Dominion Energy (NYSE:D) said Friday the projected cost of its 2.6-GW Coastal Virginia Offshore Wind (CVOW) project has increased by more than 20% to $9.8 billion, citing “commodity and general cost pressures.”

The company announced the projected cost increase on the day it reported a near doubling of third quarter profits and filed a request for approval and certification of the CVOW project with the Virginia State Corporation Commission.

In September 2019 Dominion announced a “pre-engineering” estimated cost of about $8 billion.

“Since that time through the process of detailed engineering and, most importantly, through competitive solicitations for all components and services, we’ve now developed a detailed budget of approximately $10 billion,” CEO Bob Blue told analysts during the third quarter earnings call. “The cost increase can be attributed to, among other things, commodity and general cost pressures — as seems to be the case across a number of industries right now — and the completion of the conceptual design phase for the onshore transmission route.”

Blue said the company has meet the three tests required for Dominion to qualify for cost recovery via a rider on customers’ bills: using competitive procurements; a projected levelized cost of energy (LCOE) below the $125/MWh maximum set in the Virginia Clean Economy Act (VCEA), and a projected start to construction before 2024.

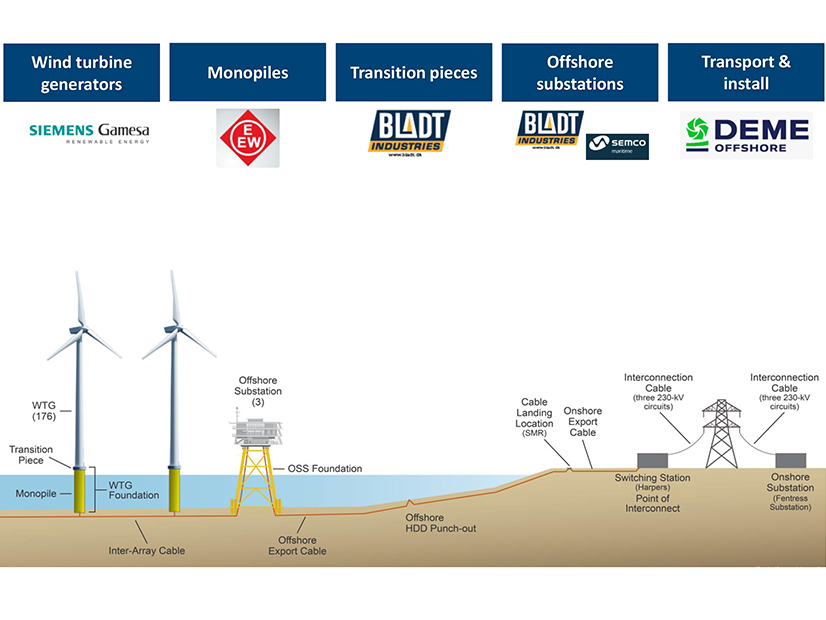

Dominion asked the SCC to classify many of the details of its filing as “extraordinarily sensitive,” citing the commercial value of its negotiated contracts and terms with vendors. The filing includes information on “costs, contractor selection, project components, transmission routing, capacity factors and permitting.”

The company said the filing keeps it on its scheduled timeline to leap from its current two-turbine, 12-MW pilot project in federal waters off Virginia Beach to the planned 2.6 GW wind farm.

Last December, Dominion submitted the plans for the larger project to the Bureau of Ocean Energy Management, which is expected to complete an environmental study and reach a decision by June 2023. The company is also expecting a final order approving the project from the SCC in the third quarter of next year. If all goes as planned, onshore construction will begin in the third quarter of 2023, followed by offshore construction in the second quarter of 2024 with construction finished in late 2026.

The company says the project will create approximately 900 jobs and have $143 million in economic impact annually during construction, increasing to approximately 1,100 jobs and almost $210 million in economic impact annually during its operation. On Oct. 25, Siemens Gamesa held a ceremony at the Portsmouth Marine Terminal celebrating the launch of the first offshore wind turbine OEM blade manufacturing facility in the U.S. The plant’s initial output will go to the Dominion project. (See Virginia Builds out OSW Supply Chain with Turbine Blade Plant.)

News of CVOW’s $1.8 billion cost increase sparked criticism on social media. A ProPublica-Richmond Times-Dispatch investigation last year reported that Dominion lobbied for changes to the VCEA that increased the maximum cost of CVOW from $7.3 to $9.8 billion.

“Dominion lobbyists snuck in an extra $2 billion on the wind cost cap in the VCEA at the last minute. Now all of the sudden their costs include an extra $2 billion…?” tweeted Brennan Gilmore, executive director of Clean Virginia.

“Lo and behold: The ceiling for rate base is the price of the project,” responded former Montana regulator Travis Kavulla, now vice president of regulation for NRG Energy (NYSE:NRG).

Blue said the LCOE of the offshore wind farm is estimated at $87/MWh but could be reduced to $80/MWh if Congress approved proposed OSW tax credits included in the $1.8 trillion spending bill pending before the House. (See related story, Energy Groups Quick to Praise Infrastructure Bill Passage.)

Although construction costs are higher than anticipated, Blue said that — based on data from the pilot turbines — the company now assumes a lifetime capacity factor of 41.5% for CVOW, up from an earlier estimate of 43.3%.

When asked about the potential impact of the Republican victory in last week’s Virginia elections on these plans, Blue said Dominion Energy “has maintained constructive relationships with members of both parties,” and that there is “a bipartisan commitment to jobs and economic growth.” Referring to the Siemens Gamesa announcement, he added: “Both parties deserve credit for that kind of job creation in Tidewater Virginia. We would expect that that’s going to continue going forward.”

Dominion Energy also recently filed a rider with the Virginia SCC that included about 1,000 MW of solar and battery storage, Blue said. The company expects a final order from the agency for this project, with its planned $1.4 billion capital investment, by the second quarter of next year.

Q3 Results

In addition to highlighting its offshore wind and solar projects during the earnings call, Dominion officials said that the utility company is nearing its pre-pandemic normal in electricity sales.

The company expects to see electric sales in its Virginia and South Carolina service territories rise by 1% to 1.5% per year, similar to growth rates before COVID-19 struck, CFO Jim Chapman said.

Dominion Energy reported $654 million ($0.79/share) in net income, nearly double the $356 million ($0.41/share) in the third quarter of 2020.

Chapman said the company expects to grow its earnings per share at a rate of at least 6.5% annually through 2025, thanks to a $32 billion, five-year growth capital plan, more than 80% of which is focused on decarbonization. Going forward, he added, investors should expect to see “compelling earnings and dividend growth combined with the largest regulated decarbonization opportunity in the industry, and an unyielding focus on extending our track record of successful projects, regulatory and financial performance.”

Assuming normal weather for the rest of 2021, the company says, it expects full-year results to be above the $3.85/ share midpoint of its 2021 estimated guidance.

The SCC is due to review a comprehensive settlement agreement in the company’s pending triennial base rate case, now that stakeholders have weighed in. Blue said a decision is expected by the end of the year. If the commission approves it, the agreement will resolve the ongoing review of the company’s earnings over the past four years, while generating $330 million in one-time refunds on customer bills, a $309 million offset as part of the Customer Credit Reinvestment Offset (CCRO) mechanism, and a $50 million rate reduction going forward. The CCRO “offsets the customer bill credit amount that the utility has invested or will invest in new solar or wind generation facilities or electric distribution grid transformation projects for the benefit of customers,” according to Virginia statute.