PJM‘s 2026 load forecast has decreased the amount of growth expected for the following six years owing to a more pessimistic view of the volume of large loads, economic growth and electric vehicles.

The forecast continues to expect that load growth will accelerate over the 20-year scope, with load reaching 253 GW in 2046.

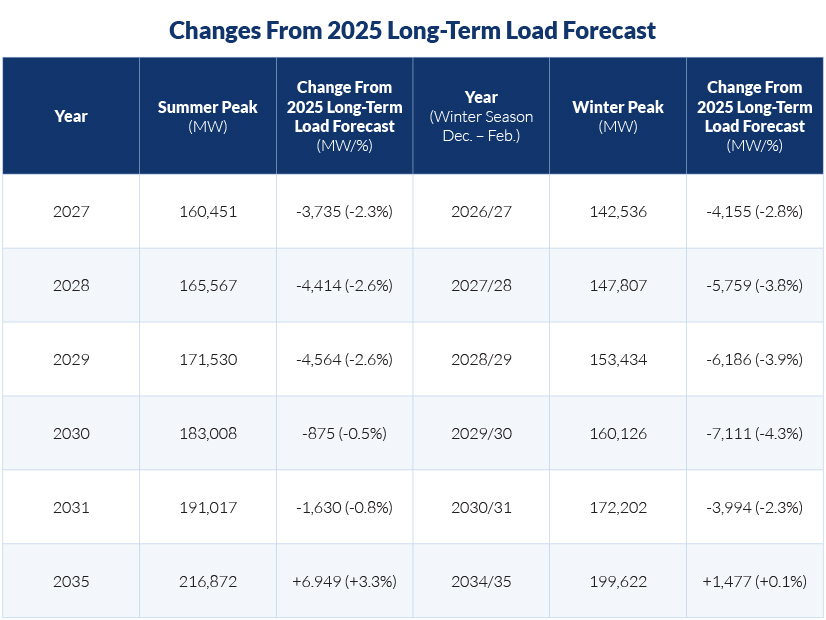

Load growth still is expected in the near term, just slower — particularly in the winter. For the summer of 2028, the total load expected is 2.6%, or 4.4 GW, lower than the 2025 forecast; for the following winter, the estimates are 3.8%, or 5.8 GW lower. Between 2027 and 2031, the summer peak is expected to grow to 191 GW, up 30 GW. By 2046, the peak is expected to reach 253 GW for the summer and 237 GW in the winter.

PJM said the forecast was likely to cut into the 6.6-GW shortfall in the 2028/29 Base Residual Auction (BRA). While the haircut is not enough to make up the difference, the RTO said it also expects some resources scheduled to deactivate and winter-only resources without an annual commitment to be available. (See PJM Capacity Auction Clears at Max Price, Falls Short of Reliability Requirement.)

Data center load growth has been the primary cause of the growing capacity shortfall and billions of dollars in transmission projects. The Board of Managers is considering a slate of proposals to rework the capacity market to address large loads, as well as an $11 billion Regional Transmission Expansion Plan to increase transfer capability into growing load clusters in Virginia, Pennsylvania and Ohio.