SPP staff are re-evaluating the level of detail they provide stakeholders for their market-to-market (M2M) activities with MISO.

The reports, intended to be monthly, have left staff playing catchup in recent years. On Thursday they were only able to share with the Seams Advisory Group a summary of May’s M2M activity, which resulted in a $6.3 million settlement in SPP’s favor.

When the group next gathers virtually in September, it will be expecting to hear summaries from June and July. The reports summarize M2M settlements for binding flowgates as a result of redispatch based on the non-monitoring RTO’s market flow in relation to firm flow entitlements.

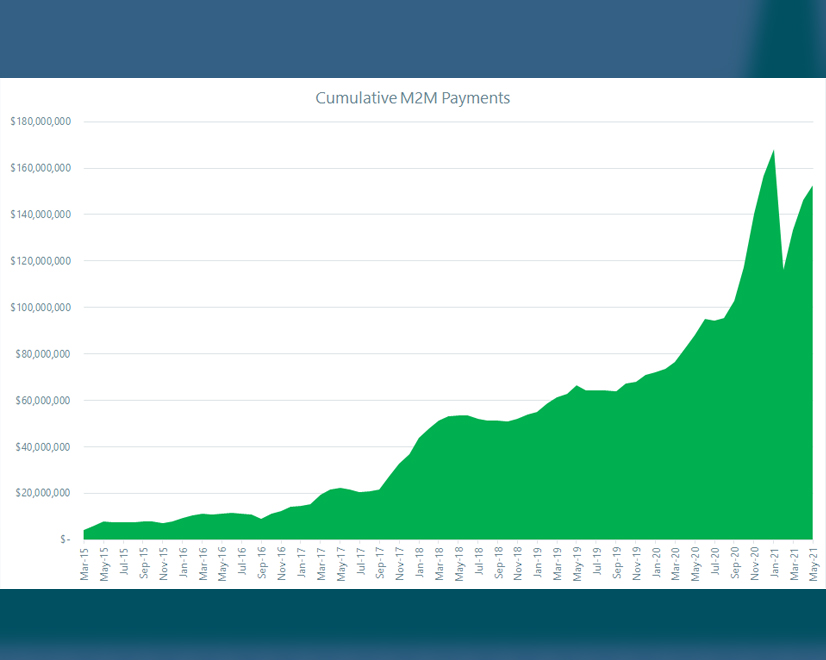

Including May, SPP has now accrued $152.3 million in settlements from MISO since the two RTOs began the M2M process in March 2015.

Staff are considering setting a threshold for flowgates with six-figure or greater settlement totals to identify “the big drivers.” May’s summary included 43 permanent and temporary flowgates that were binding for 1,405 hours. The $100,000 threshold would have reduced that total to 10 flowgates.

“At some point, does the level of market-to-market payments trigger some action in regard to transmission analysis?” Advance Power Alliance’s Steve Gaw asked. “Everybody sees this as useful information, but at some point, this should translate into either an analysis of a better way to handle this between markets or whether there’s a transmission-congestion analysis that needs to be done.”

Clint Savoy, SPP’s senior interregional coordinator, said the M2M data “informally informs our own regional and interregional processes.”

“We’re starting to get some traction and movement on … processes between SPP and MISO,” he said.

SPP and MISO are involved in several initiatives across their seam. Of course, there’s the work to find joint transmission projects that would help reduce the RTOs’ crowded interconnection queues. Their staffs met with stakeholders Friday to discuss how best to allocate costs. (See related story, MISO, SPP Offer Idea on Joint Interconnection Tx Allocation.)

The RTOs have also reached an agreement in principle over affected-system studies. Staff are working to memorialize the policy changes in their joint operating agreement. SPP and MISO are also trying to develop a targeted market efficiency project process similar to MISO’s effort with PJM.

That’s separate from the work SPP is undertaking to strengthen its seams agreement provisions with neighboring entities to ensure “adequate emergency assistance and fairly compensate emergency energy” during situations like February’s winter storm. The RTO imported more than 7.5 GW of energy from its neighbors during the storm, the highest since the Integrated Marketplace went live in 2014.

“As usual, we have a lot of balls in the air with all of our neighbors,” Savoy said.