In their response to FERC’s latest request for information, members of the planned Southeast Energy Exchange Market (SEEM) on Wednesday urged the commission to approve their proposed expansion of bilateral trading in 11 Southeastern states by next month and allow it to take effect in October (ER21-1111, et al.).

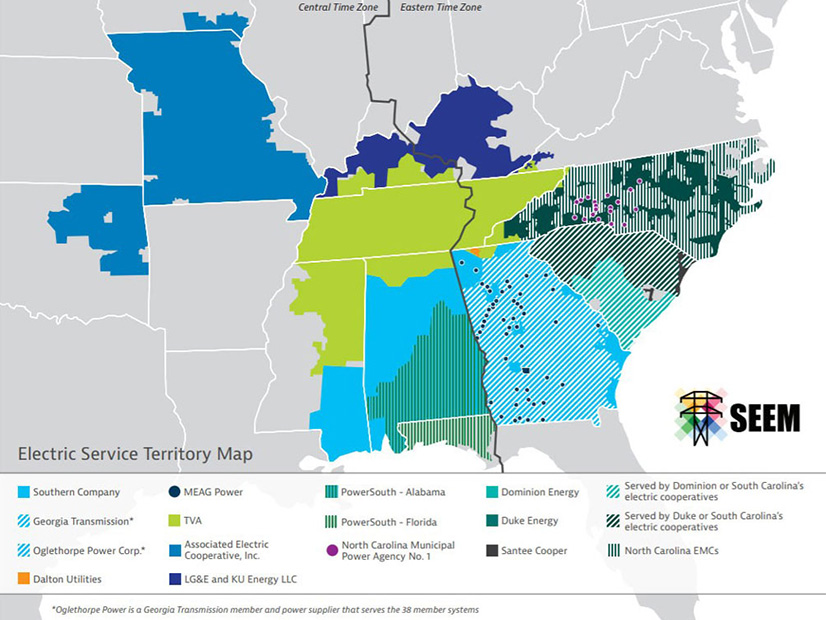

SEEM is intended to reduce trading friction by introducing automation, eliminating transmission rate pancaking, and allowing 15-minute energy transactions. Proponents, who comprise more than a dozen utilities and cooperatives in the Southeast, also claim the market would promote the integration of renewable generation resources like wind and solar.

The new filing — by a group of utilities including Alabama Power, Dominion Energy South Carolina, Louisville Gas & Electric, Georgia Power, Mississippi Power and several Duke Energy entities — answers a deficiency letter filed by the commission on Aug. 6. (See SEEM Critics Repeat Call for Technical Conference.) FERC’s letter asked:

- for assurance that members will not have access to competitors’ transmission function or commercially sensitive information through reports or information provided by the administrator or auditor;

- whether the availability of redacted documents posted to a dedicated confidential portion of SEEM’s website would vary depending on the identity of the participant accessing the documents, in order to avoid divulging commercially sensitive information to competitors; and

- whether the administrator will be independent of members and their affiliates.

Members Highlight Previous Changes

In response to the first point, proponents observed that section 3.5 of the SEEM agreement “prohibits members … from providing marketing function employees with non-public transmission function information or non-public market information” received through SEEM. In addition, they reminded the commission that they had agreed to further safeguards on sensitive information in their response to the previous deficiency letter issued in May. (See SEEM Members Offer Rule Changes.)

The initial change establishes a two-step process for market auditor and SEEM administrator postings. First, any participant-specific information and critical energy infrastructure information must be redacted prior to posting a report; second, the utilities agreed to expand the restrictions on sharing non-public transmission function information and non-public market information.

SEEM members also agreed in the first deficiency response to alter the participant agreement, creating a binding contractual commitment to:

- apply information-sharing restrictions to all participants, including both jurisdictional and non-jurisdictional members and

- bind all participants, including members, to honor the determinations of the market auditor and SEEM administrator as to information that cannot be shared with marketing function employees.

These rules are “designed to create uniformity in the application of the information-sharing restrictions,” respondents said. They applied this argument to the second question as well, saying that any decision about “what information needs to be protected from marketing function employees” — including the availability of documents with redacted information on the SEEM website — will rest with the SEEM administrator and market auditor. Participants will be contractually obligated not to share such information with unauthorized individuals.

In response to the third question, SEEM members clarified that the administrator “will not be a member, participant, agent, or the market auditor, nor an affiliate of those entities.”

Quick Decision Requested After ‘Narrow’ Inquiry

Noting the “limited nature” of the commission’s request compared to the previous deficiency letter, which ran to 14 pages with 12 detailed questions, the respondents suggested FERC shorten the standard comment period to 10 days in addition to accelerating the approval and effective date for the SEEM member agreement.

“The requested expedited action is necessary if the [SEEM] members are to stay on track to bring the benefits of [SEEM] to customers during the first half of 2022,” the filing said. “Further delay of commission action may push the implementation … into the third quarter of 2022, which would delay the cost savings benefits for customers.”

Neither FERC’s deficiency letter nor the SEEM members’ response directly mentioned the July 29 filing by several environmental groups that have criticized the proposed market on several previous occasions. However, Wednesday’s filing said that to facilitate FERC’s consideration of their response, SEEM proponents “will not answer any protests again rehashing issues outside the scope of the proceeding, or previously addressed.”