EDITOR’S NOTE: CAISO’s EDAM will go live in May 2026 for PacifiCorp and in the fall of 2026 for Portland General Electric.The original version of this story incorrectly reported the go live date for PGE.

TEMPE, Ariz. — This is the easy part, says Scott Miller, executive director of the Western Interconnection’s competitive market advocate, Western Power Trading Forum.

Indeed. Members of SPP’s Markets+ Participant Executive Committee unanimously endorsed every proposed tariff and protocol revision, with the occasional abstention here or there, during their Nov. 13 meeting. They agreed — again, unanimously — to retain the stakeholder group’s leadership for additional two-year terms during the day-ahead market’s implementation phase.

Nary was a discouraging word heard.

“We’re getting to the nub of things, but people are understanding them and digesting them,” Miller told RTO Insider after the meeting. “They’re getting used to the process, and this is obviously a lot of detail that people were dealing with. It still is a collegial group. It’s come a long way since it first started two years ago.”

Miller has seen these conversations and debates before. He said he saw firsthand the difficulties CAISO ran into as it drafted and filed its implementation tariff for its Extended Day-Ahead Market.

“There will obviously be harder issues as they get closer to the go-live date,” he said. “When you start getting into implementing tariffs and things like that, that’s where difficulties and disagreements and things pop up that people didn’t realize were there. I think we’ll find some things that will surprise us when the implementation tariffs for Markets+ get filed.”

Miller speaks from experience: He helped lead PJM’s market development in the early 2000s and later spent nine years at FERC advising commissioners and staff on electric and natural gas markets.

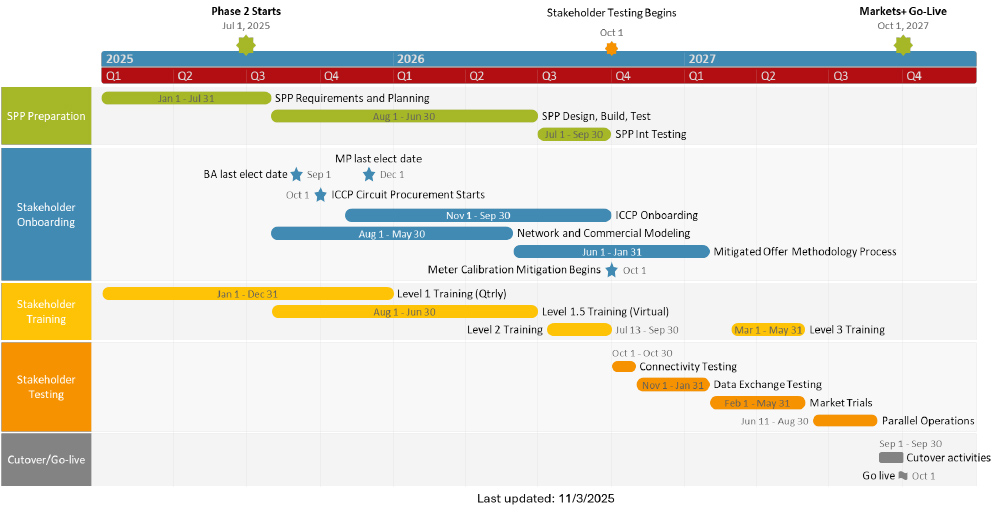

He said he’s not concerned about Markets+’ sometimes-languid pace of development. With a targeted go-live date of Oct. 1, 2027, SPP already is at least 16 months behind CAISO’s EDAM. That market is to go live in May 2026 for PacifiCorp and in the fall for Portland General Electric, with others following in later months.

“It’s a considered pace,” Miller said, noting that Western entities have never dealt with tariffs and organized markets until recently.

“The differences between market participants will begin to show themselves once you get into actual market operations, but for now, everybody’s pulling on the same oar,” he said. “People are taking things very seriously. Protocols associated with tariffs require a lot of attention.”

One complication is that SPP and CAISO are both relying on the West’s 37 existing balancing authorities, rather than a consolidating BA as grid operators normally do. Transmission operations will remain with their control areas, and SPP will clear units, but the BAs will still be responsible for dispatch.

“For reasons that still escape me, you’re taking a step toward something like an RTO but making it very complex by the fact that you maintain balancing areas and tariffs that don’t exist in RTOs,” Miller said. “It’s a step toward an RTO, but it’s much more complex than an RTO.”

MPEC members were unable to agree on whether to hire an external market design adviser and tabled the issue a second time. It will remain tabled until “interested parties” submit a proposal with specific issues for the committee’s consideration.

An SPP survey of MPEC’s 41 members found only minimal support, 17-16, to engage an external consultant or adviser during the market implementation’s early stages, given its “new design approach.” Those voting against the proposal said they saw little benefit for the expense.

Western Resource Advocates (WRA) proposed the position in 2023, and SPP began working on a plan and structure for the adviser in early 2024 before it was tabled the first time later that year. Staff have suggested the position report to SPP.

WRA saw the position as possibly filling a market monitoring role, but SPP in September brought on Tim Vigil to lead the 16-person Markets+ Market Monitoring Unit that will identify market design flaws and ensure compliance with market rules. Vigil was previously chief member relations and strategy officer for the Pacific Northwest Generating Cooperative and also spent time with the Western Area Power Administration. (See SPP Names Director to Lead Markets+ Monitoring.)

Vigil stressed the MMU’s independence in introducing himself to the MPEC.

