SPP’s average hourly load was off 7% last fall from the previous two years, the RTO’s Marketing Monitoring Unit said in its latest quarterly State of the Market report.

The Monitor attributed half the drop-off to cooler weather in September and warmer weather in November. The fall report covers September through November.

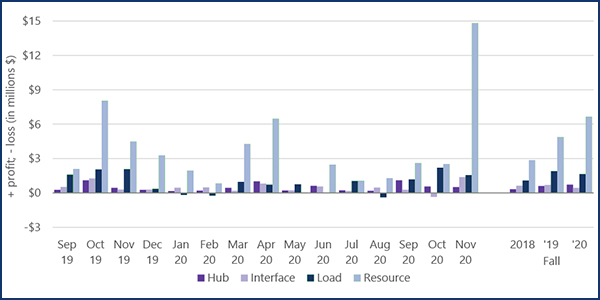

Average monthly profit from virtual transactions was just over $6.6 million in the fall, up from nearly $4.9 million the year before. Profits from virtual transactions were at their highest since the Integrated Marketplace began operations in 2014.

Virtual transactions scheduled in the day-ahead market are settled in the real-time market. Virtual demand bids are profitable when the real-time energy price is higher than the day-ahead price; virtual supply offers are profitable when the day-ahead energy price is higher than the real-time price.

The report’s special issues section reviewed the potential benefits a new coordinated transaction scheduling (CTS) process could provide SPP and MISO through improved economic transactions on their seam. CTS is a real-time only process in which both RTOs forecast the future price at their interchange locations. Participants place price-sensitive interchange offers that clear when the offered price is within the price spread of the RTOs’ forecasted prices.

The Monitor conducted the CTS study at the request of SPP’s Regional State Committee and the Organization of MISO States. It is one of several suggestions regulators have made to improve the RTOs’ cross-border operations. (See MISO, SPP Regulators Call for Pancaking Fix, Smaller Projects.)

The Monitor will host a webinar to discuss the report on Monday.