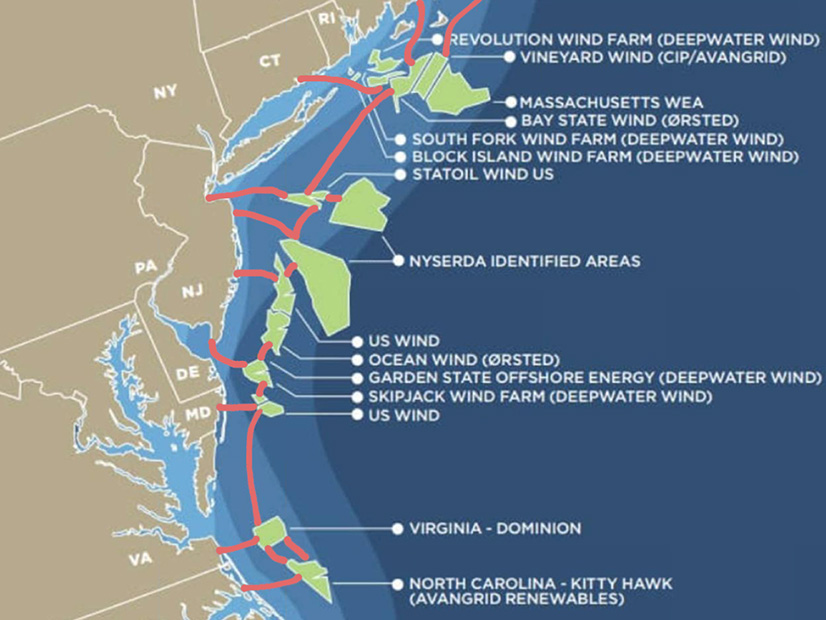

With about 30 GW of offshore wind energy planned for the East Coast, the U.S. Department of Energy’s Loan Programs Office (LPO) is anticipating the opportunity to support development of subsea transmission.

“There are a lot of folks that are looking at localized grids just for New Jersey, Massachusetts, Connecticut or Rhode Island, but there are many others who see a need for a backbone that goes from North Carolina to Massachusetts, particularly with polar vortices happening regularly,” LPO Executive Director Jigar Shah said Wednesday at the New England Energy Conference and Exposition.

LPO can help improve resiliency by supporting financing to move power up and down the Eastern Seaboard, he said. There has been a lot of “hemming and hawing” around the need for a transmission backbone in the Atlantic, but market dynamics point to its benefits, he said.

“There’s a tremendous amount of difficulty in finding where exactly to interconnect a lot of these offshore wind projects to New York and New Jersey directly, and having that Atlantic backbone actually provides a necessary buffer in case there are any failures in the proposed [transmission spur lines] being able to evacuate that power cost effectively to other places,” Shah said.

LPO has $4.5 billion in loan guarantees to fill in the gaps in commercial financing for renewable energy projects. Shah said transmission is just one of the areas where the office is seeing those gaps for offshore wind.

“The commercial banking sector is largely interested in a power purchase agreement for an offshore wind farm,” he said. Investments in transmission, vessels and the supply chain do not play into that funding. LPO, however, can view offshore projects as inclusive of all those elements.

“Many of the largest developers have had to put $100 million into four or five different manufacturing companies to help spur the supply chain so that they can hit their timelines in 2024,” he said.

U.S. offshore wind market players that have captured primary financing from European banks are now looking to LPO for more support. (See related story, Lenders, Developers Bullish on East Coast OSW.)

“They need an additional billion dollars of capital to help with ships, the last mile of transmission, as well as some of these manufacturing hubs,” Shah said.

Beyond the Money

Shah also said the OSW industry must do a better job of coordinating on labor and environmental justice to grow successfully.

The industry, he said, has been focused on the unique challenges that come with building offshore wind projects without thinking about broader societal conversations.

“The harsh reality of the situation is that if we’re going to rebuild our entire country, which is what it’s going to take to decarbonize … by 2050, then that requires everyone having a seat at the table,” he said. “That requires the offshore wind industry as well as other clean energy industries … to have a broader understanding of what a $40 billion industry needs.”

Success will not come from lobbying only for what the offshore industry needs, he said.

It will require being “part of a broader ecosystem of support,” he said. “Everyone’s got to work hard to understand each other’s needs and find areas of compromise so that we can all move forward more confidently together.”