Clean energy advocates mounted new attacks on the Southeast Energy Exchange Market (SEEM) this week, saying the proposal to automate bilateral trading in 11 Southeastern states would offer a fraction of the benefits of an organized market and undermine decarbonization efforts.

In a report released Tuesday, the American Council on Renewable Energy said SEEM “offers negligible benefits over traditional utility operations and few of the benefits associated with real-time energy markets.”

The report, done in coordination with the American Clean Power Association and the Solar Energy Industries Association, provides little new empirical data, but it contrasts SEEM’s projected cost savings with the estimates of benefits provided by PJM, CAISO and other RTO/ISO markets. Those estimates “have found consumer benefits in the billions of dollars per year, dozens of times larger than the estimated benefits of SEEM,” ACORE said.

A study conducted for SEEM by Guidehouse and Charles River Associates projected a minimum of $40 million in benefits per year (2020$) in a scenario based on current plans, rising to $100 million annually under a “carbon constrained” scenario. In contrast, a study last year by Energy Innovation Policy and Technology concluded that a competitive Southeastern RTO would save $384 billion by 2040 compared to the business-as-usual case — a 29% reduction in retail costs.

In February, SEEM’s sponsors, led by the Tennessee Valley Authority, Southern Co. (NYSE:SO) and Duke Energy (NYSE:DUK), asked FERC to approve their proposal, which they said would eliminate transmission rate pancaking and allow 15-minute energy transactions. On June 7, the proponents responded to a FERC deficiency letter with promises to provide FERC confidential market data and increased transparency and allay market power concerns (ER21-1111, et al.). (See SEEM Members Offer Rule Changes.)

But in filings this week, several intervenors said SEEM’s response to the deficiency letter failed to address their market power concerns and reiterated calls for a FERC technical conference on the future of the Southeast. The critics say FERC should insist on an independent market monitor and that governance of SEEM be opened to all market participants rather than just load-serving entities.

A group including the Sierra Club, Southern Alliance for Clean Energy, Vote Solar, the Sustainable FERC Project and the Natural Resources Defense Council, filing as “Public Interest Organizations (PIOs),” said SEEM “dodged” the commission’s questions, “doubling down on a flawed, self-serving proposal.”

“SEEM will not only fail to deliver the promised benefits but is primarily an effort to distract from or derail state- and community-led efforts in the Southeast to push for more meaningful and much-needed market reform,” the PIOs said. “As PIOs and others have pointed out, efforts to consider wholesale market reforms underway in North Carolina, South Carolina, Kentucky, Mississippi, Georgia and areas served by TVA are building pressure in the Southeast for significant market reform, and SEEM offers applicants the opportunity to try and stay ahead of and control that reform.”

SEEM, which asked for a FERC ruling on its proposal by Aug. 6, contends the commission can only opine on whether the rates proposed in the group’s Federal Power Act Section 205 filing are just and reasonable, limiting any changes to “minor deviations.”

But the ACORE report suggests the FPA gives FERC to reject freely negotiated wholesale transactions if they “seriously harm the public interest.”

In ACORE’s view, SEEM would be harmful because it would undermine utilities’ efforts to decarbonize by insulating fossil fuel plants from competition from renewables and making renewables more prone to curtailments than in an RTO.

Conceding “other factors may also contribute,” ACORE cites data from the Energy Information Administration that show CO2 emissions have fallen 5 percentage points more in organized market regions since 2013 than in non-market regions.

“While broader organized markets and certain parts of the SEEM footprint have historically succeeded in integrating renewable energy, SEEM’s unusual 15-minute transaction interval and the lack of an independent entity overseeing open access to transmission service by independent power producers whose new development is predominantly renewable energy may stymie similar growth in the full SEEM footprint,” ACORE said. “Furthermore, to the extent the SEEM footprint extends the load-serving capability of otherwise uneconomic existing generation located within a single utility’s generation fleet and helps insulate the inflexibility of those resources, those resources may see a longer service life than would otherwise be economic relative to available lower-cost alternatives. The competition provided by a full wholesale market is the most effective way to provide all resources with the level playing field that ensures large consumer and environmental benefits.”

Southern, Duke, TVA and SEEM sponsors Dominion Energy (NYSE:D), Louisville Gas & Electric and Kentucky Utilities, and the North Carolina Electric Membership Corp. all have emission-reduction goals, ACORE noted.

