With support from the Trump administration and demand from data centers, 2025 and now 2026 are high times for the U.S. natural gas sector.

But the picture is not uniformly rosy: Large gas turbines are hard to come by and increasingly expensive, gas transmission pipelines are constrained in some regions, and rising LNG exports further weld the U.S. market to global price volatility.

Natural gas accounted for 43.4% of U.S. utility-scale generation in 2024, more than nuclear (18%) and renewables (17%) combined, according to the U.S. Energy Information Administration. Net generation from natural gas was 3.5% higher in 2024 than 2023, while renewables jumped 12.8% and nuclear held steady.

Renewable energy, particularly solar, is likely to carry this momentum well into President Donald Trump’s second term, despite his efforts to boost fossil fuels, but a large pipeline of natural gas projects awaits.

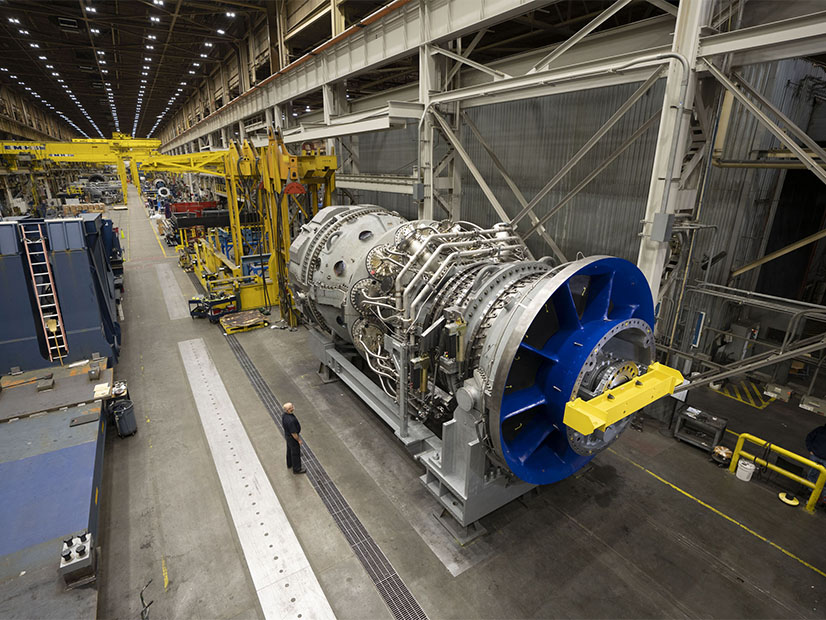

GE Vernova, which claims the title of world’s largest gas turbine manufacturer and supplier, said in early December it would end 2025 with a backlog of 80 GW of orders and manufacturing slot reservations — and need until the end of 2028 to fulfill it. The company has been raising its prices as well — CEO Scott Strazik said in October that a new combined-cycle gas plant now runs in the range of $2,500/kW of capacity.

Two large competitors, Siemens Energy and Mitsubishi Heavy Industries, report similarly strong order books.

“We continue to see high demand for gas turbines particularly in the U.S., where new electricity demand from the data center buildout and other factors are driving capital expenditures at our utility customers,” Mitsubishi CFO Hiroshi Nishio said in November.

Siemens Energy said in November it closed its 2025 fiscal year with a $162 billion backlog and with a 43% increase in transactions for its gas services division, which sold 194 gas turbines.

Natural gas-fired generation has had its ups and downs. It replaced coal as the dominant U.S. power generation fuel when advances in hydrofracking techniques made the nation the world’s leading natural gas producer.

Federal priorities quickly swung toward renewables under President Joe Biden, then swing back even more suddenly under President Donald Trump.

Natural gas-fired generation capacity will grow, Brattle Group principal Samuel Newell told RTO Insider. But that does not necessarily lock the U.S. into decades of use.

“I think the next several years, the demand growth is such that the combination of using the existing gas-fired fleet more and new capacity, we’re going to be burning a lot more gas in the next several years,” he said. “But in the long run, if we go in a direction that does take climate change seriously, you’d have to increase non-emitting generation a lot, some combination of renewables and nuclear. [But] the gas-fired is still helpful to have there for reliability reasons.”

The larger problem is that load forecasts are increasing at a rate that outstrips the supply chain’s ability to produce new gas-fired generation, said Newell, who leads more than 50 electricity-focused consultants at Brattle.

“I think we’re in a position where it would really help to have everything,” he said, which is why he expects wind, solar and storage development to continue despite the policy shifts against wind and solar.

The political shifts are not the only influence on energy-sector strategies, but they can be hard to overlook.

Strazik said in December 2024 that GE Vernova had secured 9 GW of turbine manufacturing reservations just in the month after Election Day.

NextEra Energy in February 2023 boasted it was the word’s largest generator of renewable energy from the wind and sun. In January 2025, it emphasized that it had the nation’s largest natural gas fleet and recently had struck a framework agreement with GE Vernova to pair new gas generation with renewables and storage.

NextEra’s December 2025 investor presentation contains more than 200 references to “gas” and boasts of being the quintessential all-forms-of-energy company: Gas-fired generation, nuclear, electric transmission, gas pipelines, storage and renewables, in that order. The December 2023 investor presentation contains only 26 references to “gas,” and 16 of those were buried in the fine-print disclaimers at the end.

So what becomes of all this gas generation demand if the major manufacturers cannot quickly meet it?

In some cases, smaller-scale generation is a solution.

Caterpillar, Cummins, Generac, Rolls Royce, Wartsila and others all are reporting booming demand for their products as standby or prime power for data centers.

GE Vernova does not operate in this space — its offerings start at around 35 MW.

The company says its 35-MW LM2500 aeroderivative gas turbine will consume about 60% more fuel and emit 60% more carbon dioxide per megawatt hour generated than its 7HA.03 heavy duty combined-cycle gas turbine configured in a 2×1 block, while its 90-MW 7E simple-cycle gas turbine’s consumption and emissions are roughly 90% higher.

But a new 7HA.03 is taking about 24 months to reach commercial operation, compared with about six months for the 7E and about six weeks for the LM2500.

Strazik said in December 2025 that GE Vernova is not losing deals to competitors pitching small generation.

However, he said, there are projects that initially will rely on someone else’s reciprocating engine or other small generation as a bridge solution to eventual installation of his company’s heavy-duty turbines.

“But I don’t really cry in my beer over that because it’s enabling the heavy-duty to get done later,” Strazik said.