Most renewable energy investors plan to increase their investments in 2021, with PJM, CAISO and NYISO seen as the most favorable markets, according to a survey by the American Council on Renewable Energy (ACORE).

Investors and developers are “extremely confident” about the growth of renewable energy and energy storage over the next three years, with nearly all surveyed companies planning to increase their investment or development activity, according to the study, “Expectations for Renewable Energy Finance in 2021-2024.”

More than two-thirds of surveyed investors (68%) said they will increase their investments by more than 10% this year compared to 2020. Nearly all surveyed investors (90%) and developers (93%) said they had maintained or increased risk appetites in 2021 versus 2020.

The report is based on an April 2021 survey of companies that finance, invest in or financially advise renewable projects, technologies or companies and a second survey of those active in the development of renewable energy projects using financing from third parties. ACORE solicited responses from more than 100 financial institutions and more than 100 development companies, surveying 31 companies from each group.

Two-thirds of the financial institutions represented in the survey invest more than $100 million annually in the U.S. renewable energy sector. Almost 40% of the developers surveyed operate U.S. renewable energy businesses with revenues greater than $100 million.

Most investors expect the attractiveness of renewable energy as an asset class to increase compared to other asset classes through 2024. The respondents said long-term extensions of renewable energy tax credits, and standalone tax credits for energy storage and “regionally significant” transmission could help fuel growth.

PJM, CAISO and NYISO were ranked as the most attractive markets by both investors and developers. The Southeast, which lacks an RTO, scored the lowest among both groups.

$1T 2030 Goal

ACORE reported that the U.S. has attracted $167 billion in investment for renewable energy, grid-enabling technologies and transmission for renewable integration since the group launched an effort to reach $1 trillion in private investment by 2030. Reaching the “$1T 2030” goal would require an average of $92.6 billion annually, an annual increase of 59% over spending in 2020, which showed a 12% drop over 2019.

The U.S. ranks second in renewable energy investment, behind China, which hit $101.5 billion in 2020, 1.7 times the investment in the U.S., according to Bloomberg NEF.

“If we are going to meet our $1T 2030 objective and achieve [President Biden’s] goal of decarbonizing the power sector by 2035, the status quo is no longer going to cut it,” ACORE CEO Gregory Wetstone said in a statement. “Renewable sector investors and developers seem to understand that this is the moment to accelerate investment in renewable energy and grid-enabling technologies to avoid the worst impacts of climate change.”

ACORE cited data from BloombergNEF that found wind and solar will replace coal and could replace three-quarters of existing gas generation by growing to 1,100 GW by 2030, from 215 GW as of the end of 2020.

“The remaining one-quarter of gas generation could be replaced by 330 GW of capacity from hydrogen, carbon capture and storage, geothermal or other `clean firm’ technologies,” the study said. “Just boosting wind and solar capacity to 1,100 GW by 2035 would require a capital investment of $1.1 trillion.”

On April 21, 43 banks with $28.5 trillion in assets committed to align their portfolios with net-zero emissions by 2050 as part of the United Nation’s Net-Zero Banking Alliance. About 69% percent of Fortune 100 companies have targets for either greenhouse gas reductions or renewable energy procurements.

Respondents’ Comments

The report included anonymous comments from survey respondents, including developers that said their efforts have been negatively affected by tariffs on solar panels and FERC’s rulings on the minimum offer price rule in PJM.

One developer said tariffs account for about 10% of its costs. “FERC’s unresolved decision-making in PJM has dampened our efforts on development in that market. We have a lot of stranded projects while we wait for a decision,” the developer said.

Although the investors and developers were largely bullish “some companies cite lingering challenges in tax equity availability and decreased appetites for hedge agreements after the Texas power crisis in February 2021,” ACORE said.

Developers said COVID hurt the availability of tax equity investors and that Texas’ February deep freeze had caused some companies to adjust their risk management strategies. “Electricity spot prices skyrocketed, leading to substantial company profits and losses, particularly those in hedge arrangements,” ACORE said.

Nearly half (46%) of investors reported that tax equity availability had “decreased” or “significantly decreased” in the last year with only 19% reporting an increase.

“Tax equity is always the piece of the capital stack that’s hardest to put in place and to pin down. The events in Texas have brought up questions for both tax equity providers and debt providers in that market,” said one unnamed investor.

“In terms of project finance, lenders and sponsors are getting more comfortable with [energy storage]. It is still in its early stage, but in five years, those issues will be solved,” said one investor.

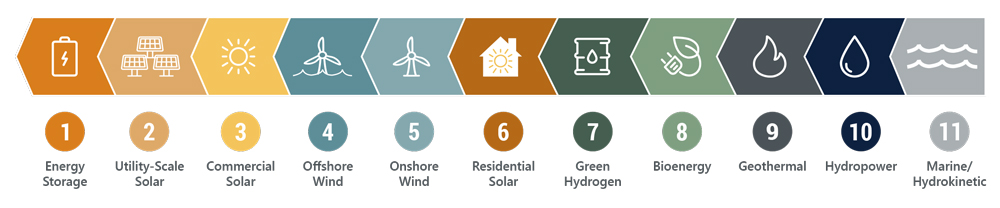

Energy storage and utility-scale solar were the most popular investments over the next three years, followed by commercial solar and offshore wind.

The survey found increased interest in solar plus storage. One developer said its strategy is for “storage to be synonymous with our development pipeline. Pretty much everything we scope out these days is going to be solar plus storage.”

Investors generally favored proven technologies, such as wind, solar and energy storage, although green hydrogen ranked above bioenergy and hydropower, despite concerns about hydrogen’s scalability and costs.

“Hydrogen is extremely water-intensive, and we are far from the technology being scalable,” said one investor.