. Supply-constrained areas like Rochester and Monroe County have seen supply gains more rapidly than other areas of the state.