During Southern Co.’s quarterly earnings call Oct. 30, CEO Chris Womack assured investors the company “continues to perform exceptionally well [with] an incredibly bright future ahead.”

Southern’s net income for the third quarter stood at $1.71 billion ($1.55/share), up from $1.54 billion ($1.40/share) in the same period in 2024. Year-to-date income was $3.93 billion ($3.56/share), up from $3.87 billion ($3.53/share) in the same period the year before.

Operating revenue for the quarter came to $7.82 billion, a $549 million increase from the third quarter of 2024, while year-to-date revenue also rose by $2.19 billion over the same period in 2024, to $22.57 billion. Operating expenses for the third quarter rose to $5.23 billion from $4.91 billion for the third quarter of 2024, and from $14.37 billion to $16.2 billion year-to-date.

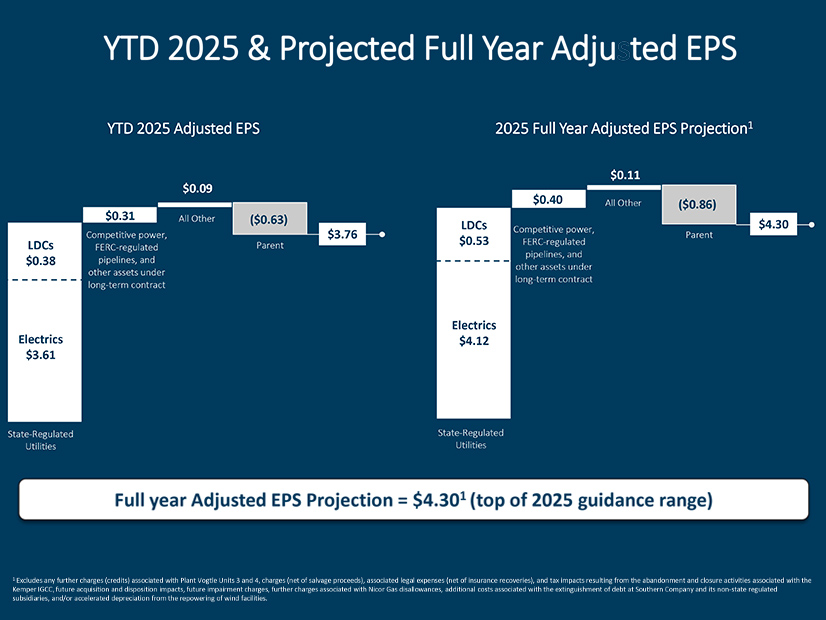

Adjusted earnings per share came to $1.60, CFO David Poroch said, 17 cents higher than the same period last year and 10 cents above the company’s estimate. He attributed the growth to investment in state-regulated utilities and increased usage by customers, offset by milder-than-expected weather, higher depreciation and amortization, and higher interest costs. Southern predicts adjusted earnings per share of 54 cents for the fourth quarter and $4.30 for the full year.

Weather-normal retail electricity sales were up 1.8% from the first three quarters of 2024, Poroch said, on track for the highest annual increase since 2010 excluding the COVID-19 pandemic. The biggest change was in commercial customers, which grew 2.6%. Next came the industrial sector with 1.6% growth, and then residential with 1.2%. Sales to other sectors fell 2.5%.

For the third quarter alone, total weather-adjusted retail electricity sales grew 2.6%, again led by the commercial sector with growth of 3.5%. Residential sales were up 2.7%, while industrial sales rose 1.5% and others grew 1.9%.

Poroch attributed the growth in the commercial sector to increased sales to existing and new customers, including a 17% increase in electricity usage by data centers from the previous year. Overall economic growth across the company’s service territory “remains robust,” Poroch said, citing announcements in the third quarter by 22 companies to either establish or expand operations in the Southeast, resulting in an expected 5,000 new jobs and capital investments of about $2.8 billion.

Womack said the company has “made great progress with signing new large-load contracts,” with 23 projects totaling 7 GW of demand having already broken ground with construction expected to conclude by 2029. Additional contracted projects are expected to bring this total to 8 GW by the mid-2030s, Poroch said.

Southern is working to build the generation capacity to meet this demand, Womack added, pointing to the ongoing construction of natural gas and battery storage facilities in Georgia and Alabama totaling about 2.5 GW and expected to come online over the next two years.

Reviewing Southern’s financing activities, Poroch said the company issued $4 billion in long-term debt across its subsidiaries, crediting “the quality and credit strength” of the company for drawing “robust investor interest,” which in turn will lead to lower interest costs and long-term benefits to customers. He said the debt issues, combined with those of the first half of the year, “fully satisfied” each subsidiary’s long-term debt financing needs for 2025.

Southern has raised about $7 billion of the $9 billion in equity needed to fund its long-term $76 billion capital investment plan, with $1.8 billion of that total raised since the company’s July earnings call, Poroch said. (See Southern Expects Large Load Growth to Continue.)

Asked about his reaction to the federal government’s recently announced agreement with Westinghouse to build at least $80 billion of the company’s nuclear reactors nationwide, Womack said he was “incredibly excited” about the news and that the commitment represents an important step toward meeting the country’s growing electricity demand. (See U.S., Westinghouse Partner for $80B in Nuclear Construction.)

However, he said the company had not made any decisions about pursuing new nuclear construction after the completion of Plant Vogtle Units 3 and 4 in Georgia, the first new nuclear plants in a generation whose construction ran years behind schedule and vastly over budget.

“We want to make sure that all risks are mitigated before we make that kind of decision,” Womack said. “I’m excited about all the activity that’s occurring around the country with considerations about new nuclear, [and] we’re going to continue to work with the administration [and] other government agencies to talk about the … role that new nuclear can play in meeting this growing demand, but … we’re not in a position to make that decision at this point.”