ISO-NE’s probabilistic modeling indicates there is minimal risk of shortfall in the upcoming winter, COO Vamsi Chadalavada told the NEPOOL Participants Committee on Nov. 6.

The risk levels identified by ISO-NE’s Probabilistic Energy Adequacy Tool are well below the duration and magnitude metrics recently established by the RTO in its Regional Energy Shortfall Threshold (REST). (See ISO-NE Proceeding with Shortfall Threshold After Positive Feedback.)

The REST shortfall metrics are calculated based on the 0.25%, 21-day model cases with the greatest shortfall risk. These extreme model cases averaged a 0.1% shortfall magnitude and a 0.7-hour shortfall duration for the upcoming winter, well shy of the 3% magnitude and 18-hours criteria that would need to be exceeded to violate the REST.

Chadalavada said ISO-NE is confident it can maintain grid reliability even in the worst-case scenarios.

“The worst-case 21-day energy shortfall quantities result from a low probability combination of several uncertainties,” including low LNG and fuel oil inventories, low import levels and high levels of unexpected outages, Chadalavada said.

“In the worst cases, energy shortfall begins on Day 14 or later, thus allowing time for additional actions,” he said. “ISO expects that in the event of a forecasted energy shortfall, market-based incentives will encourage relief in the form of market response, including additional fuel replenishment.”

If ISO-NE’s 21-day forecast indicates a shortfall is likely, the RTO would have access to other emergency measures, including limiting exports, scheduling imports, seeking waivers to air permit limits and conservation appeals, he said.

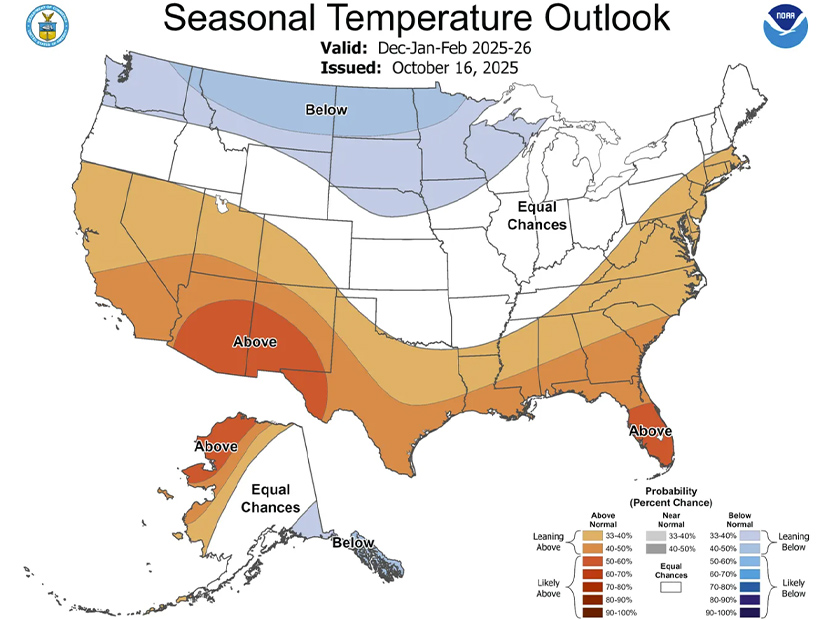

Seasonal weather forecasting shows a 33 to 40% probability of above-average temperatures for southern New England, and equal changes for above average and below average temperatures in northern New England, Chadalavada said.

He said ISO-NE anticipates the tanks at the Saint John LNG terminal being full, and he added that generators with large fuel oil storage capabilities have indicated “that pre-winter replenishment is underway and supply chains are expected to be strong with adequate supply available.”

Operations Report

Energy market value totaled $429 million in October, up significantly from $350 million in October 2024, ISO-NE reported. Ancillary market value totaled nearly $17 million, more than double the $8 million total in the prior October.

ISO-NE recorded its first monthly net export in 13 years in October, Chadalavada noted.

The low import levels appear to be driven by continued drought conditions and low reservoir levels in Québec and also may be affected by Hydro-Québec’s looming baseload export commitments associated with the New England Clean Energy Connect and Champlain Hudson Power Express transmission projects.

Hydro-Québec has said it is managing its reservoir levels to ensure it will have enough power to meet these commitments. ISO-NE expects NECEC to be in service this upcoming winter. (See Drought, Climate Drive Uncertainty on New England Imports from Québec.)