CAISO on Tuesday released an inaugural draft of its long-term transmission plan, projecting a $30.5 billion need for new high-voltage lines to transport wind power long distances across the West and to carry solar, offshore wind and geothermal power from in-state California generators to urban load pockets.

“Given the lead times needed for these facilities, primarily due to right-of-way acquisition and environmental permitting requirements, the CAISO has found that a longer-term blueprint is essential to chart the transmission planning horizon beyond the conventional 10-year time frame that has been used in the past,” the ISO said in its 20-Year Transmission Outlook.

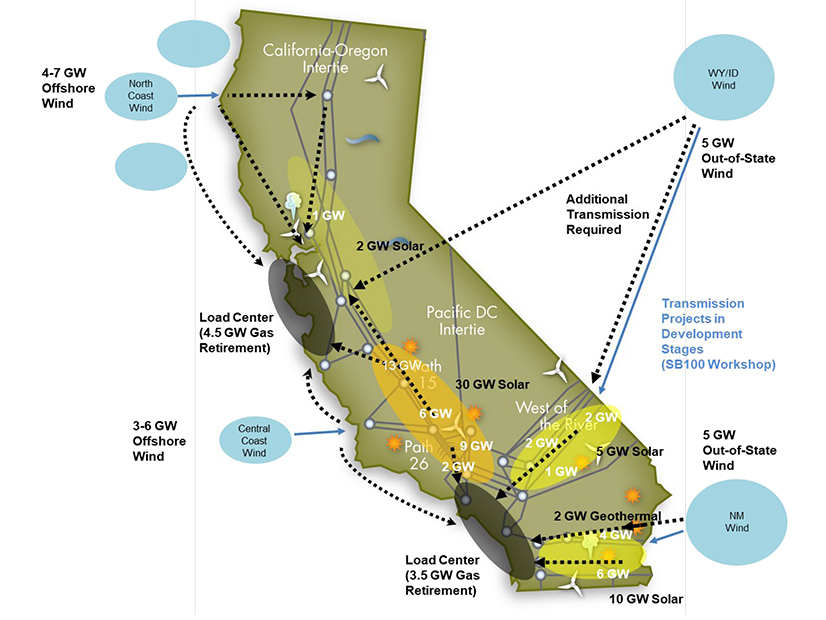

CAISO launched its 20-year planning process in May, saying it was needed to help California meet its mandate to serve all retail customers with carbon-free electricity by 2045, as required by 2018’s Senate Bill 100. The ISO’s 10-year process looks at in-state needs; the long-term process considers transmission required to import wind resources from nearly 1,000 miles away in Wyoming and New Mexico.

“This type of forward-looking planning and coordination is essential to meeting the state’s energy policy goals in a reliable and cost-effective fashion and strengthening interconnections with our partners across the West,” CAISO CEO Elliot Mainzer said in a statement.

CAISO has been working with the California Energy Commission, which forecasts long-term demand, and the California Public Utilities Commission, which orders procurement, “to begin delineating the long-term architecture of the California grid and better align power and transmission planning, resource procurement and interconnection queuing,” Mainzer said.

As its starting point, the 20-year outlook used a joint agency report from March 2021 that predicted California will need to add 120 GW of capacity to reach SB 100’s goals in the next quarter century. That will require tripling its solar and wind resources and achieving an eightfold increase in battery storage, the report said. (See Calif. Must Triple Capacity to Reach 100% Clean Energy.)

At the same time, the state will see a large increase in demand from electrifying the transportation and building sectors and the loss of 15 GW of natural gas generation, it said.

“To meet these needs, the starting point called for 37 GW of battery energy storage, 4 GW of long-duration storage, over 53 GW of utility scale solar, over 2 GW of geothermal and over 24 GW of wind generation — the latter split between out-of-state and in-state resources,” CAISO’s long-term outlook said. “The bulk of the in-state resources consist of offshore wind. These total 120.8 GW.”

CAISO next identified new transmission necessary to connect those resources to its grid.

It said the state needs $30.5 billion in transmission development, including nearly $12 billion for 500-kV AC and HVDC lines to carry 10 GW of out-of-state wind power from the Great Plains and Rocky Mountain states; $11 billion to upgrade CAISO’s system with 230- and 500-kV lines to transport solar and geothermal power; and $8 billion for 500-kV and HVDC lines to carry 7 to 13 GW of offshore wind to major urban areas.

“The 20-Year Outlook provides a baseline to establish expectations for longer-term planning, recognizing that resource planning and procurement decisions will differ over the years ahead from the assumptions used to establish this baseline,” CAISO planners wrote. “Those changes will be managed by adapting future plans around the baseline architecture in subsequent updates and in the CAISO’s annual transmission planning processes that approve and initiate specific projects.”

A stakeholder meeting to discuss the 20-year outlook and the ISO’s latest 10-year plan is scheduled for Feb. 7. CAISO said it expects to continue stakeholder discussions on the long-term outlook throughout 2022.