IESO is proposing rule changes to eliminate unwarranted make-whole payments (MWPs) to operating reserve (OR) providers under Ontario’s nearly eight-month-old Market Renewal Program.

“These are very specific and limited circumstances and only became apparent after the Renewed Market ‘go-live’ and relate to the interaction between payments for energy and operating reserve,” the ISO said at an engagement session Nov. 21.

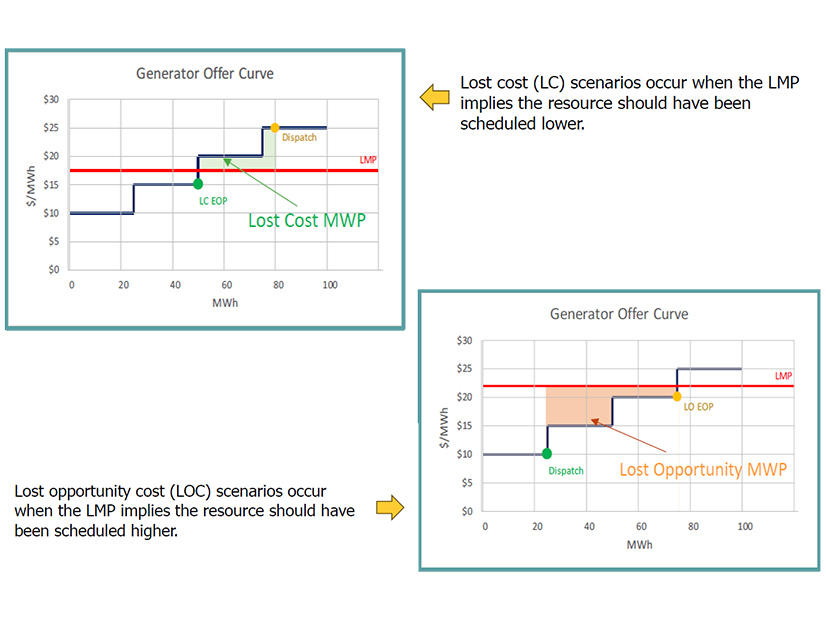

MWPs are intended to incentivize market participants to follow their schedules by compensating a resource for the financial difference between its actual dispatch and what it would have been based on its offer curves and LMPs.

Although improved alignment between schedules and LMPs under the new market has reduced the need for MWPs, they still are needed because of manual out-of-market actions taken for reliability and differences between scheduling passes and pricing passes.

Real-time MWPs should represent a resource’s physical capabilities and are calculated considering co-optimization of energy and OR. IESO calculates payments for lost costs and lost opportunity costs (LOCs) based on economic operating points (EOPs), which reflect the output a resource could have achieved based on its physical capabilities and LMP, under actual market conditions.

EOPs are based on offers and bids, resource-specific characteristics and LMPs. Lost cost scenarios occur when the LMP indicates a resource should have been scheduled lower.

The Renewed Market, which launched May 1, created a financially binding day-ahead market (DAM) and about 1,000 generation, load and intertie pricing nodes to replace its provincewide price. (See Ontario Nodal Market Nearing ‘Steady State’ After Nearly 4 Months.)

Hok Ng, IESO’s senior manager of market development, identified three types of inappropriate real-time make-whole payments:

EOPs and ‘Forbidden Regions’

Some hydro generators have “forbidden regions” in which they cannot maintain steady operation without damaging their equipment and thus must ramp through.

Although the forbidden regions are considered in dispatch schedules, they are not reflected in determining the EOPs on which MWPs are based.

The energy market accounts for cases in which EOPs are physically unattainable with a settlement process that subtracts the portion of the MWP resulting from an energy schedule in a forbidden region or at the upper boundary.

IESO’s proposed rule change (MR Ch.0.9 Section 3.5.6) would add a similar adjustment for OR MWP calculations.

OR Ramping in LOC EOP Calculations

An inconsistency between OR ramp constraints in the dispatch scheduling optimizer and EOP calculation engine is overstating EOPs beyond what resources can physically perform, resulting in unwarranted MWPs.

The EOP calculation engine is missing constraints containing the interval-to-interval energy ramp impact on available OR ramp.

IESO’s proposed revision would add equations including the interval-to-interval change in energy to the LOC EOP OR calculations (MR Ch.0.7 App. 7.8).

MWPs not Offsetting Energy and OR Products

Make-whole payments are intended to keep a resource whole for following dispatch instructions that are co-optimized across energy and reserve products, such as 10-minute spin, 10-minute non-spin and 30-minute reserves.

But the current LOC MWP settlement is ignoring profits realized for the same capacity in the market, resulting in market participants being paid twice for the same megawatts.

The proposed Market Rule Amendment (MR Ch.0.9 Section 3.5) and Market Manual changes (MM 0.5.5 Section 2.7) will clarify how the offsetting should be calculated.

Next Steps

IESO requests comments on the Adjustments to RT MWP engagement by Dec. 1 via its feedback form. The ISO will respond to feedback and present a red-lined draft of the market rule amendments on Dec. 16.

IESO’s Technical Panel will conduct an education session on the changes on Dec. 2 with a vote to recommend to the IESO board scheduled for Feb. 10, 2026.

Implementation is planned for April 2026.