“The independence allows us to be objective [and] impartial while we’re monitoring the market, investigating potential problems and protecting the market to ensure workable competition,” he said. “It just puts us in a place to accomplish these things without any undue influence.

“The MMU is committed to be transparent … with FERC, SPP and all the stakeholders that are sitting here today,” Vigil added. “Our obligation is to inform FERC of any proposed tariff changes with something that we identify that we’d like to see. We’re not trying to surprise anybody.”

The Markets+ MMU will be separate from the SPP MMU. The Western monitor will increase the MMU’s total staff from 23 to 38.

Readiness Activities Progressing

Kevin Morelock, an SPP Markets+ program manager, said stakeholders’ decision to run the market in the Pacific Time Zone has created issues as the grid operator tries to save on infrastructure costs.

The RTO’s Integrated Marketplace in the Eastern Interconnection uses the Central Time Zone for its operating day procedures.

“It’s causing some complexity with our design and being able to operate both in a CT time zone for the RTO and Integrated Marketplace and then PT for Markets+,” he said, citing the challenge of modeling both markets at the same time and the boundaries between monthly releases.

Still, Morelock said the program implementation’s design phase is on track. Staff have refined the timeline, work plan and operating time zone effects to downstream SPP systems, and an internal strike team has been assembled to mitigate issues and risks.

Chief among the risks are staffing and registration delays, Morelock said. The grid operator had hired 42 of 47 full-time-equivalent employees through September. It expects hiring to pick up in January and eventually reach a target of 206 FTEs in June 2027.

The RTO has completed 52 of 60 market registrations for BAs and non-BA transmission providers. Entities desiring to register as market participants face a Dec. 1 deadline, but Morelock said staff may adjust the schedule to ensure it doesn’t miss embedded entities or transmission customers of the BAs or transmission providers.

“We’re really continuing to ask MPs to come forward and declare their interest in joining Markets+ for those entities that are transmission customers or embedded entities,” he told MPEC.

The program is operating under its budget through September, Morelock said, and is on pace to meet its forecast $149.7 million total. That includes almost $10 million in financing charges.

The Markets+ Design Working Group is leading a holistic review of the protocols — including checking for alignment with the Markets+ tariff, improving readability and adding late changes — working with stakeholders first. The group plans to bring the finished product to a Dec. 18 MPEC conference call for its approval.

MSC to Gear up Involvement

Idaho Public Utilities Commissioner John R. Hammond Jr. stood in for Arizona Corporation Commission Vice Chair Nick Myers, chair of the Markets+ State Committee, and told MPEC members that state commissioners will participate in and monitor the stakeholder groups as the market’s development phase moves forward.

Much of the MSC’s focus will be on the tariff’s development, implementation effort, revision request process, seams issues and interchange transactions, he said.

Hammond, the MSC’s vice chair, said the increasing load growth across all states has been “truly amazing.”

“There are commonalities between all the jurisdictions, and there are differences,” he said. “Working together, we can really make a big difference for this country.”

The Western Interstate Energy Board’s (WIEB) staff, which provide independent staffing for the MSC and offer analysis on the market’s development and operations, told MPEC the committee’s 2026 budget will increase when it aligns with the standard fiscal cycle.

Lisa Brohaugh, WIEB’s director of finance and administration, said the MSC’s budget will grow to $437,923, up 12.4% from the 2025 budget of $389,680, which covered just nine months. Brohaugh noted that the previous budget of contractual expenses covered the last nine months of 2025.

The Interim Markets+ Independent Panel, composed of three SPP independent directors, will consider the budget when it next meets. SPP will then allocate the budget’s costs to Markets+ participants.

Trolese, Walter to Again Lead MPEC

MPEC members accepted staff’s nominations of The Energy Agency’s Laura Trolese and Arizona Public Service’s Kent Walter to serve additional two-year terms as the committee’s chair and vice chair, respectively.

“Their leadership has been excellent so far,” SPP’s Kelli Schermerhorn said.

The MPEC will also retain the leadership of its four key working groups after the incumbent chairs were all nominated for additional terms: Nick Detmer (Markets+ Design WG) and Joe Taylor (Markets+ Transmission WG), both with Xcel Energy subsidiary Public Service Company of Colorado; Tuuli Hakala (Markets+ Seam WG), Chelan County Public Utility District; and Libby Kirby (Markets+ Operations & Reliability WG), Bonneville Power Administration.

MPEC’s approval of the consent agenda added Chelan PUD’s Peter Graf to a vacant public power seat on the MORWG; Tri-State Generation and Transmission Association’s Kyle Cunningham to an open public power seat on the MSWG; and Black Hills Energy’s Raena Orr to an available investor-owned utility seat on the MDWG.

The consent agenda also included a scope change for the MORWG, clarifying its responsibility to provide guidance on reliability functions and not just balancing authorities.

SPP Schedules Seams Symposium

SPP has scheduled a Western Seams Symposium for Feb. 26 that follows the MPEC’s next in-person meeting.

The final details are still being worked out, but staff have invited representatives from other grid operators as part of a broader regional discussion of the boundaries between entities.

SPP has touted its seams management experience with its MISO and ERCOT neighbors as preparing it for Western operations, where the markets have been placed on top of the seams between BAs and transmission providers. (See SPP’s Experience with Seams Could Help Markets+.)

The symposium will be held at the Salt River Project’s PERA Training & Conference Center in Tempe. In-person registration closes Feb. 19.