With the 88th Texas Legislature’s regular session in the history books Monday, and a 30-day special session already underway, the state’s clean energy industry can breathe a little easier again.

“Members, I hope you enjoyed your summer. I sure did,” House Speaker Dave Phelan (R) said as he gaveled his chamber back to business Tuesday.

The consensus is that the industry, which an Austin-based research firm says reduced wholesale electricity costs in the state by almost $28 billion from 2010 to 2022, fared better than recent gloomy predictions. (See Uncertain Future for Texas’ Renewables Industry.)

“It could have been very, very bad,” Stoic Energy principal Doug Lewin, a close observer of the Legislature, told RTO Insider. “The threats were serious and real, and it’s still not great … the worst stuff, the permitting, the cost allocation … that didn’t pass.”

“While more than a dozen anti-renewable energy bills were filed this session, only a few ended up making it through the process,” said Luke Metzger, executive director of Environment Texas. “Some of the measures that would have been most harmful to renewables … thankfully died.”

For that, Metzger and others can thank a broad coalition of environmentalists, industry organizations and business groups, along with House representatives beholden to their constituents, for preventing the renewable energy sector from being kneecapped.

After the Senate tacked on language from bills that had yet to make it out of committee as amendments to the must-pass bill reauthorizing the Public Utility Commission (House Bill 1500), the interest groups worked last weekend with legislators to again eliminate or water down the more onerous language.

Out went language from Senate Bill 624 that would have required wind and solar facilities to acquire special permits from the PUC, a requirement thermal generators wouldn’t face. A firming mandate that would have required renewables to pay for other energy sources when wind and solar aren’t producing was pushed back to the end of 2027 and its cost increases tied to generation portfolios, rather than individual units.

“Over at the Legislature, those people are accountable to consumers and voters. They just can’t ignore what consumers want,” said attorney Katie Coleman, who represents Texas Industrial Energy Consumers.

“I think the language that ended up in 1500 is heading in the direction of trying to have some reliability for renewables in their output, but it’s not as punitive as some of the other proposals,” Lewin said. “I think there’s a lot of what they’re calling firming going on in the market anyway. So, kind of pushing that along, but I don’t think it is going to really be that detrimental to the industry.”

Rather than make renewables pay higher ancillary services fees, HB1500 instead requires that a study first be conducted. It would also end Texas’ renewable energy requirement, or portfolio standard. However, the state met that requirement years ago.

HB1500 also adds a $1 billion annual net cap to the performance credit mechanism (PCM), which since PUC Chair Peter Lake pushed it through in January has been criticized by almost everyone connected to the market — except the large generators that would benefit from it. Various studies have pegged the PCM’s cost at between $5 billion and $12.7 billion a year, which ERCOT has said would flow down to consumers. (See Texas PUC Submits Reliability Plan to Legislature.)

Lake said the commission would wait to see what direction the Legislature offered before pursuing the PCM’s implementation. The PUC got that direction with HB1500, which requires ERCOT to complete an updated assessment of the reliability program and submit a report on its costs and benefits to the commission and Legislature.

The bill also includes 14 requirements to be met before the PCM can be implemented, including one that mandates that ERCOT add real-time co-optimization and ancillary services to the market before implementing the PCM. That would push the latter back to 2025 or 2026.

Other HB1500 requirements related to the PCM include:

- Central procurement of performance credits to prevent market manipulation by affiliated generation and retail companies;

- Not assigning costs, credit or collateral for the program such that it provides a cost advantage to load-serving entities that own, or whose affiliates own, generation facilities;

- Establishing a penalty structure providing a net benefit to load for generators that bid into the PCM’s forward market but do not meet the full obligation;

- Not allowing generators to receive credits that exceed the amount of their bid into the forward market;

- Removing the bridge solution by the end of the PCM’s first year; and

- Setting a single ERCOT-wide clearing price that does not differentiate payments or credit values based on locational constraints.

