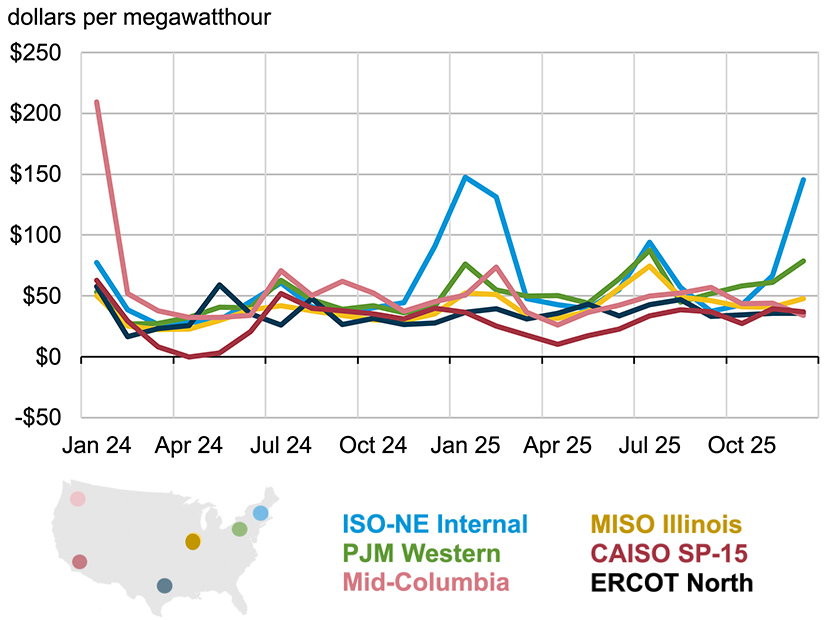

The U.S. Energy Information Administration reported average wholesale day-ahead electricity prices were higher in 2025 than in 2024 at most but not all major trading hubs in the contiguous 48 states.

The largest decrease was $14/MWh at the Mid-Columbia hub in the Northwest. The largest increase was $29/MWh in ISO-NE.

In one of its regular “Today in Energy” posts, EIA said the national average was pushed higher largely by rising prices for natural gas, the leading source by far for U.S. electricity. Average benchmark Henry Hub spot prices were 56% higher in 2025 than the historic low prices seen in 2024.

This contributed to a minor shift in generation away from natural gas: Electricity generation in the 48 states increased 93 BkWh or 2% year over year, despite 2025 being one day shorter than 2024. Natural gas generation decreased 3% (53 BkWh), while coal increased 11% (76 BkWh) and solar jumped 32% (66 BkWh) to make up the difference.

The details of the shift varied by region.

In the PJM and MISO regions, total generation rose 3% (49 BkWh) in 2025 as gas generation decreased by 24 BkWh from 2024 levels, solar increased 24 BkWh and coal increased 49 BkWh.

In Texas, demand increased 5% (22 BkWh) in 2025; the major movers were natural gas (down 6 BkWh) and solar (up 20 BkWh).

In the Northwest, which saw a less severe winter in 2025 than in 2024, total generation decreased 4% (17 BkWh). Natural gas prices reached historic lows in the Northwest in 2025 amid subdued demand and ample supply from Canada, but natural gas generation nonetheless decreased 8 BkWh. Other movers were hydropower (3 BkWh higher), solar (2 BkWh higher) and nuclear (2 BkWh lower, thanks to a 65-day refueling outage).