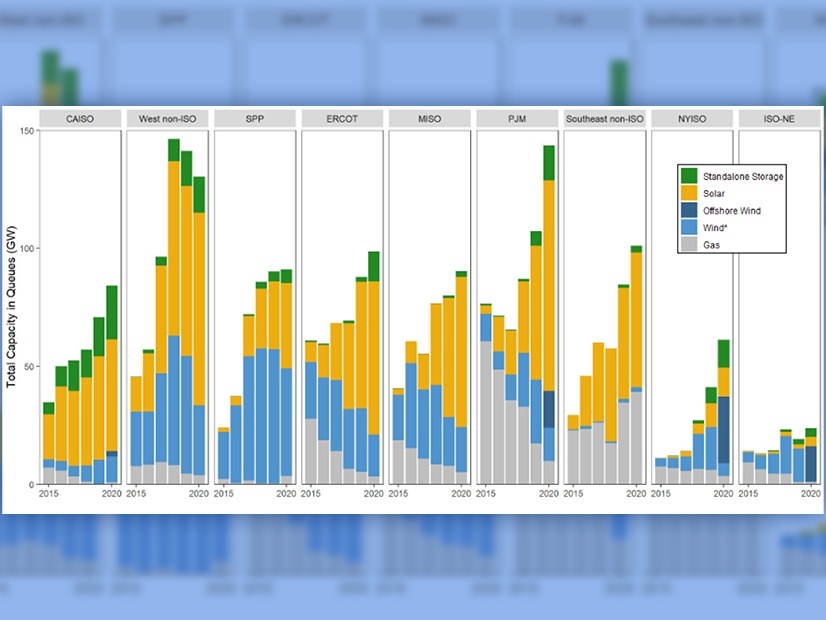

It also noted that proposed natural gas generating capacity has declined across most of the country while proposed renewable capacity has rapidly increased. “The Southeast, one of only two non-real-time market regions in the continental U.S., has bucked this trend with a record of nearly 40 GW of natural gas capacity waiting in grid interconnection queues as of 2020,” ACORE said. It cited an April 2021 survey of leading renewable energy project developers who found the Southeast the least attractive region in the continental U.S. for project development, with PJM, CAISO and NYISO ranked as the most attractive. (See Study Finds Robust Appetite for Green Investing.)

ACORE said Southeast ratepayers would continue to pay above-average electric bills under SEEM, citing EIA data that ranks Alabama, South Carolina, Mississippi, Virginia, Tennessee and Georgia among the top 10 states for average monthly electric bills. “Electricity rates themselves are low in the Southeast, but high consumer energy demand generates high retail electric bills,” ACORE said.

“SEEM offers little in the way of the benefits provided by centralized wholesale energy markets relative to traditional utility operations,” ACORE said. “The lack of centralized clearing prices, a transparent stakeholder process and an independent market monitor are all readily apparent when contrasted with an [energy imbalance market], which itself is only a light form of a real-time market. SEEM also lacks effective means for planning and paying for transmission on a regional basis, which helps ensure competitive electricity markets.”

Response

Duke spokesperson Erin Culbert said the ACORE report “expressly acknowledges that RTOs do not adhere to or protect state clean energy policies, but SEEM will.”

“RTOs don’t necessarily place a high value on the carbon-free benefits nuclear provides, and that conflicts with many of the clean energy goals that we and our states want to reach by 2050,” she continued. “This is one of many reasons why RTO membership decisions should not be made in Washington. For the Southeast, our nuclear units are absolutely critical to our ability to achieve a clean energy future with carbon-free resources that meet customers’ needs reliably and affordably. We can’t do it without them.”

Culbert also rejected ACORE’s allegation that solar power would suffer under SEEM, saying North Carolina, Florida and South Carolina are among the nation’s leaders in installed solar generation.

“The SEEM proposal reduces solar curtailments and better integrates renewables across 11 states at a much lower cost than an RTO,” she added. “In fact, the SEEM region is already on pace or outperforming RTO markets on critical metrics like reliability, affordability and clean energy.”

TVA, Dominion and Southern did not respond to requests for comment.

FERC Filings

In their filings with FERC this week, Advanced Energy Economy, the Advanced Energy Buyers Group and SEIA, filing as the “Clean Energy Coalition,” said SEEM’s governance structure would concentrate decision-making authority in TVA, Southern and Duke.

The coalition said it seeks competitive wholesale markets because they “allow customers to access a suite of products and services that incumbent utilities have refused to provide under a vertical integration model.”

“The SEEM proposal … does no more than add a computerized platform to add efficiency to the existing bilateral market,” the coalition added.

The coalition said FERC should convene a technical conference as well as a joint federal-state hearing under FPA Section 209 to “develop additional record evidence regarding the SEEM proposal [and] provide a forum to resolve the deficiencies in the SEEM proposal.”

The PIOs challenged SEEM’s legal argument, saying the public utilities in SEEM should file a pool-wide or systemwide tariff and that its actions should be held to the higher “just and reasonable” standard rather than the lower public interest standard that applies to bilateral transactions.

“In a bilateral market that is as closed to competition as the Southeast, the new transmission service that encompasses service across the entire SEEM territory and eliminates rate pancaking has significant value to owners of generation resources in the territory. By controlling access to the transmission service by exclusionary practices related to enabling agreements, the applicants have the ability to exercise market power over transmission service,” the PIOs said. “This exercise of market power may be as simple as exclusion of access to the non-firm energy exchange transmission service. It could also take the form of extraction of concessions from resource owners unrelated to participation in the SEEM that may help solidify the existing market power of SEEM’s member utilities.”

Their filing included an affidavit from former PJM economist Paul Sotkiewicz alleging that independent power producers wheeling out of SEEM to sell energy into PJM, MISO and SPP will be forced to pay higher firm point-to-point transmission rates and will not get any benefits because they do not serve load in SEEM territory.