“There really hasn’t been a lot of support for [the PCM] from any group other than actual existing generators and leadership with the PUC and ERCOT,” Coleman said. “We all want more reliability. Always. I think the Legislature wanted to put some pretty strict parameters around the limits of it. That was something that we worked really hard to get done, along with a pretty broad range of groups.”

Hard Sell

Where this leaves the PCM is anyone’s guess.

During a virtual press conference Wednesday, ERCOT CEO Pablo Vegas said the grid operator’s staff are reviewing legislation that passed and analyzing its impact on the grid. He promised to share more details publicly, “like we often do in our in our open board meetings,” once staff understand the bills better.

“We’re not at a place where we’re ready to discuss that in any detail right now,” he said. “But I can tell you that we share the same goal that the Legislature does, which is to continue to support a reliable and stable grid now and long-term into the future. We’ll continue to work closely, too, with the Legislature to enact what they passed this session.”

The ERCOT Board of Directors next meets June 19-20.

“I think it’s going to be a hard sell to come back and say, ‘Hey, we’ve done this analysis and now the PCM is going to cost $2 billion or $3 billion or $4 billion.’ That’s going to be hard, hard argument to make,” Coleman said.

The Legislature also sent SB2627 to Gov. Greg Abbott’s desk. The bill provides $5 billion to $10 billion in government low-interest loans and completion bonuses to builders of new gas plants. However, SB6, which would have ordered the construction of 10 GW of gas-fired generation at a cost of $10 billion to $18 billion, didn’t make it. Texans will get a chance to pass judgment on SB2627 when they vote on it as a constitutional amendment.

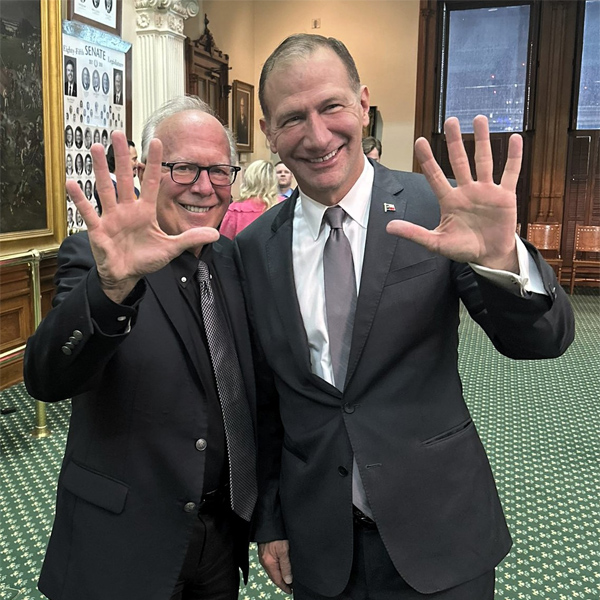

Texas Rep. Todd Hunter and Sen. Charles Schwertner celebrate the passage of House Bill 5. | Sen. Charles Schwertner via Twit

Texas Rep. Todd Hunter and Sen. Charles Schwertner celebrate the passage of House Bill 5. | Sen. Charles Schwertner via TwitAnother bill, HB5, a corporate incentive program to boost infrastructure investment, excludes wind and solar development from tax abatements.

“The landmark legislation package passed this evening will ensure our economic miracle continues into the mid-21st century and beyond,” Lt. Gov. Dan Patrick, who controls the Senate, said in a statement after the bills’ passage.

Lewin points out that very little of the legislation addresses the root causes of ERCOT’s capacity shortfalls during the two most recent storms of 2021 and 2022: the failure of gas supplies to show up in frigid temperatures.

He said a friend asked him after the regular session ended whether the Legislature’s actions meant the grid is fixed.

“No. Not even close,” Lewin said he responded.

“One of the points I’m trying to make leaving this session is that if you don’t focus on the root cause, if all the focus is on renewables, you’re causing problems, which is really where the focus was,” he said. “There was very little focus on the actual problems facing the grid. We’re just going to continue to have a grid that is problematic and leaves us all kind of white-knuckling it through the through the next winter storm.”